COVID-19-related hospitalizations are once again on the rise due to the onslaught of new subvariants. Vaccine-maker Moderna, Inc. (MRNA) announced that an initial study shows that its updated vaccine is effective against the EG.5 (Eris) and FL 1.5.1 (Fornax) subvariants.

The updated shots await approval from health regulators and are expected to be available in the upcoming weeks. After the boom during the global pandemic, MRNA’s vaccine sales have toppled from their highs. Its product sales for the second quarter of 2023 were $293 million, down 94% year-over-year.

Nonetheless, the company expects $4 billion in sales to governments this year and between $2 and $4 billion in a private market for the shot in the United States and other countries. MRNA revealed to Reuters its expected COVID-19 vaccine price of about $130, while it initially priced the shot in the range of $25-$37 per dose in 2020.

Given this backdrop, let’s look at the trends of MRNA’s key financial metrics to understand why it could be wise to watch the stock and wait for a better entry point.

Examining MRNA's Financial Performance: Significant Fluctuations and Trends from 2020 to 2023

The trailing-12-month net income of MRNA showed significant fluctuations and a general upward trend from September 2020 to June 2023.

- Starting at losses of -$597.69 million in September 2020, the net income declined further to -$747.06 million by December 2020.

- A significant turnaround was seen in the first quarter of 2021, when MRNA reported a positive net income of $598.16 million in March 2021.

- This growth trend continued, with MRNA's net income rising substantially to $3.49 billion by June 2021, $7.06 billion by September 2021, and peaking at $12.20 billion in December 2021.

- In 2022, despite a slight increase to $14.63 billion in March, the net income started to exhibit a decline from June 2022.

- The net income decreased to $14.05 billion in June 2022, further to $11.76 billion in September 2022, and then declined sharply to $8.36 billion by December 2022.

- This downward trend persisted into 2023, with MRNA having a net income of $4.78 billion in March 2023 and $1.21 billion in June 2023.

Despite the decreasing trend in 2022 and 2023, the company's net income in June 2023 ($1.21 billion) signifies a tremendous increase compared to its initial point in September 2020, showing a progressive performance over the years.

