Drug and vaccine manufacturing giant Pfizer Inc. (PFE) is facing losses due to the company's charges due to its difficulty concerning COVID antiviral treatment Paxlovid and COVID vaccine.

PFE recently reported its third-quarter results, posting a $13.23 billion revenue, indicating a 42% year-over-year decline and missing the $13.34 billion expected. However, the company also reported an adjusted loss per share of 17 cents, narrower than the 34 cents expected.

The company reiterated its full-year 2023 guidance, expecting revenues between $58 billion and $61 billion and adjusted EPS between $1.45 and $1.65. These projections are strikingly lower than its earlier projections, reflecting weaker demand for its COVID-related products.

Given this backdrop, let’s look at the trends of PFE’s key financial metrics to understand why it could be wise to wait for a better entry point in the stock.

Analysis of Pfizer Inc.'s Financial Performance and Market Predictions (2020-2023)

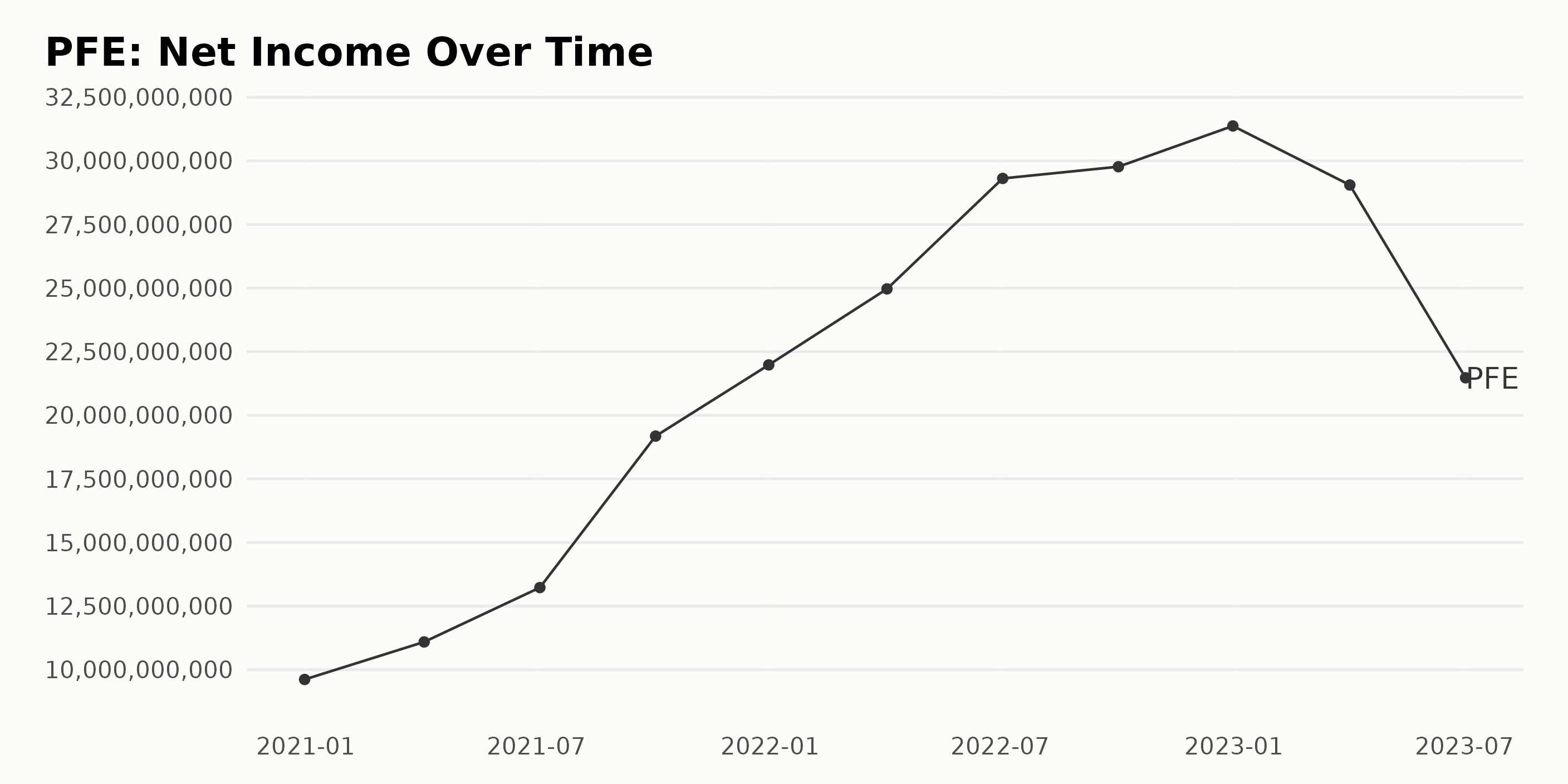

The data series represents the reported trailing-12-month net income of PFE from December 31, 2020, to July 2, 2023. Here is a summarized breakdown of the trend and fluctuations:

- December 31, 2020, PFE registered a net income of $9.61 billion.

- Over the series' course, PFE experienced a generally increasing trend up to the end of 2022, with intermittent periods of growth and slight declines.

- Notably, the period between July 4, 2021, and October 3, 2021, saw an increase in net income from $13.22 billion to $19.18 billion. This trend continued with the highest reported Net Income on December 31, 2022, reaching $31.37 billion.

- However, the first quarter of the subsequent year (April 2, 2023) saw a substantial decline to $29.05 billion, representing one of the most significant drops within this series.

- The most recent data point, as of July 2, 2023, shows a further decrease in net income to $21.47 billion.

Examining the growth rate from the first value ($9.61 billion on December 31, 2020) to the last value ($21.47 billion on July 2, 2023), the net income of PFE increased by approximately 123%.

