Palladium (PAU23) is one of the six platinum group metals, including platinum, rhodium, osmium, ruthenium, and iridium. Platinum group metals, or PGMS, are transition metals on the periodic table of elements with high heat and corrosion resistance. Platinum group metals are precious because they are rare but have many industrial applications.

Platinum (PLV23) and palladium are the only PGMs that trade on the futures market on the Chicago Mercantile Exchanges’ NYMEX division that lists energy contracts. Platinum and Palladium trade on the NYMEX because of their requirements in oil and petrochemical refining catalysts.

Over the first half of 2022, palladium was one of the worst-performing commodities, falling by more than 32%. In my July 6, Q2 Barchart report on the precious metals sector, I highlighted palladium’s decline in Q2 and over the first six months of 2023, along with the even more significant percentage drop in rhodium, a PGM that only trades in the physical market. Rhodium fell nearly 69% over the first six months of 2023. Rhodium was at the $3,700 per ounce level on June 30, with nearby palladium futures at $1,222 per ounce. While prices have edged higher in Q3, they remain not far from the year’s Q2 closing levels and lows.

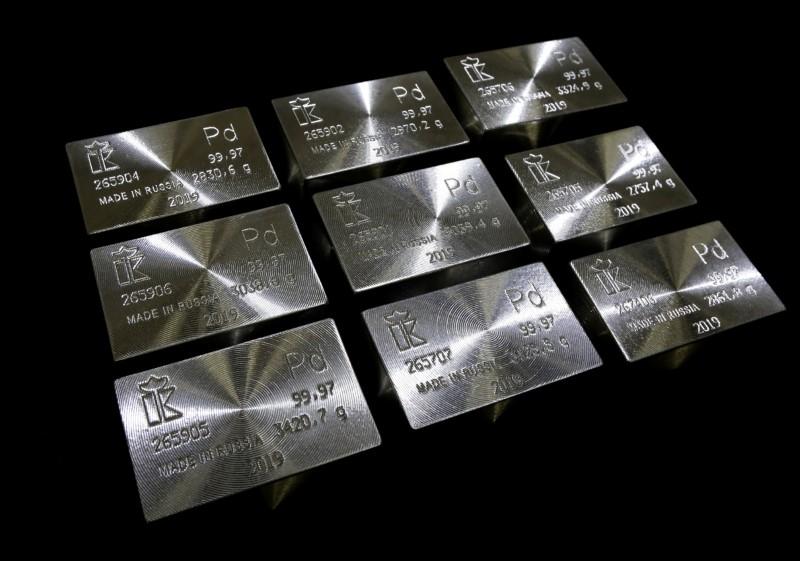

Russia is the leading palladium-producing country- Annual output is low

The world’s leading palladium-producing countries in 2022 were:

Source: Statista

The chart shows Russia and South Africa dominate the world’s palladium output. Of the total 210 tons of 2022 production, they produced 80%, with Russian output around eight tons more than South Africa.

In Russia, palladium is a byproduct of nickel output in the Norilsk region of Siberia. In 2022, the world produced 3,612 metric tons of gold, the leading precious metal. Palladium production was less than 6% of gold output.

Palladium has many industrial uses

Palladium is precious, but its properties make it a critical industrial metal. Catalytic converters account for most palladium consumption. Palladium is also required for jewelry, dentistry, watchmaking, blood sugar strips, aircraft spark plugs, surgical instruments, and electrical contacts. Palladium has other applications, including in concert or classical flutes.

Given the low output and the metal’s industrial nature, investment demand in the palladium market is minor.

A bearish trend since the 2022 high

In March 2022, supply fears caused by Russia’s invasion of Ukraine lifted palladium to a record $3,380.50 high.

The chart shows the parabolic rise from the early 2016 low below $500 per ounce to the March 2022 all-time high. Since then, palladium prices have made lower highs and lower lows, falling to the most recent low at just over $1200 per ounce in August 2023. Nearby September NYMEX palladium futures were sitting near the low below the $1275 level on August 22.

Technical support at the 2001 high

The long-term chart shows the critical technical support level for palladium.

The chart dating back to the 1970s highlights illustrates palladium’s rise to $1,035 per ounce in February 2001, which stood as the upside target and technical resistance level from 2001 through 2017 when palladium rose to a new record peak.

The long-term technical resistance at the 2001 high became technical support as palladium prices have not traded below $1,035 per ounce since 2017. At the 2022 all-time high, palladium rose to over triple the level of the 2001 high.

PALL is the palladium ETF product

At the $1273 level on August 22, palladium was $238 above its technical support level and $2,107.50 under the 2022 peak. The war in Ukraine, sanctions on Russia, and Russian retaliation against countries supporting Ukraine continue to threaten palladium supplies. Moreover, South Africa is a BRICS member. The BRICS countries have been cooperating, meaning the BRICS bloc controls 80% of the world’s palladium supplies.

While palladium has declined, and the trend remains bearish in August 2023, the price is approaching the critical technical support level. The limited supplies and industrial demand suggest that palladium prices will find a bottom and recover sooner rather than later.

The most direct route for a palladium investment is through palladium bars and coins. The NYMEX futures provide another investment alternative with a physical delivery mechanism.

The Aberdeen Physical Palladium ETF product (PALL) owns physical palladium bullion and moves higher and lower with the metal’s price. At $117.25 per share on August 22, PALL had over $222.77 million in assets under management. PALL trades an average of 22,264 shares daily and charges a 0.60% management fee.

NYMEX palladium futures fell 62.3% from $3,380.50 in March 2022 to the $1273 level on August 22, 2023.

Over the same period, PALL dropped 60.7% from $298.21 to $117.25 per share. PALL does an excellent job tracking palladium’s price on the downside and should keep pace when palladium recovers.

The critical technical level in palladium is 2001's $1035 high. Even though the bearish trend continues, the odds favor a higher low over the coming weeks and months. I favor a scale-down buying approach to PALL and would only reconsider if palladium prices fell below the support level that had previously been technical resistance.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.