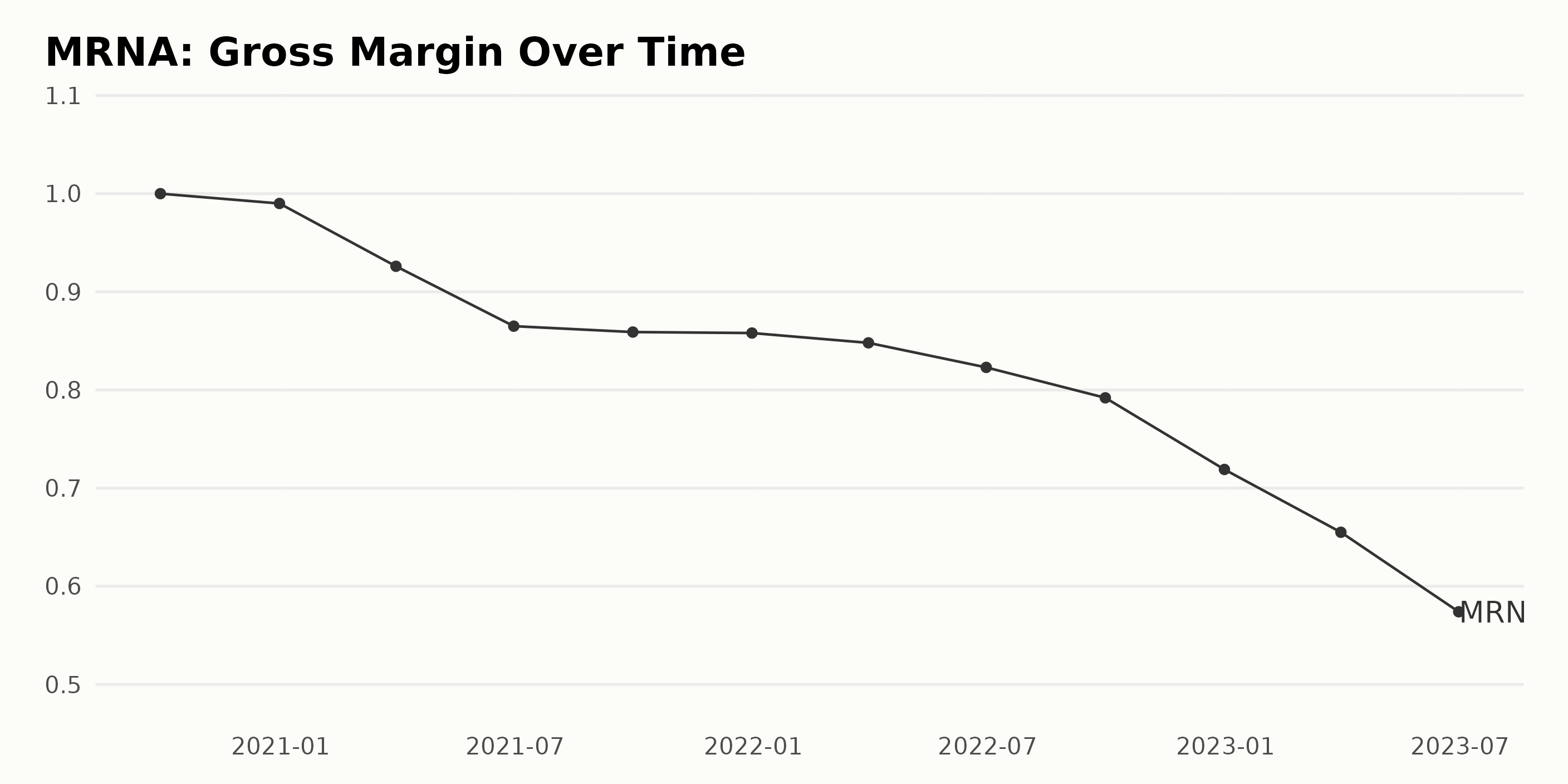

The gross margin of MRNA has experienced a downward trend over three years. Here's a summary of the recorded values:

- As of September 2020, the gross margin was 100%.

- By December 2020, the figure slightly declined to 99%.

- A noticeable dip occurred by March 2021, with a value of 92.6%.

- The gross margin continued to decrease throughout 2021: 86.5% (June), 85.9% (September), 85.8% (December).

- In 2022, the downward trend persisted: 84.8% (March), 82.3% (June), and 79.2% (September).

- As 2022 ended, the gross margin plummeted to 71.9%.

- The first half of 2023 saw a severe drop: 65.5% (March) and 57.4% (June).

Emphasizing recent figures, as of June 2023, MRNA's gross margin stands at 57.4%, indicating a significant decrease from previous years. Overall, from September 2020 to June 2023, MRNA suffered an absolute loss of 42.6% in gross margin. This could have considerable implications for the company's profitability.

