Norwegian Cruise Line Holdings Ltd. (NCLH) has been benefitting from improved booking activities and occupancy thanks to strong demand in this WAVE season. The company achieved sequential occupancy improvement of approximately 101.5% in the first quarter, while its cumulative booked position for the remainder of 2023 is at record levels.

While the company is focusing on efforts to maximize revenue opportunities and streamline costs, to achieve profitable growth, inflation and global supply chain constraints could continue to pressure margins in the near term.

NCLH is also ramping up efforts to enhance liquidity and financial flexibility. However, considering the uncertain macroeconomic environment, its financial recovery can be challenging. Rising interest rates are raising worries about the cruise operator’s massive debt load and ability to recover in a broader economic downturn.

NCLH is saddled with $13.77 billion in total debt, while its net debt is $13.07 billion. Its total cash stood at $700.60 million, and its trailing-12-month levered free cash flow stood at a negative $401.80 million. Its debt/free cash flow ratio is negative 45.92.

NCLH has been bearing the brunt of inflationary pressures, interest rate hikes, and rising fuel prices. These factors pose concerns about its return to profitability anytime soon.

Let’s look at some of its metrics to gauge its challenges and further understand why it may be best to avoid NCLH for the time being.

Analyzing NCLH’s Net Income, Revenue, Gross Margin, and Current Ratio

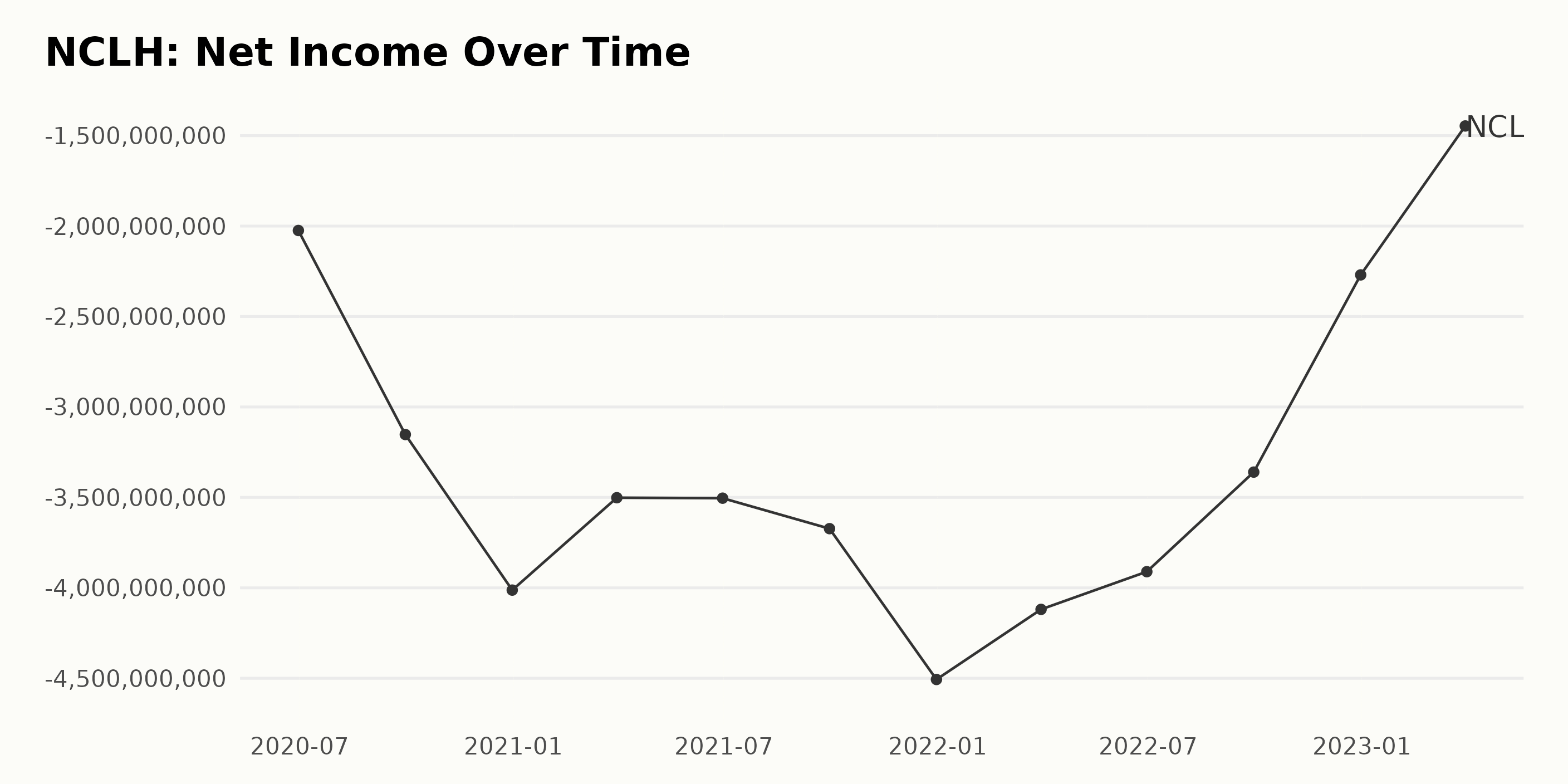

NCLH’s net income has improved from negative $202 million (June 30, 2020) to negative $14 million (March 31, 2023). Meanwhile, fluctuations can be observed throughout this data series, with the most notable change occurring between March 31, 2021, and December 31, 2021, with a growth rate of 28%.