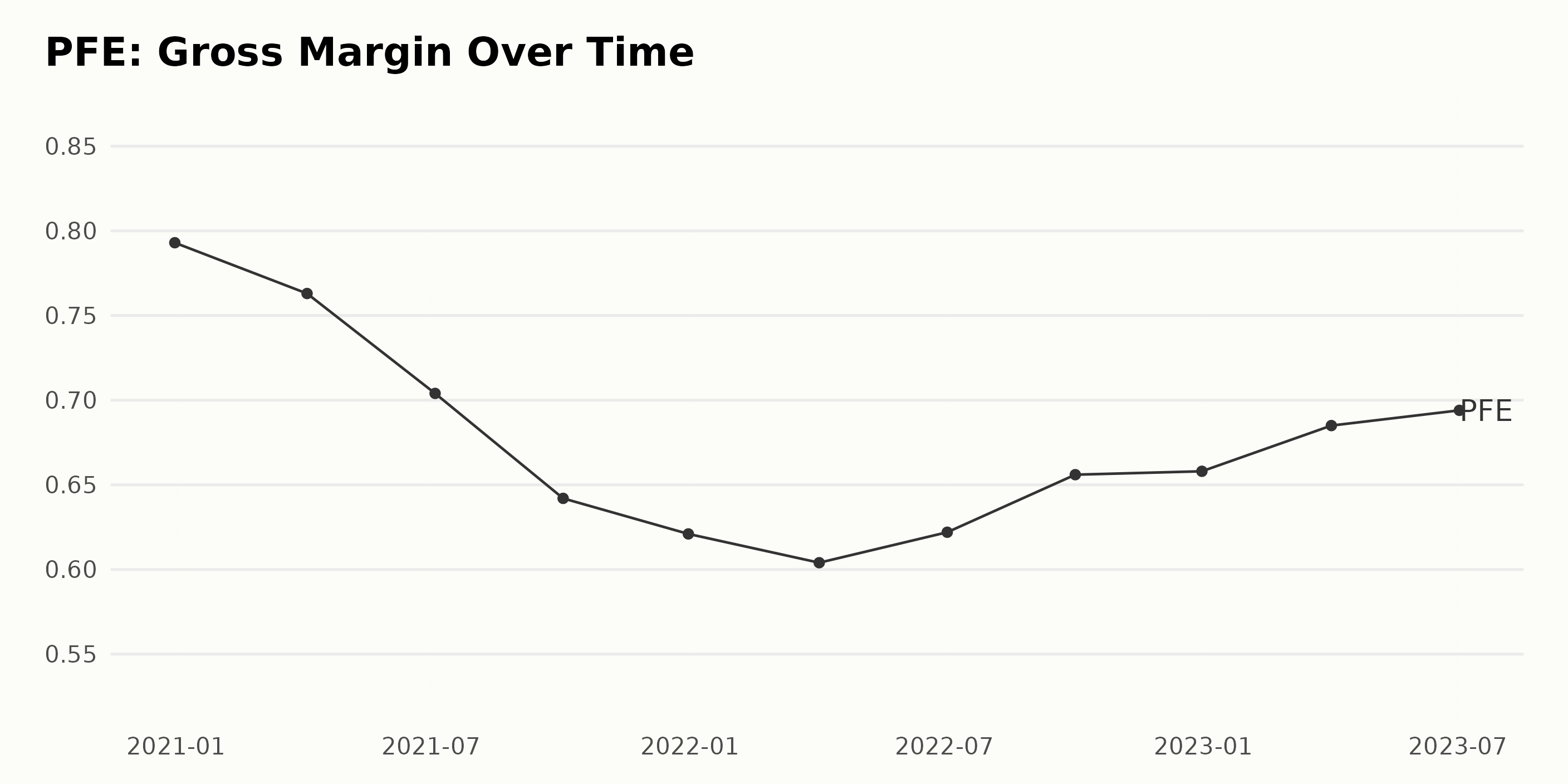

The gross margin of PFE has shown distinct fluctuations over the given data series. Here's a summary of the data:

- As of December 31, 2020, the gross margin was reported at 79.3%.

- There was a steady decrease over time during 2021, starting from 76.3% in April to 62.1% by the end of the year on December 31, 2021.

- In the first half of 2022, the gross margin demonstrated a further decline down to 60.4% by April 3, 2022.

- However, in the second half of 2022, the gross margin showed signs of recovery, rising upwards from 62.2% in July to reaching 65.8% by December 31, 2022.

- This increasing trend continued into 2023, with the reported gross margin reaching 68.5% in April and further improving to 69.4% by July.

Notably, there has been a significant decrease overall when comparing the first recorded value of 79.3% in December 2020 with the most recent data in July 2023 (69.4%). This translates to a decrease in growth rate of approximately 12.5% over the observed period. It is important to emphasize that while there was this general fallback trend, the most recent quarters display a stable, increasing margin trend.

