With a market cap of $231.9 billion, T-Mobile US, Inc. (TMUS) is a leading national wireless service provider offering voice, messaging, data, and high-speed internet services across the United States, Puerto Rico, and the U.S. Virgin Islands. Headquartered in Bellevue, Washington, T-Mobile is a subsidiary of Deutsche Telekom AG and a pioneer in 5G network deployment.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks and T-Mobile US fits this criterion perfectly. Operating under the T-Mobile, Metro by T-Mobile, and Mint Mobile brands, the company provides wireless devices, accessories, and financing solutions through retail stores, apps, and third-party distributors.

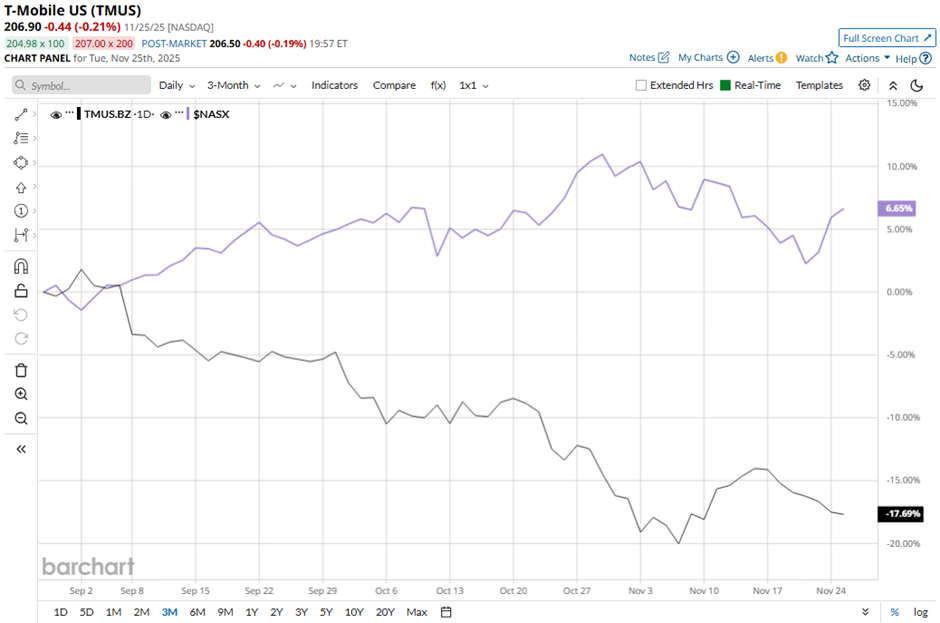

Shares of T-Mobile US have dipped 25.2% from its 52-week high of $276.49. The stock has fallen 17.8% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 7.4% gain over the same time frame.

In the longer term, TMUS stock is down 6.3% on a YTD basis, underperforming NASX’s 19.2% return. Moreover, shares of the wireless carrier have decreased 13.8% over the past 52 weeks, compared to NASX’s 20.8% increase over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since early September.

Despite beating expectations with Q3 2025 adjusted EPS of $2.59 and revenue of $21.96 billion, TMUS shares fell 3.3% on Oct. 23. Reported GAAP EPS was only $2.41, dragged down by a sizable $208 million impairment expense, and cash purchases of property and equipment jumped 35% to $2.6 billion. T-Mobile also raised 2025 capital expenditure guidance to ~$10 billion (an increase of $500 million).

In comparison, TMUS stock has outpaced its rival, AT&T Inc. (T). AT&T stock has soared nearly 12% over the past 52 weeks and 13.6% on a YTD basis.

Despite the stock’s underperformance, analysts remain moderately optimistic on TMUS. The stock has a consensus rating of “Moderate Buy” from the 29 analysts covering the stock, and the mean price target of $274.65 is a premium of 32.7% to current levels.