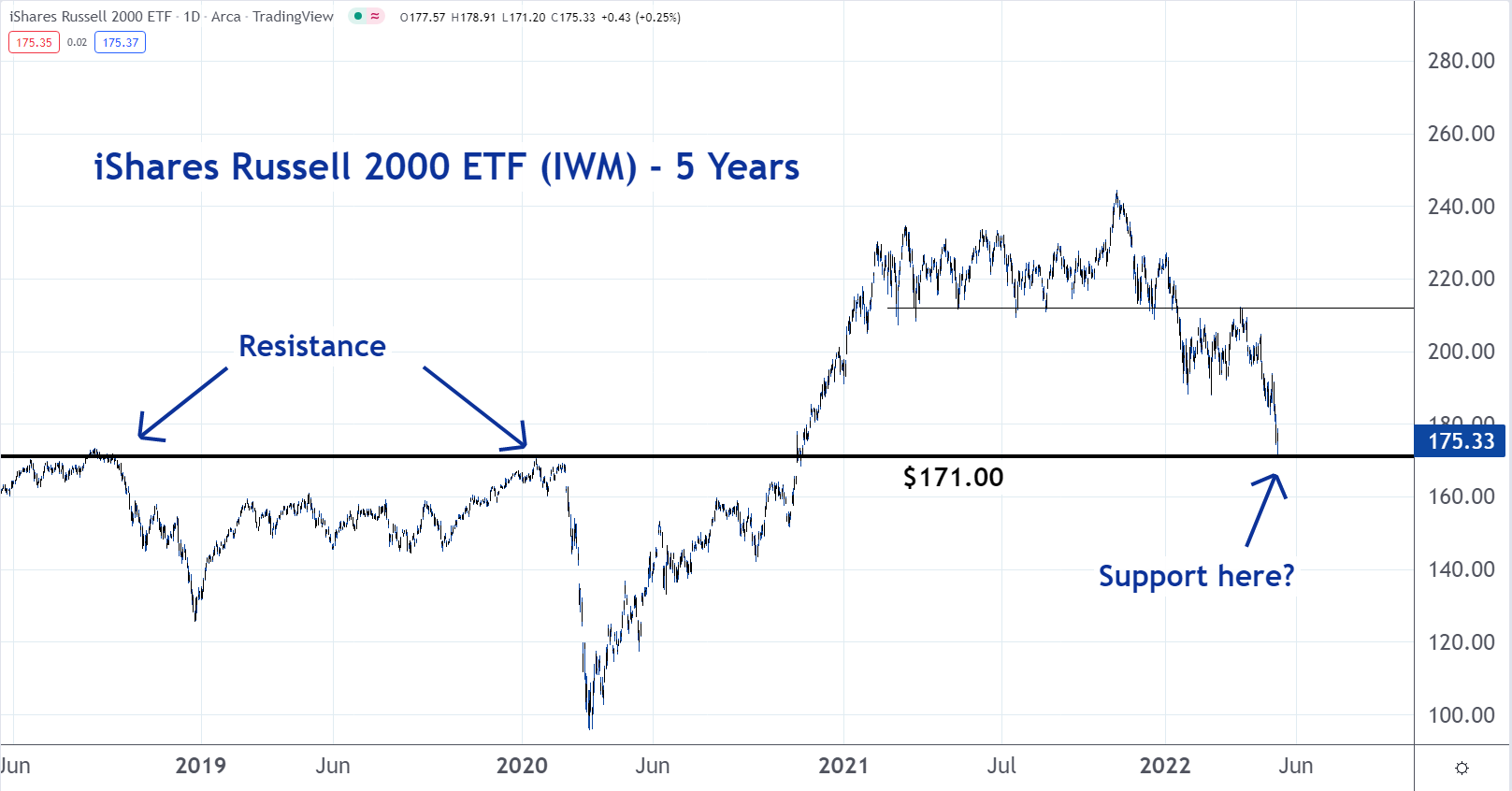

The selling in the small-cap sector of the stock market may be about to pause or at least halt. After a nasty move lower the iShares Russell 2000 ETF (NYSE:IWM) has reached a level that has been resistance in the past. Sometimes, levels that had been resistance can convert into support.

That may happen here.

Also Read: Nasdaq Breaks 12,000 After 4.29% Sell-Off On Monday

As you can see on the following chart, the $171 level was resistance for IWM. Many investors sold when the shares reached it, and IWM backed off and went lower.

But now the price is higher.

A number of the investors who sold at $171 now regret doing so. Many decide to buy their shares back, but only if they can get them for the same price they were sold at.

As a result, they place their buy orders around $171. If there are enough of these orders, the former resistance level will convert into support.

That could put a floor under the price. It may even cause the market to reverse.

To learn more about trading, check out the new Benzinga Trading School.