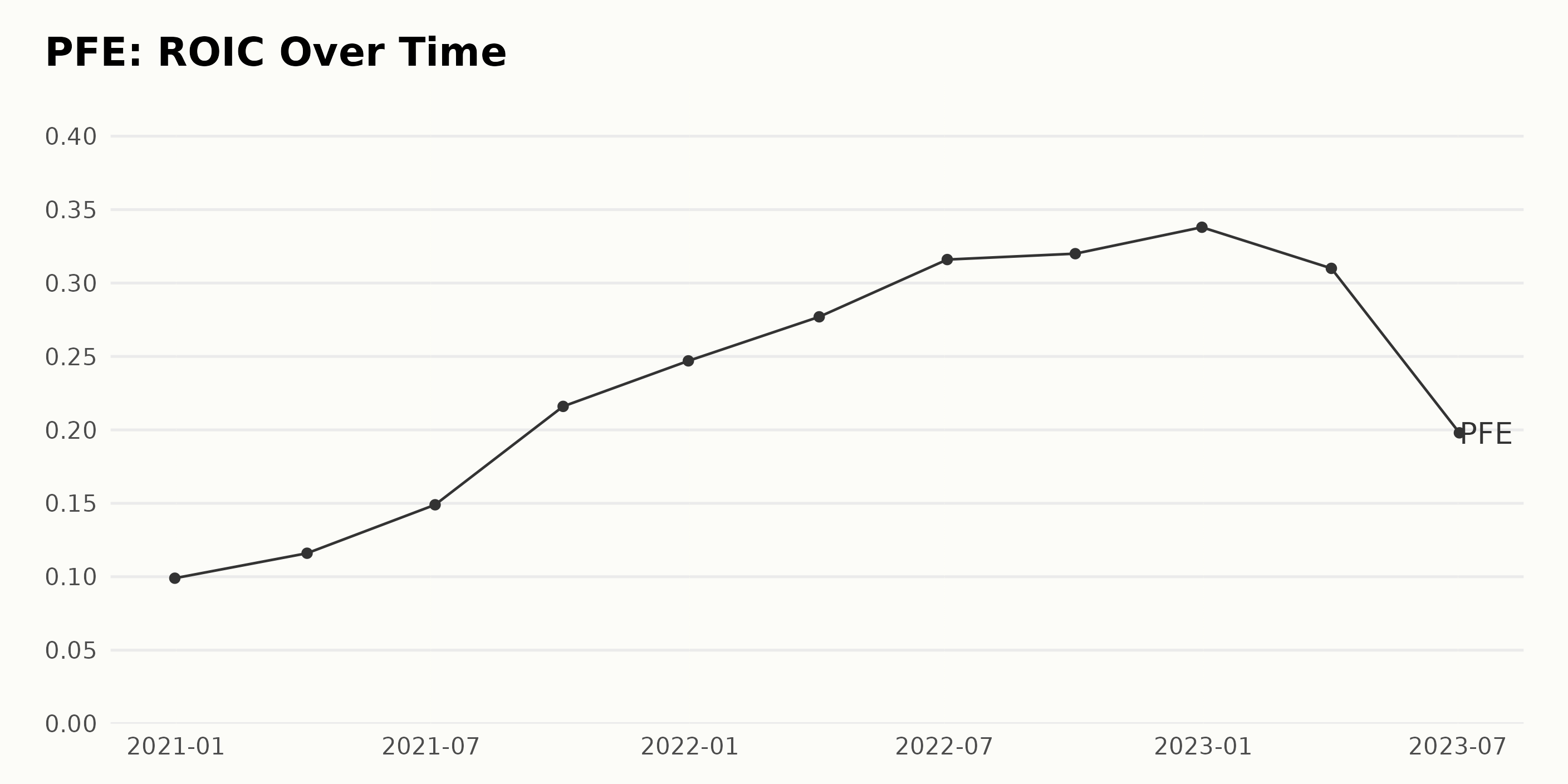

PFE's Return On Invested Capital (ROIC) indicates an overall rising trend since December 31, 2020, from 9.9% to a peak of 33.8% by December 31, 2022.

- By the end of 2021, there was a significant leap to 24.7%, up from 9.9% at the end of the previous year.

- In 2022, PFE witnessed more growth, albeit at a slowing pace, with ROIC increasing to 27.7% in April and then slightly more to 32% by October.

- The highest ROIC of 33.8% was achieved by the end of 2022.

- However, in 2023, a decrease began to occur in PFE's ROIC, hitting 31% in April of 2023 and then severely dropping to 19.8% by July of the same year.

In terms of overall growth rate, from the end of 2020 through to the summer of 2023, there's roughly a doubling in PFE's ROIC.

This clearly suggests that recent years have been highly beneficial for those invested in the company despite the noticeable dip seen halfway through 2023.

