With a market cap of $13.2 billion, Erie Indemnity Company (ERIE) operates as the managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States. The company provides a range of services, including policy issuance and renewal, underwriting, customer support, and information technology solutions.

The Erie, Pennsylvania-based company's shares have lagged behind the broader market over the past 52 weeks. ERIE stock has decreased 32.9% over this time frame, while the broader S&P 500 Index ($SPX) has increased 12.7%. Moreover, shares of the company are down 30.9% on a YTD basis, compared to SPX’s 14.4% gain.

In addition, shares of the insurance company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 8.3% return over the past 52 weeks.

Despite beating Q3 2025 EPS expectations with $3.50 on Oct. 30, Erie Indemnity’s shares fell 5.5% the next day as revenue of $1.07 billion missed estimates. Investors were also cautious about rising commission costs, which increased $41 million year-over-year, outpacing the 7.3% growth in management fee revenue.

For the current fiscal year, ending in December 2025, analysts expect Erie Indemnity’s EPS to grow 9.7% year-over-year to $12.59. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

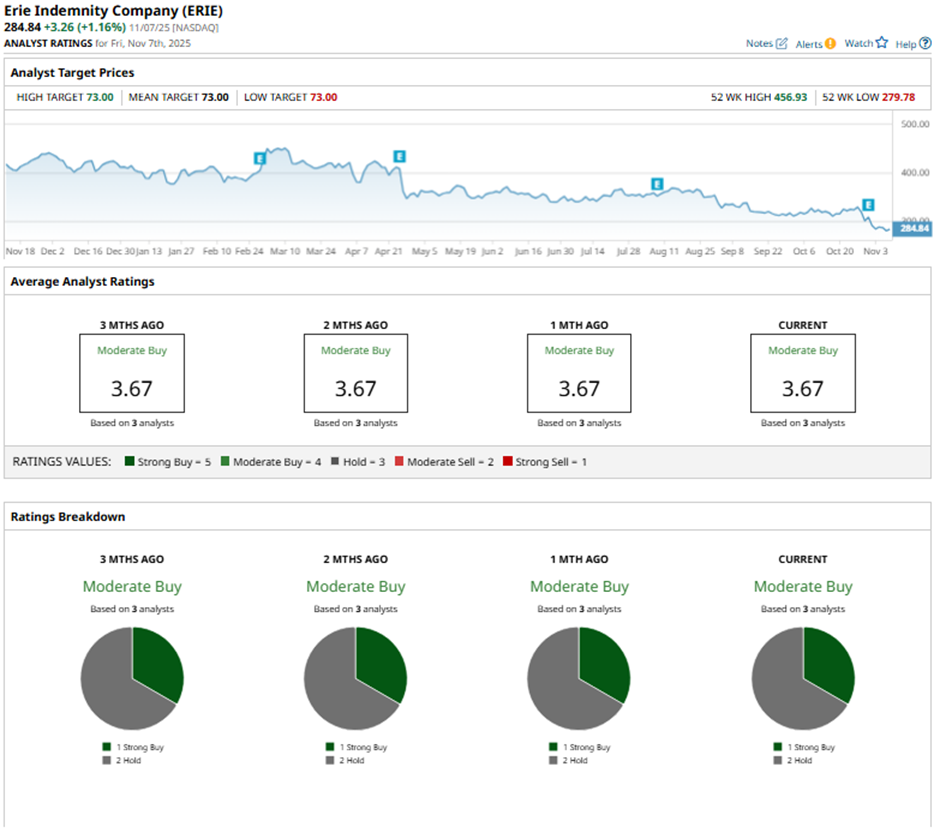

Among the three analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on one “Strong Buy” rating and two “Holds.”

As of writing, the stock is trading above the mean price target of $73, which also represents the Street-high price target.