With Apple Inc (NASDAQ:AAPL) shares down nearly 15% since the start of the year, Kevin O'Leary, chairman of O'Shares ETFs, is looking to increase his exposure.

"Apple is in a different category," O'Leary said Monday on CNBC's "Fast Money Halftime Report."

O'Leary's Thesis: Most of the issues weighing on the markets won't impact Apple, he explained. In terms of supply chain constraints, Apple has plenty of access to semiconductors in China.

"They're so big as an employer that the Chinese government is not going to shut them down from the supply chain side," said O'Leary, who will be the keynote speaker at the inaugural Benzinga Psychedelics Capital Conference on April 19.

O'Leary wants to own any company growing earnings by more than 8%, particularly if it's a "behemoth" like Apple, which is unlikely to have a big downside surprise on quarterly reports.

The reason everyone started betting on Apple was the emergence of the company's services business, "which has not slowed down," he emphasized: "I don't see any wane of demand of the product or service anywhere in any geography."

Every year someone comes out and tries to predict the end of Apple, but those individuals are always wrong, he said.

"I get selling a stock when all the metrics change, particularly the underlying growth," O'Leary said. "People use their phones all around the world more and more and more and more ... I don't know why you wouldn't take the opportunity here ... and get up to a 5% weighting in your portfolio."

See Also: Apple Co-Founder's New Car Is An EV — And It Is Made By This Tesla Rival

AAPL Price Action: Apple has traded between $118.86 and $182.94 over a 52-week period.

The stock was down 2.69% at $150.59 at time of publication.

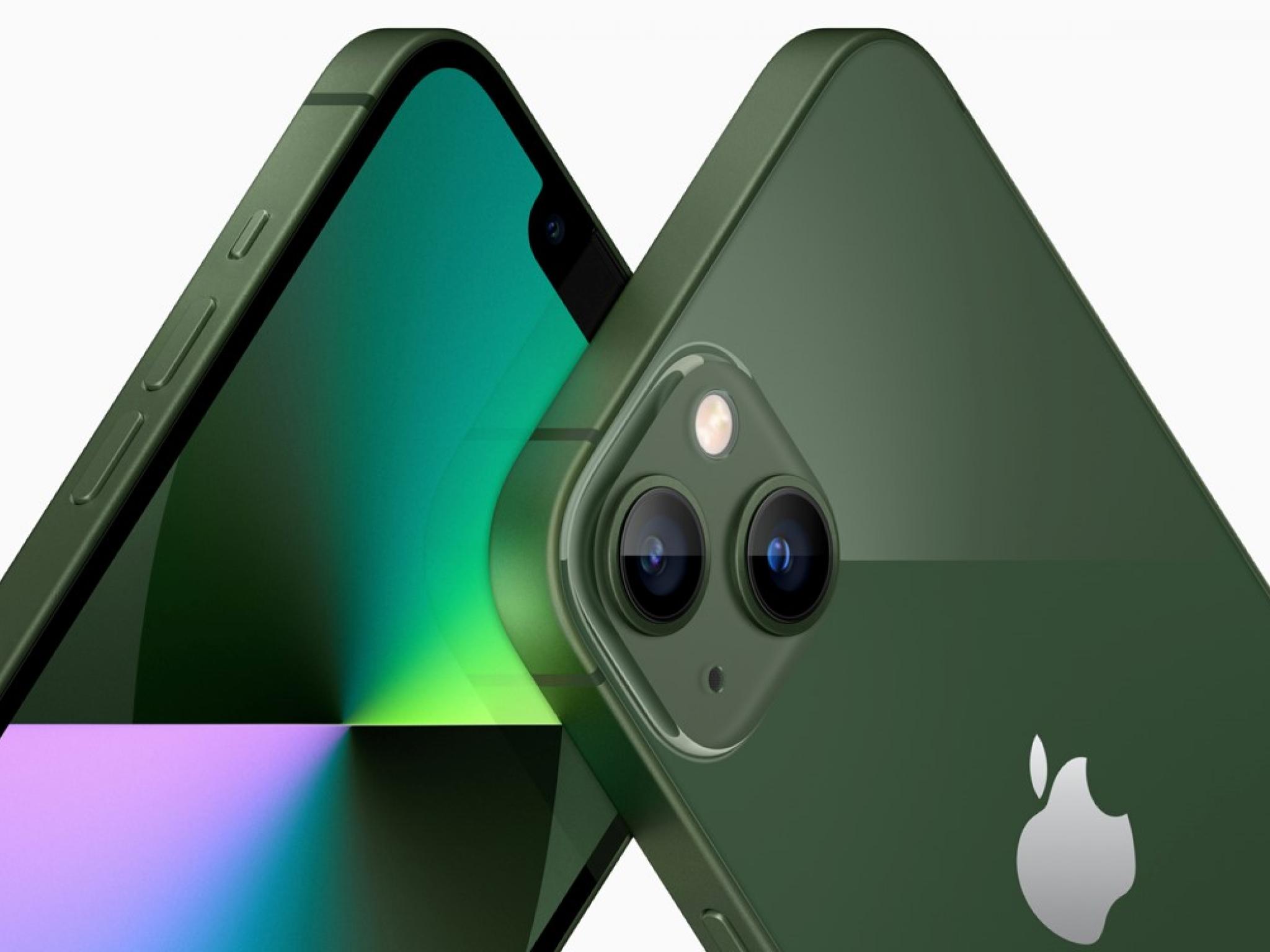

Photo: courtesy of Apple.