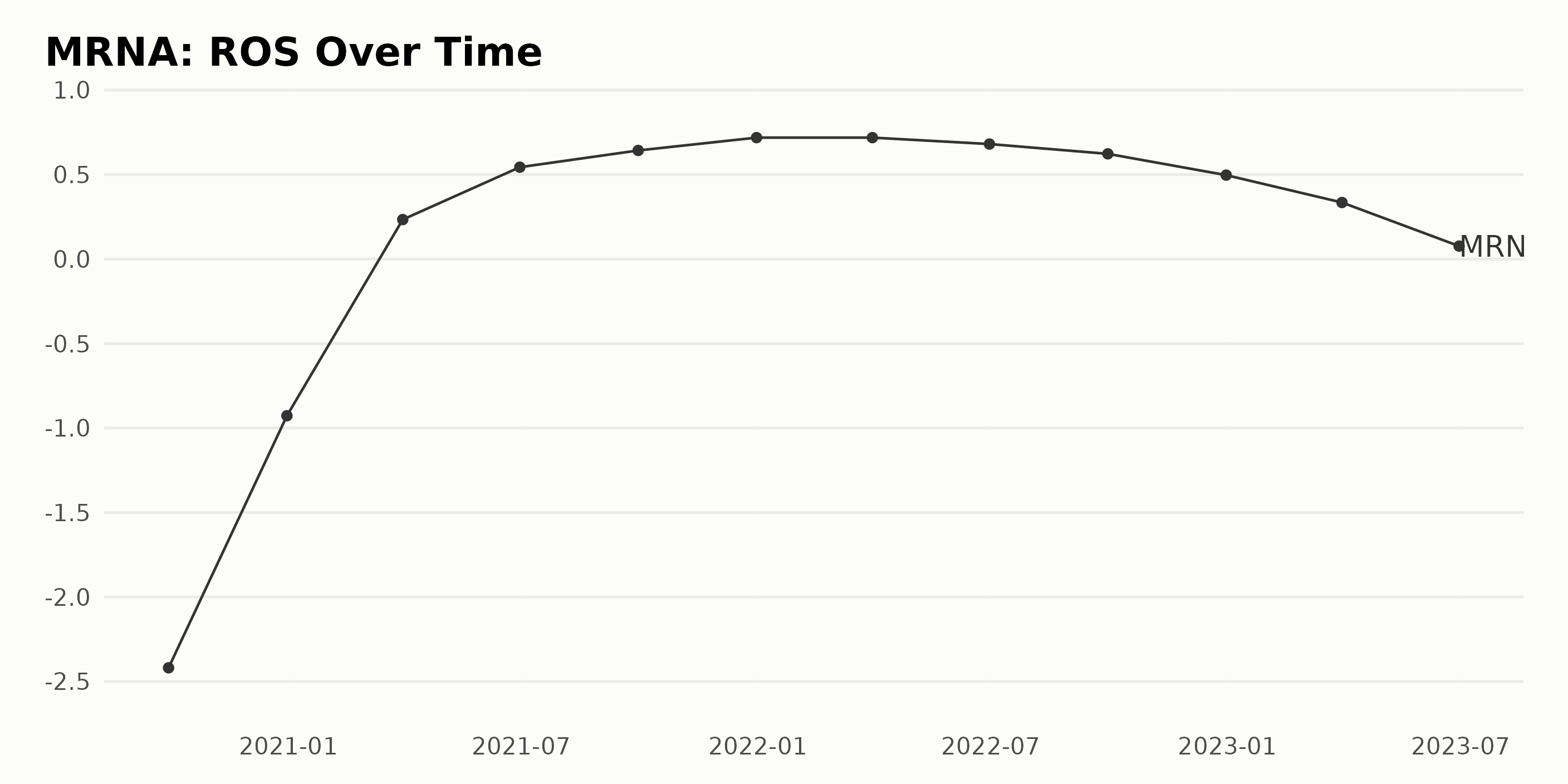

The Return On Sales (ROS) of MRNA has shown significant growth and a notable trend over several years.

- In September 2020, MRNA's ROS was -2.42, reflecting a negative return.

- By December 2020, the ROS had improved to -0.93, showing signs of recovery, although it remained negative.

- A positive turning point occurred in March 2021, where the ROS rose to 0.23.

- The ROS continued to increase, reaching 0.54 by June 2021 and 0.64 by September 2021.

- By the end of 2021, ROS peaked at 0.72, representing a considerable growth from the initial value.

- The first quarter of 2022 saw the same peak of 0.72 before experiencing a slight drop to 0.68 in June 2022 and further down to 0.62 in September 2022.

- For 2022, a ROS of 0.50 was recorded, signifying a downturn from previous quarters.

- Subsequent quarters in 2023 indicate a downward trend where the ROS dipped to 0.34 in March and plummeted to 0.08 by June 2023.

In conclusion, MRNA experienced a significant rise in ROS from September 2020 to December 2021, with a peak value of 0.72. However, this was followed by troughs starting from the second quarter of 2022 and a declining trend throughout 2023, ending at a modest 0.08 by mid-year. The overall growth rate from the start (September 2020) to the most current report (June 2023) is positive, from -2.42 to 0.08.

