Cambridge, Massachusetts-based GE Vernova Inc. (GEV) engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity. It operates through Power, Wind, and Electrification segments. With a market cap of $158.8 billion, GE Vernova’s operations span the Americas, Indo-Pacific, and EMEA.

The renewable energy giant has notably outperformed the broader market in 2025 and over the past year. GEV stock prices have soared 76.7% on a YTD basis and 93.1% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 19.6% returns over the past year.

Narrowing the focus, GE Vernova has also outperformed the sector-focused Energy Select Sector SPDR Fund’s (XLE) 2.9% gains in 2025 and a marginal 12 bps uptick over the past 52 weeks.

GE Vernova’s stock prices dropped 1.6% in the trading session following the release of its mixed Q3 results on Oct. 22. Continuing its solid momentum, the company reported an 11.9% year-over-year surge in total revenues to $9.97 billion, beating the Street’s expectations by 8.6%. Meanwhile, the company’s net income came in at $452 million, significantly up from the $96 million net loss reported in the year-ago quarter. However, its EPS of $1.64 missed the consensus estimates by 7.9%.

Nonetheless, GEV’s fundamentals remain robust; it has observed a massive growth in orders and backlogs driven by the demand for its power and electrification equipment. Further, driven by favorable pricing on the orders and backlogs, its margins are expected to expand in the coming quarters.

For the full fiscal 2025, ending in December, analysts expect GEV to deliver an adjusted EPS of $7.47, up 211.3% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it surpassed the projections on two other occasions.

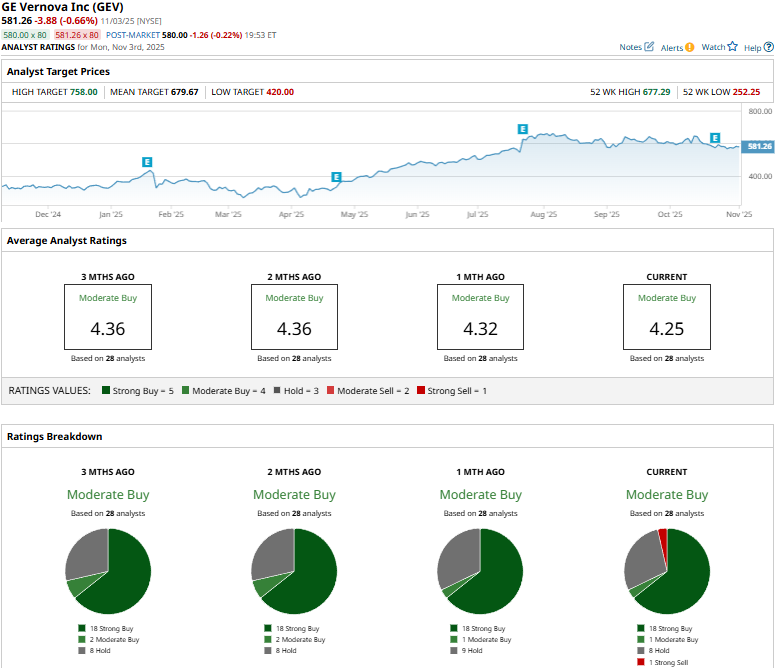

Among the 28 analysts covering the GEV stock, the consensus rating is a “Moderate Buy.” That’s based on 18 “Strong Buys,” one “Moderate Buy,” eight “Holds,” and one “Strong Sell.”

This configuration is slightly less optimistic than a month ago, when none of the analysts covering GEV gave a “Strong Sell” recommendation.

On Oct. 23, BMO Capital analyst Ameet Thakkar maintained an "Outperform" rating on GEV and raised the price target from $690 to $710.

GEV’s mean price target of $679.67 represents a premium of 16.9% from current price levels. Meanwhile, the street-high target of $758 suggests a notable potential upside of 30.4%.