New York-based Take-Two Interactive Software, Inc. (TTWO) is a leading global video-game publisher and developer known for blockbuster franchises such as Grand Theft Auto, Red Dead Redemption, NBA 2K, Borderlands, and others. Valued at $45.6 billion by market cap, the company operates through key labels including Rockstar Games, 2K, and Zynga, covering console, PC, and mobile platforms.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and TTWO perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the electronic gaming & multimedia industry. With a worldwide presence and a strong portfolio of high-revenue titles, Take-Two is recognized as one of the most influential companies in the gaming industry, supported by a large and growing digital distribution business.

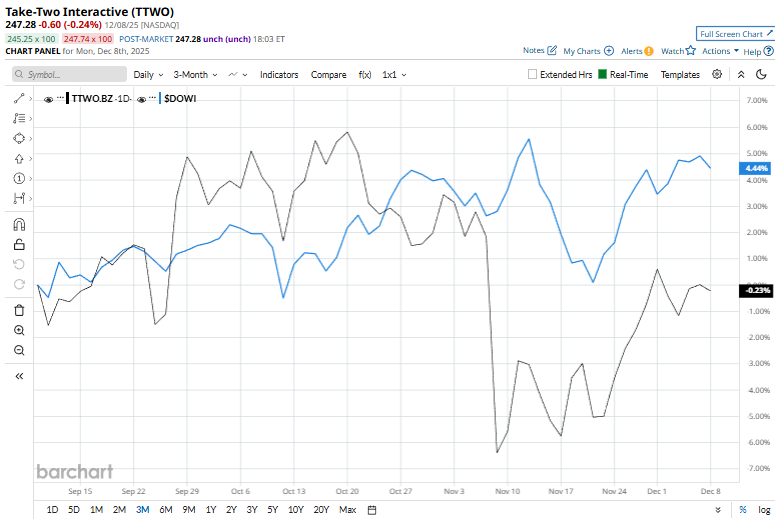

TTWO slipped 6.6% from its 52-week high of $264.79, achieved on Oct. 15. Over the past three months, TTWO stock has dipped marginally, underperforming the Dow Jones Industrial Average’s ($DOWI) 4.9% rise during the same time frame.

In the longer term, shares of TTWO rose 34.3% on a YTD basis and climbed 30.4% over the past 52 weeks, outperforming DOWI’s YTD gains of 12.2% and 6.9% returns over the last year.

While TTWO dipped below its 50-day moving average last month, it has been trading above its 200-day moving average for the past year.

On Nov. 6, Take-Two Interactive shares sank 8.1% after the release of its second-quarter earnings, as investors reacted sharply to news of a delay in the highly anticipated Grand Theft Auto VI. Despite the market’s disappointment, the company posted strong underlying results. Quarterly revenue jumped 31.1% year-over-year to $1.8 billion, significantly topping consensus estimates, while non-GAAP EBITDA reached a robust $116.7 million. Additionally, operating cash flow for the first half of 2026 improved markedly, swinging to $83.7 million from a negative $319.4 million in the prior-year period.

In the competitive arena of electronic gaming & multimedia, Electronic Arts Inc. (EA) has lagged behind TTWO over the past year with a 21.9% gain , but its 39.1% uptick on a YTD basis has surpassed TTWO.

Wall Street analysts are bullish on TTWO’s prospects. The stock has a consensus “Strong Buy” rating from the 27 analysts covering it, and the mean price target of $274.81 suggests a potential upside of 11.1% from current price levels.