/Raymond%20James%20Financial%2C%20Inc_%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $32.3 billion, Saint Petersburg, Florida-based Raymond James Financial, Inc. (RJF) is a diversified financial services firm offering private client, capital markets, asset management, banking, and other specialized services across the U.S., Canada, and Europe. The company supports individuals, corporations, and municipalities with a wide range of financial solutions.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Raymond James Financial fits this criterion perfectly. Its operations span investment advisory, wealth management, investment banking, asset management, and lending products.

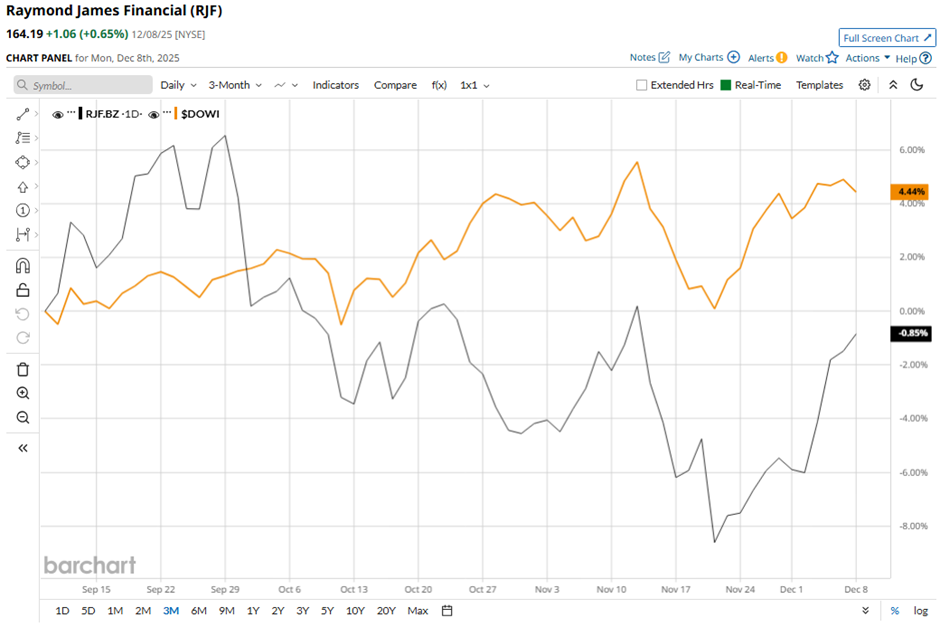

RJF stock has fallen 7.6% from its 52-week high of $177.66. Shares of the firm have declined marginally over the past three months, lagging behind the broader Dow Jones Industrials Average's ($DOWI) 4.9% return over the same time frame.

In the longer term, RJF stock is up 5.7% on a YTD basis, underperforming DOWI’s 12.2% gain. Moreover, shares of RJF have risen marginally over the past 52 weeks, compared to DOWI’s 6.9% increase over the same time frame.

RJF stock has been trading above its 50-day and 200-day moving averages since May. However, it has fallen below its 50-day moving average since October.

Raymond James Financial reported stronger Q4 2025 results on Oct. 22, including capital markets net revenues increasing to $513 million from $483 million and adjusted net income rising to $635 million ($3.11 per share) from $621 million ($2.95). Investor sentiment was further boosted by a rebound in global dealmaking and management’s optimistic outlook for fiscal 2026, supported by record client assets and a strong investment banking pipeline. Nevertheless, the stock fell marginally the next day.

In comparison, RJF stock has outpaced its rival, Blackstone Inc. (BX). BX stock has decreased 19.1% over the past 52 weeks and 12.2% on a YTD basis.

Despite RJF’s underperformance relative to the Dow, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 15 analysts covering it, and the mean price target of $184.38 indicates a 12.3% premium to current levels.