/NXP%20Semiconductors%20NV%20sign%20in%20Austin%2C%20TX-by%20JHVEPhoto%20via%20Shutterstock.jpg)

NXP Semiconductors N.V. (NXPI), headquartered in Eindhoven, the Netherlands, designs, manufactures, and supplies high-performance mixed-signal and standard product solutions. Valued at $49.1 billion by market cap, the company's innovative products and solutions are used in a wide range of applications, including automotive, industrial, IoT, mobile, and communication infrastructure.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and NXPI perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the semiconductors industry. NXPI is a key player in the automotive market, leveraging its portfolio of microcontrollers and analog chips for clusters, powertrains, infotainment, and radars. With substantial R&D investments, the company drives innovation, positioning itself for growth in electrification and autonomous driving trends.

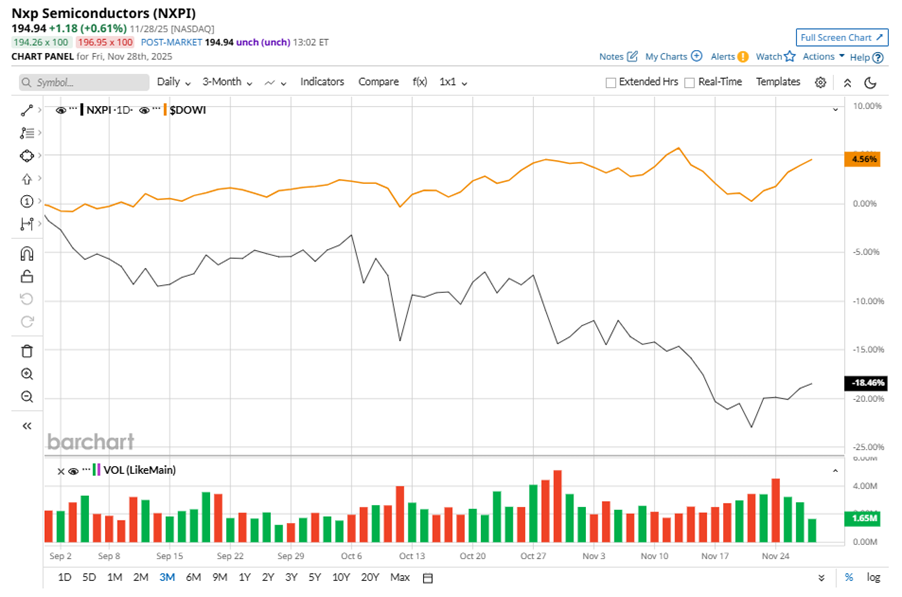

Despite its notable strength, NXPI slipped 23.7% from its 52-week high of $255.45, achieved on Feb. 20. Over the past three months, NXPI stock declined 18.5%, underperforming the Dow Jones Industrials Average’s ($DOWI) 4.6% gains during the same time frame.

In the longer term, shares of NXPI fell 6.2% on a YTD basis and dipped 14% over the past 52 weeks, underperforming DOWI’s YTD gains of 12.2% and 6.7% returns over the last year.

To confirm the bearish trend, NXPI has been trading below its 200-day moving average since late October. The stock has been trading below its 50-day moving average since early October.

On Oct. 27, NXPI shares closed up more than 1% after reporting its Q3 results. Its adjusted EPS of $3.11 met Wall Street expectations. The company’s revenue was $3.17 billion, beating Wall Street forecasts of $3.15 billion. For Q4, NXPI expects its adjusted EPS to be between $3.07 and $3.49.

In the competitive arena of semiconductors, Monolithic Power Systems, Inc. (MPWR) has taken the lead over the stock, showing resilience with a 56.9% gain on a YTD basis and a 65.7% uptick over the past 52 weeks.

Wall Street analysts are bullish on NXPI’s prospects. The stock has a consensus “Strong Buy” rating from the 30 analysts covering it, and the mean price target of $257.51 suggests a notable potential upside of 32.1% from current price levels.