/Union%20Pacific%20Corp_%20logo%20on%20side%20of%20train%20car-by%20Joseph%20Creamer%20via%20Shutterstock.jpg)

With a market cap of $135.9 billion, Union Pacific Corporation (UNP) is one of the largest freight railroad operators in North America, running a vast rail network across 23 U.S. states and linking major West Coast and Gulf Coast ports with key inland distribution hubs and gateways to Mexico. Through its subsidiary Union Pacific Railroad, the Nebraska-based company transports a wide range of goods, including agricultural products, industrial commodities, chemicals, automotive shipments, energy resources, and intermodal containers, to over 10,000 customers.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Union Pacific fits this criterion perfectly. As a critical backbone of U.S. supply chains and trade infrastructure, Union Pacific plays a major role in supporting manufacturing, agriculture, and international logistics.

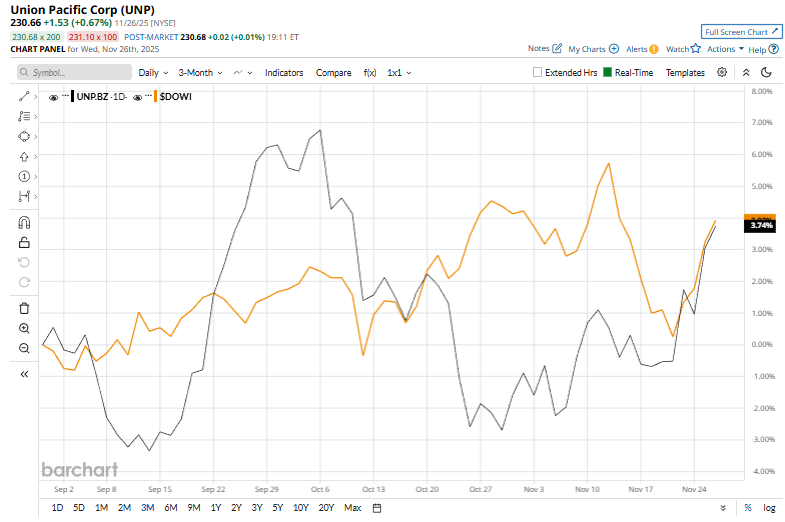

Despite this, shares of the company have declined 10.2% from its 52-week high of $256.84 touched on Jan. 27. UNP stock has risen 3.6% over the past three months, underperforming the broader Dow Jones Industrial Average’s ($DOWI) 4.4% rise over the same time frame.

In the longer term, Union Pacific stock is up 1.2% on a YTD basis, lagging behind $DOWI’s 11.5% gain. Moreover, shares of the railroad have decreased 6.1% over the past 52 weeks, compared with Dow Jones’ 5.7% rise over the same period.

Despite significant fluctuations, UNP stock has climbed above its 50-day and 200-day moving averages recently.

Union Pacific posted stronger-than-anticipated third-quarter results on Oct. 23, yet its shares still slipped 2.3% in the subsequent trading session. The railroad operator delivered robust pricing improvements that largely counterbalanced lower fuel-surcharge revenue. Total revenue rose 2.8% year over year to $5.9 billion, edging past consensus estimates by 16 basis points. In addition, adjusted earnings per share climbed 12% from the prior year to $3.08, topping Wall Street expectations by 3%.

In contrast, rival Norfolk Southern Corporation (NSC) has outpaced UNP stock. Shares of Norfolk Southern have soared 23.6% on a YTD basis and 5.1% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Union Pacific. The stock has a consensus rating of “Moderate Buy” from 24 analysts in coverage, and the mean price target of $264.17 is a premium of 14.5% to current levels.