Valued at a market cap of $39.9 billion, Paychex, Inc. (PAYX) is a leading provider of human capital management (HCM) solutions for small and medium-sized businesses. The Rochester, New York-based company offers payroll processing, HR services, benefits administration, and workforce management through cloud-based platforms.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and PAYX fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software - application industry. The company generates a significant portion of revenue from recurring service contracts, supported by a scalable technology platform and a large client base across the U.S. and parts of Europe.

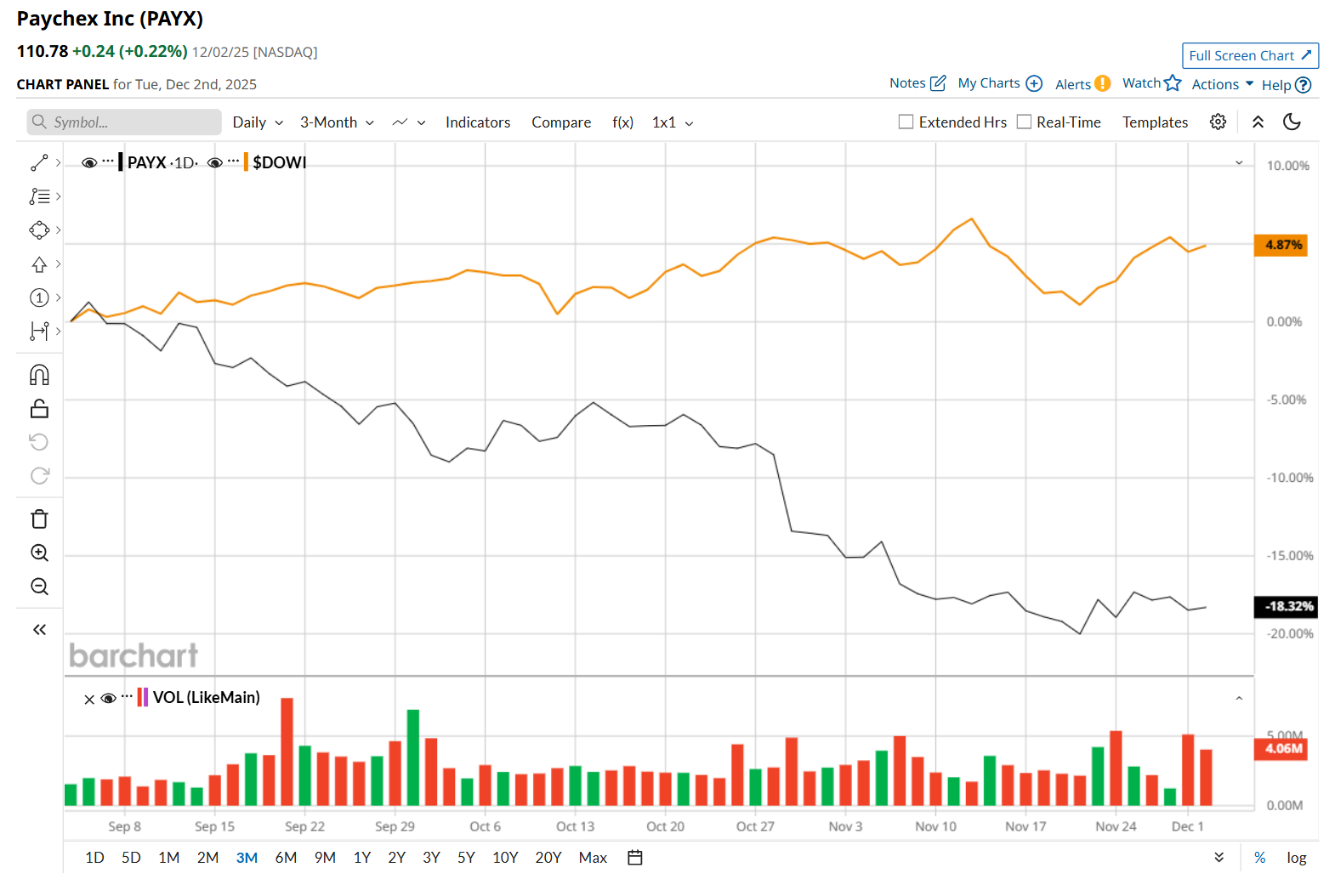

This HCM solutions provider has dipped 31.3% from its 52-week high of $161.24, reached on Jun. 6. Shares of PAYX have declined 18.5% over the past three months, considerably lagging behind the Dow Jones Industrial Average’s ($DOWI) 4.8% rise during the same time frame.

In the longer term, PAYX has fallen 23.8% over the past 52 weeks, notably underperforming DOWI's 6% uptick over the same time period. Moreover, on a YTD basis, shares of Paychex are down 21%, compared to DOWI’s 11.6% return.

To confirm its bearish trend, PAYX has been trading below its 200-day moving average since early July, with slight fluctuations, and has remained below its 50-day moving average since mid-June.

Shares of PAYX plunged 1.4% on Sep. 30 after its Q1 earnings release, despite reporting strong results. The company’s total revenue increased 16.8% year-over-year to $1.5 billion, meeting analyst estimates. Meanwhile, its adjusted EPS also grew 5.2% from the year-ago quarter to $1.22, exceeding consensus estimates by a penny. Furthermore, PAYX raised its fiscal 2026 adjusted EPS growth outlook in the range of 9% to 11%.

PAYX has also lagged behind its rival, Automatic Data Processing, Inc. (ADP), which declined 16% over the past 52 weeks and 12.1% on a YTD basis.

Looking at PAYX’s recent underperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 17 analysts covering it, and the mean price target of $135.28 suggests a 22.1% premium to its current price levels.