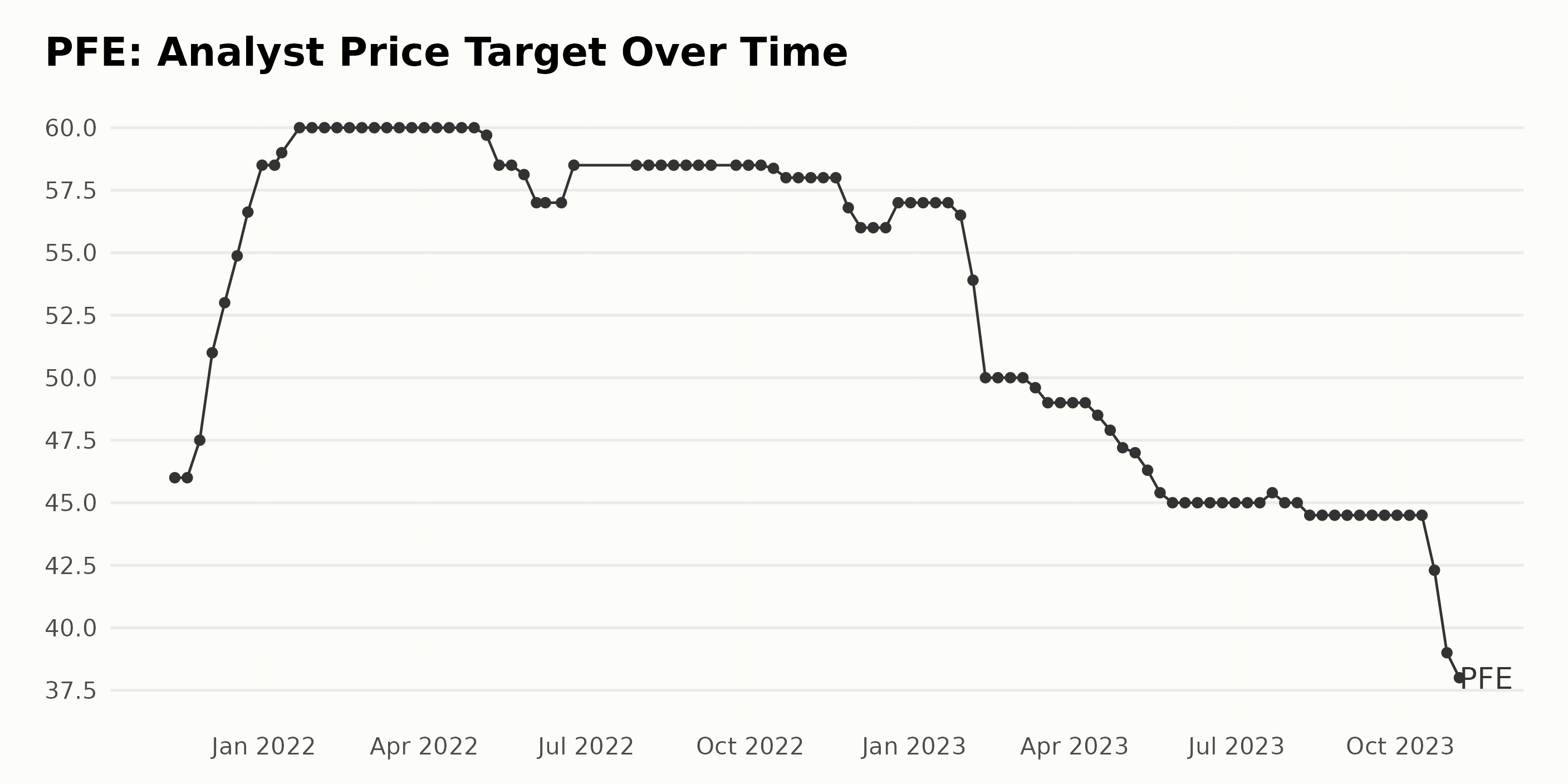

The analyst price target of PFE shows a fluctuating trend as per the data series from November 2021 to November 2023. Summary:

- The analyst price target for PFE started at $46 in November 2021, seeing a consistent uptrend until it reached its peak of $60 in January 2022.

- From January 2022 through April 2022, the price target remained stable at $60. However, it marked a minor dip to $59.7 in early May 2022 before returning to a consistently stable phase of $58.5 from June to September 2022.

- Toward late October 2022, there was a gradual decline setting in until it reached $56 by the end of November 2022. This mild downward trend continued till February 2023, when it reached $50.

- Following a stable phase at $50 through March 2023, the price target saw another declining trend, starting from $49.6 in March 2023 and eventually reaching $45 in May 2023.

- After holding steady at $45 through July 2023, the stock then registered a downward movement, dropping to $42.3 in mid-October 2023 and further down to $39 and $38 in late October and early November 2023, respectively.