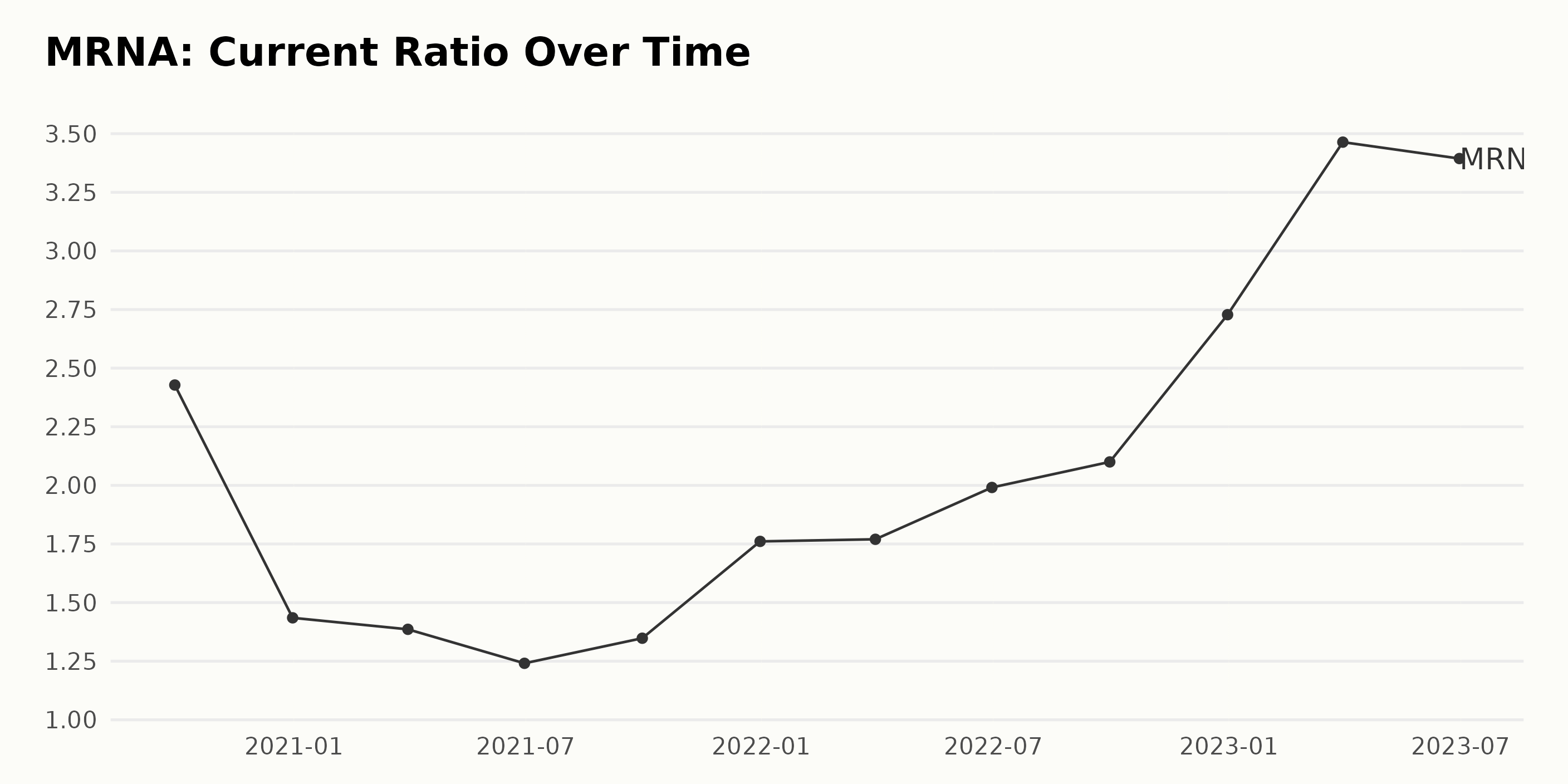

The data set describes the fluctuation of MRNA's current ratio from September 2020 to June 2023. Here are the key points:

- The current ratio of MRNA started at 2.43 as of September 30, 2020.

- It then exhibited a downward trend until June 30, 2021, reaching 1.24.

- Following this low point, the current ratio started rising again and reached 2.1 by September 30, 2022.

- Significantly, it demonstrated substantial growth and peaked at 3.46 on March 31, 2023.

