Few big stocks have performed for investors like Nvidia has since the end of the big market slump of 2022.

The shares are up nearly 500% since 2023 opened. They're up 77% this year alone, seemingly immune from any kind of market worries.

A close of $1,000 seemed inevitable on March 8. Maybe its market, now north of $2 trillion could even challenge the giant market caps of Microsoft (MSFT) and Apple (AAPL) .

A big investor blink

But, mid-morning Friday, the stock tipped over from an all-time high of $974, falling more than 11% before rebounding to $875.28. The 5.6% loss on the day was Nvidia's biggest since May 2023.

That slump may weigh on markets this coming week in part because Nvidia (NVDA) wasn't alone on Friday. Amazon.com (AMZN) , Microsoft, Meta Platforms (META) and Tesla (TSLA) also fell.

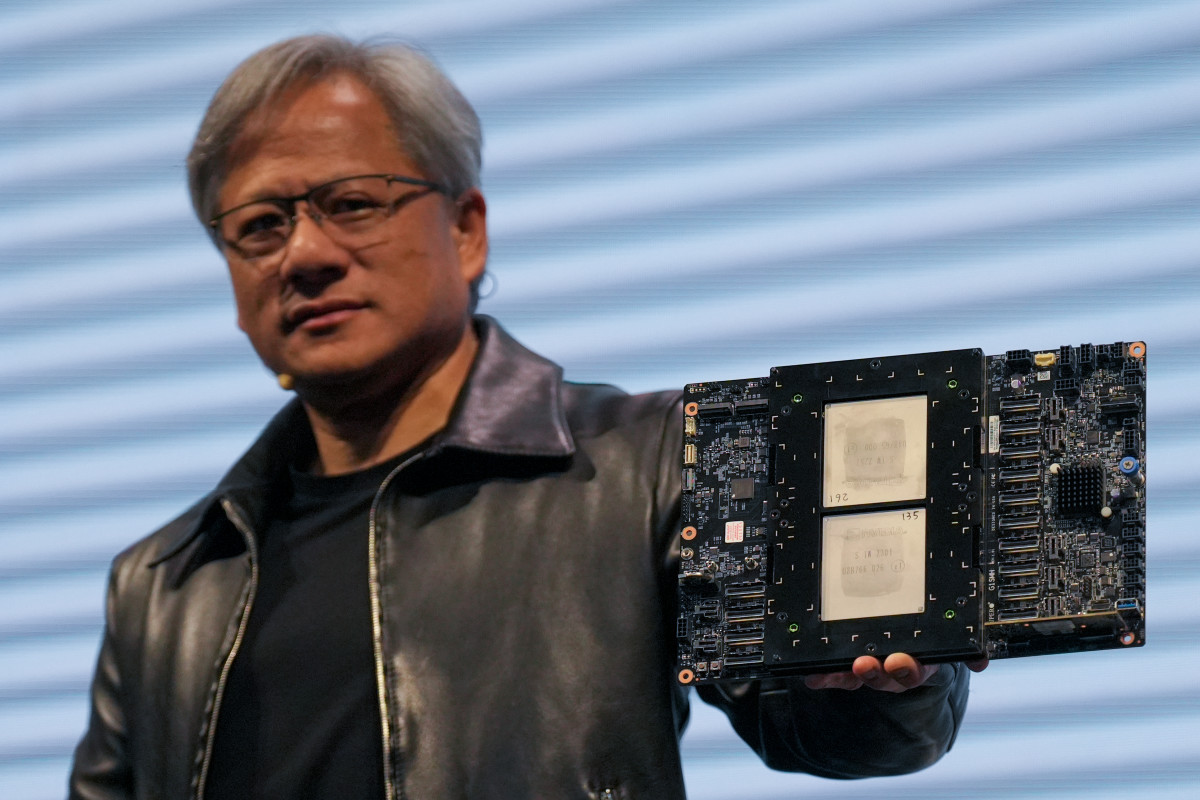

Related: Nvidia CEO Jensen Huang weighs in on huge AI opportunity

The major averages — S&P 500, the Dow Jones industrials, the Nasdaq Composite, Nasdaq-100 — all slipped as well on the day and for the week.

It's worth noting that the S&P 500 hit a new closing high on Thursday but was a loner. The Dow's record close of 39,131 came on Feb. 23. The Nasdaq and Nasdaq-100 had record-high closes on March 1.

For lack of a better word, call this a blip, but it may be more than a blip because one of the contributors to it has been a monumentally hot stock.

And the recent highs come at roughly the 24th anniversary of when the Nasdaq hit its then-peak of 5,048.62 on March 10, 2000. The dot.com bust erupted later that year.

So investors will be watching stocks this week because of the blip.

Inflation reports will be important

The focus on stocks may be a little more intense for two more reasons.

- The most important earnings reports for the fourth quarter have come out. This week features tech reports from Oracle (ORCL) on Monday, Adobe (ADBE) on Thursday and Jabil (JBL) on Friday, home builder Lennar (LEN) and discount retailers Dollar General (DG) and Dollar Tree (DLTR) .

- The most important economic report of the month is out — the monthly jobs report. There are two important inflation reports due this week and the monthly report on retail sales.

The earnings season has been good overall.

Nvidia's was, of course, the star, with huge revenue and earnings gains and the assertion by CEO Jensen Huang that artificial intelligence will be as profound a game changer in computing as the Internet was in the 1990s.

More on the economy and markets:

- Jobs report signals soft landing as hiring hits 275,000 and wage gains ease

- Major airline faces Chapter 11 bankruptcy concerns

- Analysts take another look at troubled NY bank

The jobs report showed job growth up by 275,000 with a small rise in the unemployment rate to 3.9%. The latter appears to reflect more people looking for jobs. Both reports will be revised, possibly lower over the next two months.

Getty Images

That assumes the Consumer Price Index due Tuesday and the Producer Price Index on Thursday don't surprise to the upside. Both are expected to show inflation edging closer to the Federal Reserve's 2% annual target.

If the estimates hold, the reports should not present a roadblock to the Federal Reserve's goal to cut interest rates this year.

Recession? What recession?

One other point. Business confidence is strong.

Even if a number of executives continue to fret about a potential recession, the word "recession" has receded in use during earnings season.

FactSet's John Butters noted in a blog post the earnings season "will mark the lowest number of S&P 500 companies citing 'recession' on earnings calls for a quarter" since the fourth quarter of 2021.

Interest rates fall back

Meanwhile, interest rates drifted lower this past week. The 10-year Treasury yield fell to 4.08% from 4.2% the week before and a near-term high of 4.33% on Feb. 22. Mortgage rates drifted a bit lower as well.

Crude oil prices also slipped.

Crude finished at $78.01 on Friday, down 92 cents on the day and 2.45% on the week.

Retail gasoline rose about 2% but were falling over the weekend.

Keep an eye this week on whether a $1 billion cash infusion into New York Community Bancorp (NYCB) stabilizes worries about a possible collapse.

An investor group led by former Treasury Secretary Steve Mnuchin agreed to help the regional bank struggling with earnings woes, management shakeup and fears of bigger problems.

Related: Veteran fund manager picks favorite stocks for 2024