The growth rate, calculated by measuring the last value from the first value, is about -17.39%. These figures put greater emphasis on more recent data and the last value in the series.

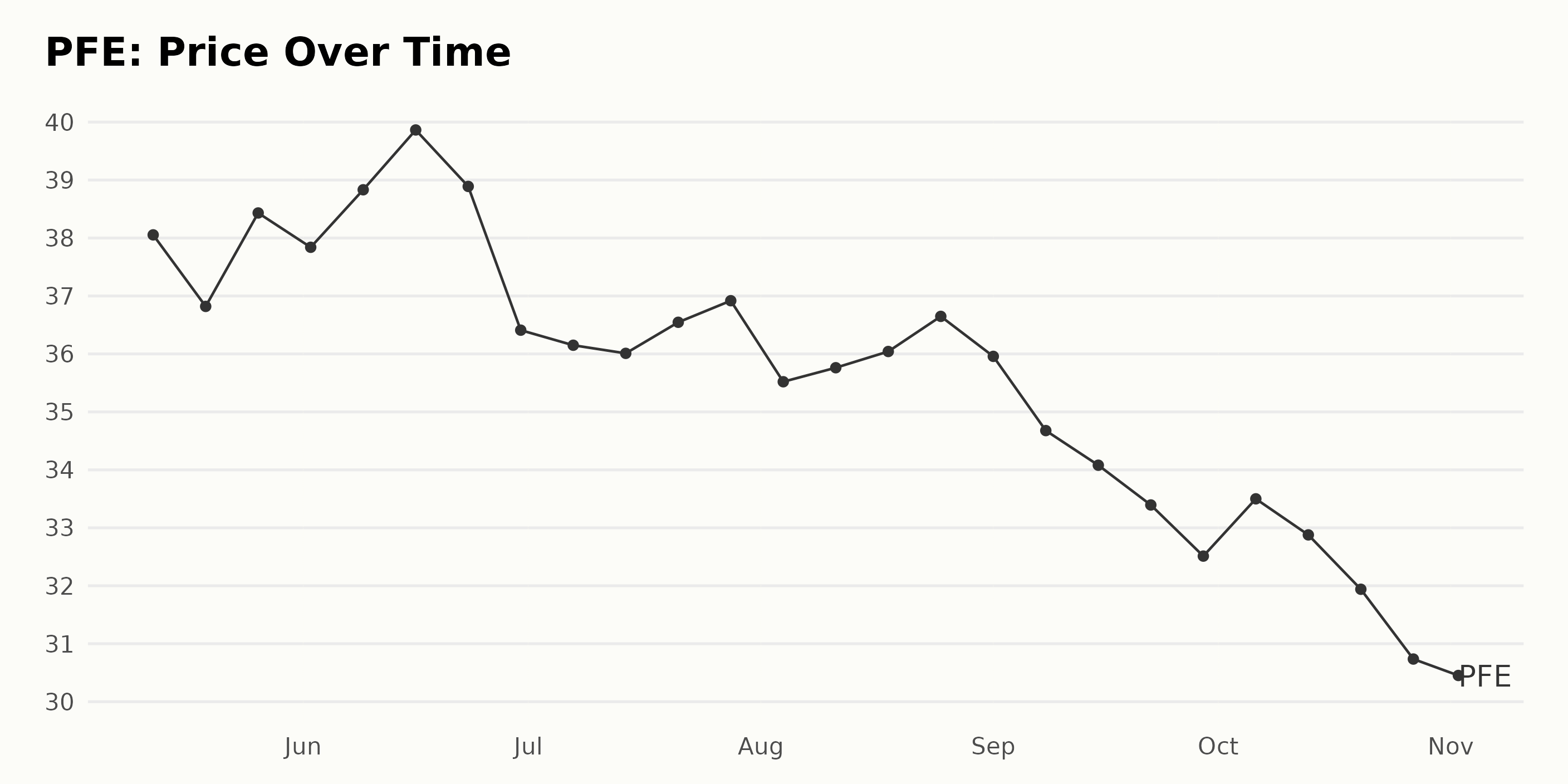

Analyzing Pfizer Inc.'s Gradual Share Price Decrease from May to November 2023

The data reflects the changing share price of PFE from May 2023 to November 2023. Please note that all prices have been rounded to two significant digits.