- There was a minimal dip to 3.39 in the current ratio as of June 30, 2023.

Over the entire period, the current ratio grew from 2.43 in September 2020 to 3.39 in June 2023, a growth rate of approximately 40%. Emphasis is placed on the latter part of the series, where the current ratio saw substantial increases. The shift in the trend from an initial decline to a more recent rise suggests an overall strengthening of MRNA's liquidity position.

Analyzing MRNA's Share Price Trend and Growth Rate from March to August 2023

Upon analyzing the data, here are key points to note about the trend and growth rate of the asset MRNA:

- Starting at a price of $138.8 on March 3, 2023, MRNA saw a gradual increase over the month. It peaked on March 24, 2023, reaching a price of $151.6 before dipping slightly to $149.03 by the end of March.

- April 2023 started with an upward trend again. The highest price recorded was $157.37 on April 14, 2023, marking the overall peak for the observed period. However, the month's latter half featured a noticeable drop down to $133.63 by April 28, 2023.

- The overall trend through May 2023 to June 2023 was a gradual decrease. The prices fluctuated around $130s in May, except for a dip to $126.1 on May 19, 2023. By the end of June, the price fell to $121.41.

- In July 2023, MRNA share price saw slight variations, fluctuating between $121.07 and $124.44.

- There was a clear downward trend in August 2023, where the price fell significantly from $120.97 to $100.42 on August 18, setting a new low in the given duration. However, there was a slight recovery on August 24, 2023, to $112.65.

As per the data from March through August 2023, MRNA's share price follows a pattern of increment and decrement. A steady decline followed an initial growth phase extending through mid-April.

This trend appears to accelerate, particularly in August. Overall, the dataset suggests a decelerating growth rate for MRNA during this timeframe. Here is a chart of MRNA's price over the past 180 days.

