/Steris%20Plc%20logo%20and%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Mentor, Ohio-based STERIS plc (STE) provides infection prevention products and services. Valued at $25.7 billion by market cap, the company offers sterilizers, washers, surgical tables, lights and equipment management systems, and endoscopy accessories.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and STE perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical devices industry. STE is a market leader in infection prevention, offering a unique mix of consumables and capital equipment. Its diverse portfolio makes it a one-stop solution for healthcare providers, driving revenue and customer retention.

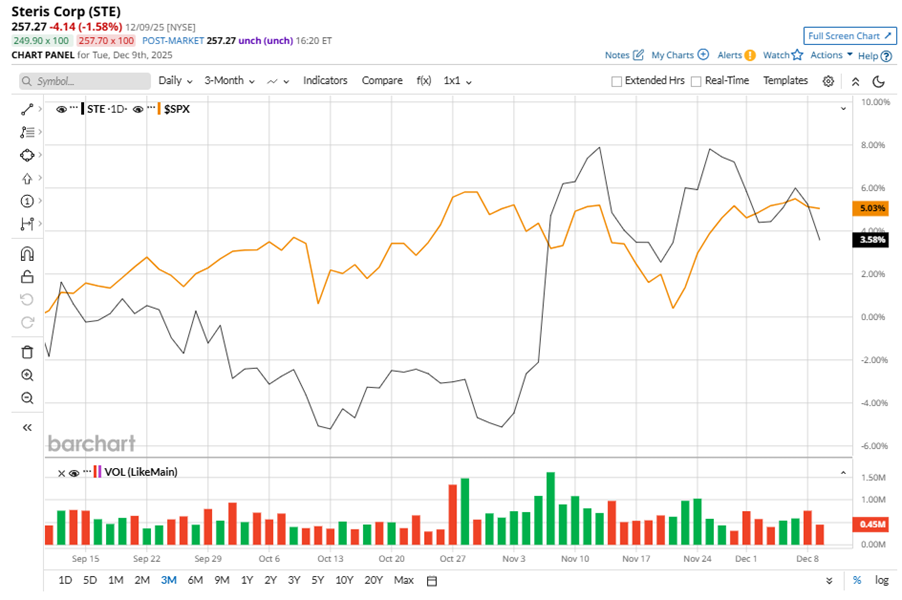

Despite its notable strength, STE slipped 4.2% from its 52-week high of $268.60, achieved on Nov. 25. Over the past three months, STE stock has gained 3.6%, underperforming the S&P 500 Index’s ($SPX) 5% gains during the same time frame.

In the longer term, shares of STE rose 6% on a six-month basis, underperforming SPX’s six-month gains of 13.9%. However, the stock climbed 19.3% over the past 52 weeks, outperforming SPX’s 13% returns over the last year.

To confirm the bullish trend, STE has been trading above its 200-day moving average since mid-May, with slight fluctuations. The stock has been trading above its 50-day moving average since early November.

On Nov. 5, STE reported its Q2 results, and its shares closed up by 6.9% in the following trading session. Its revenue was $1.5 billion, surpassing analyst estimates of $1.4 billion. The adjusted EPS of $2.47 exceeded analyst estimates by 5.1%.

STE’s rival, Stryker Corporation (SYK), has lagged behind the stock, plummeting 8.4% over the past 52 weeks and 8.7% on a six-month basis.

Wall Street analysts are reasonably bullish on STE’s prospects. The stock has a consensus “Moderate Buy” rating from the nine analysts covering it, and the mean price target of $288.86 suggests a potential upside of 12.3% from current price levels.