- On May 12, 2023, the price was $38.05.

- On May 19, 2023, the price decreased slightly to $36.82.

- The price then rose to $38.43 on May 26, 2023.

- The price fluctuated throughout June, peaking at $39.86 on June 16, 2023, before dropping to $36.41 at the end of the month.

- In July 2023, there was a slight decrease in the price, beginning at $36.15 and ending at $36.92 by July 29.

- The price dropped further in August to $35.52 on August 4, 2023, but then slightly increased towards the end of the month to reach $36.65 on August 25, 2023.

- The price followed a downward trend in September, with a notable drop to $34.68 on September 8, 2023, followed by a continued decrease to $32.51 towards the end of the month.

- A brief increase occurred in early October with a price of $33.5 on October 6, 2023, followed by a continued decrease throughout the month, finishing at $30.74 on October 27, 2023.

- By November 2, 2023, the price dropped slightly further to $30.50.

In general, the trend analyses for this period reveal a gradual decrease in PFE's share price. While there are slight fluctuations month by month, the data shows a consistent downward trend from mid-June onwards, with the price depreciating in value. This suggests a decelerating growth rate during this timeframe. Here is a chart of PFE's price over the past 180 days.

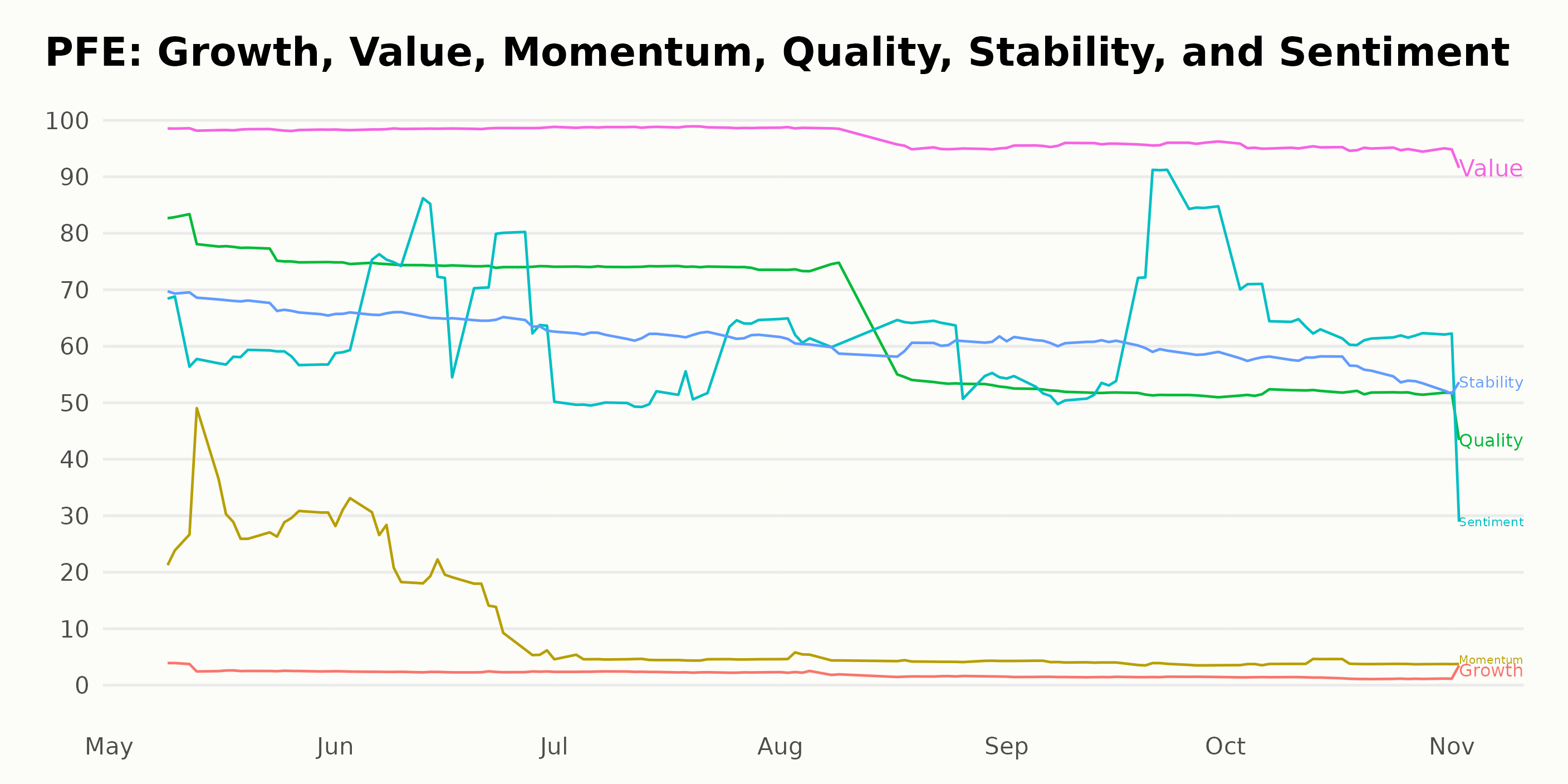

Analyzing Pfizer's Value, Quality, and Sentiment Ratings: Trends and Implications

PFE, a stock in the 151-stock Medical - Pharmaceuticals category, has seen changes in its POWR Ratings Grade and rank within its category over time. Here's a detailed overview: From May 13, 2023, to July 1, 2023:

- POWR Grade: B (Buy)

- Rank in Category (Best): #32 (May 13, 2023)

- Rank in Category (Worst): #40 (June 24, 2023, and July 1, 2023)

From July 8, 2023, onward:

- POWR Grade changed from B (Buy) to C (Neutral)

- Rank in Category (Best): #40 (July 29, 2023)

- Rank in Category (Worst): #68 (November 2, 2023)

As of the latest date provided, November 3, 2023, the POWR Grade of PFE is C (Neutral) and its rank within the category is #77. Thus, the PFE stock has declined in its category ranking recently.