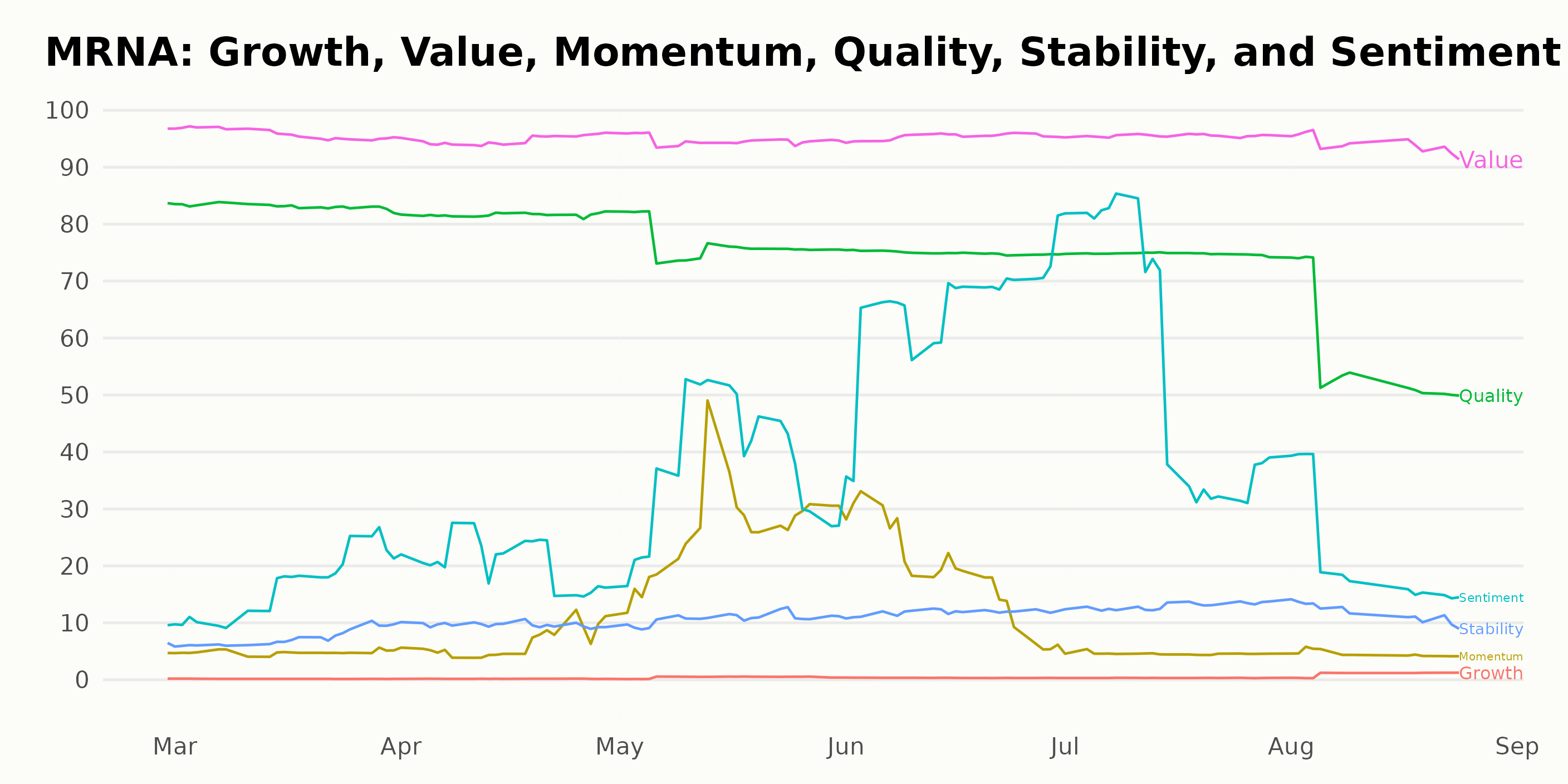

Analyzing MRNA's Value, Quality, and Sentiment Trends: A POWR Ratings Perspective

MRNA, being a part of the Biotech category, which comprises 378 stocks, has had its POWR Ratings grade maintained at C (Neutral) throughout the observed period. Let us examine its progress in detail:

- Starting from the week of March 4, 2023, at the #84 rank within the category, the rank fluctuated but remained within the top quartile.

- Despite some ups and downs in the ensuing weeks, the POWR grade of MRNA remained steady at C (Neutral).

- MRNA showed improved performance during the weeks of June 10, 2023, to July 8, 2023, with ranks ranging from #68 to #57, respectively.

- However, MRNA's ranking significantly declined from the week of August 9, 2023, downward to #140 and further witnessed a drop, touching #156 by August 24, 2023.

As of August 25, 2023, MRNA recorded a C (Neutral) POWR Grade and was ranked #170 amongst its peers in the Biotech category.

The three most noteworthy POWR Rating dimensions for MRNA show clear trends over time. These three dimensions are Value, Quality, and Sentiment.

- Value: The consistently high ratings in the Value dimension are definitely worth highlighting. With a metric of 97 in February 2023, it gradually decreased to 94 by August 2023. Maintaining a high-Value rating throughout this period suggests that MRNA could potentially be an undervalued asset.

- Quality: The Quality dimension also shows a clear declining trend. Starting at a rating of 84 in February 2023, it decreased to 58 in August 2023. Notwithstanding, its score stayed relatively high, indicating that the asset's fundamentals may remain robust over time despite the declining trend.

- Sentiment: The Sentiment dimension displays an interesting fluctuation. From February to June 2023, there's a steady increase in sentiment from 10 to 65. However, from June 2023 onwards, it variably declined, reaching back down to 23 by August 2023. This variation may highlight investors' changing emotional bias toward the stock.

It's worth noting that these trends provide valuable insights into the potential performance and perception of MRNA over this period.

How does Moderna, Inc. (MRNA) Stack Up Against its Peers?

Other stocks in the Biotech sector that may be worth considering are Alkermes plc (ALKS), Gilead Sciences, Inc. (GILD), and Otsuka Holdings Co., Ltd. (OTSKY) - they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

MRNA shares were trading at $110.75 per share on Friday afternoon, down $1.90 (-1.69%). Year-to-date, MRNA has declined -38.34%, versus a 15.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Is Now the Time to Buy Into Moderna, Inc. (MRNA)? StockNews.com