The POWR Ratings for PFE along the most noteworthy three dimensions: Value, Quality, and Sentiment are discussed below:

Value: PFE has consistently high Value ratings throughout the observed period. The rating starts at 98 in May 2023, increases to 99 in June 2023 and remains consistently high through September 2023. A slight decrease is noted from October 2023 onwards, with the rating dropping to 95 and decreasing further to 93 by November 2023.

Quality: The Quality ratings for PFE start relatively high at 78 in May 2023. There is a noticeable downward trend over the ensuing months. Despite the initial decrease to 74 by June 2023, which holds steady until July 2023, there is a significant drop to 61 by August 2023. The decline continues to September and October 2023 as the rating reaches 52, followed by a further reduction to 48 by November 2023.

Sentiment: In May 2023, the sentiment rating of PFE was 59, and it saw an increase to 71 by June 2023. There is a variable but overall declining trend, with a rating of 54 in July 2023, reaching 61 by August 2023, and then rising again to 66 in September 2023. However, it drops to 64 in October 2023 and further declines strongly to 46 by November 2023.

Please note that these changes suggest PFE's Value rating has remained strong, albeit with a slight downtrend in later months. However, both Quality and Sentiment ratings show marked declining trends over the observed period. This highlights potential areas of attention for the firm.

How does Pfizer Inc. (PFE) Stack Up Against its Peers?

Other stocks in the Medical - Pharmaceuticals sector that may be worth considering are AbbVie Inc. (ABBV), Taro Pharmaceutical Industries Ltd. (TARO), and Novartis AG (NVS) - they have better POWR Ratings. Click here to explore more stock within the Medical - Pharmaceuticals sector.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

PFE shares were trading at $31.16 per share on Friday afternoon, up $0.66 (+2.16%). Year-to-date, PFE has declined -37.27%, versus a 15.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Is Pfizer (PFE) a Stock to Buy Following Its Q3 Earnings? StockNews.com