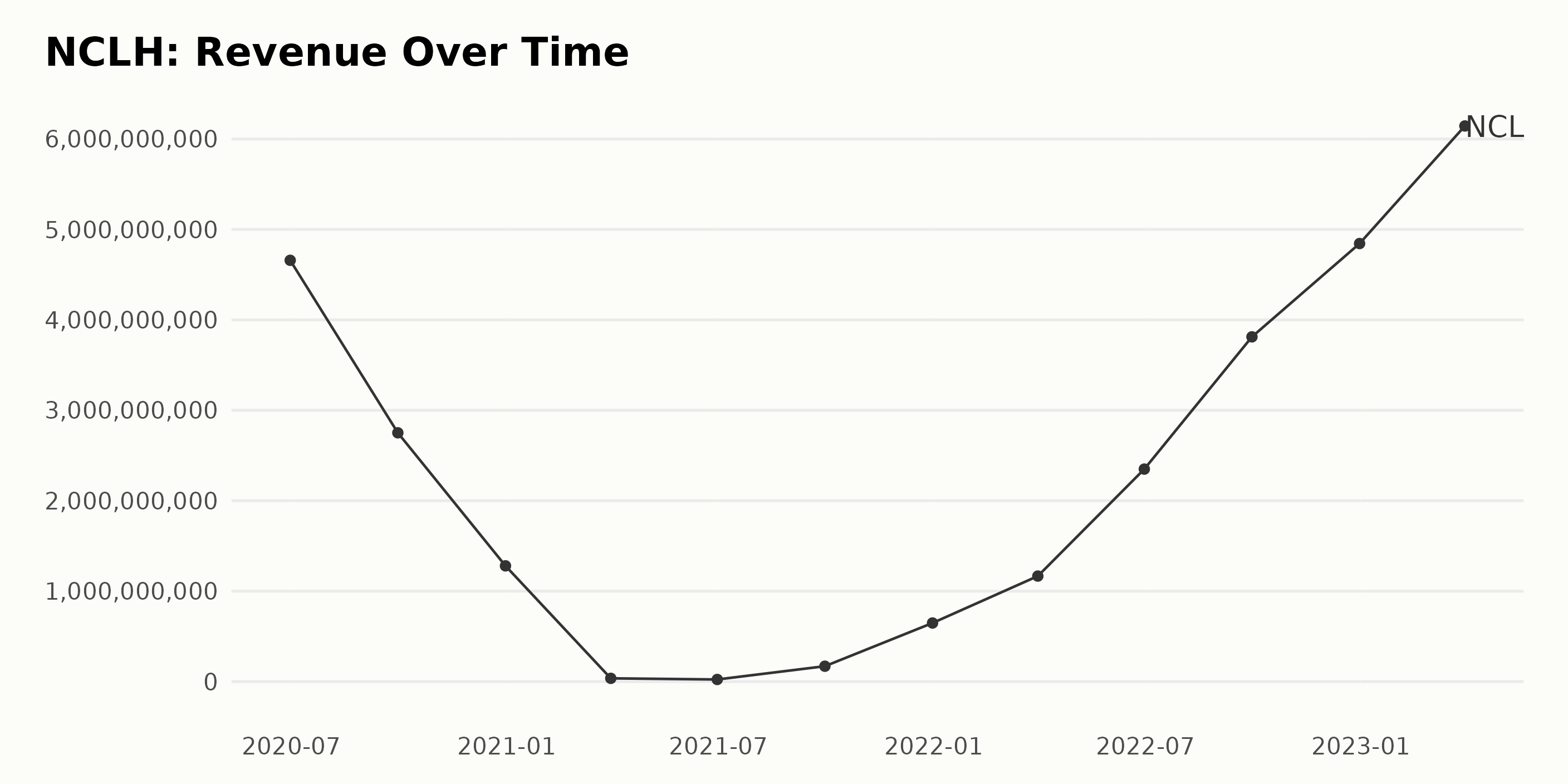

NCLH’s revenue has steadily increased from $127.99 million on December 31, 2020, to $614.38 million on March 31, 2023, representing a growth rate of 377%. Its revenue was at $484.38 million on December 31, 2022.

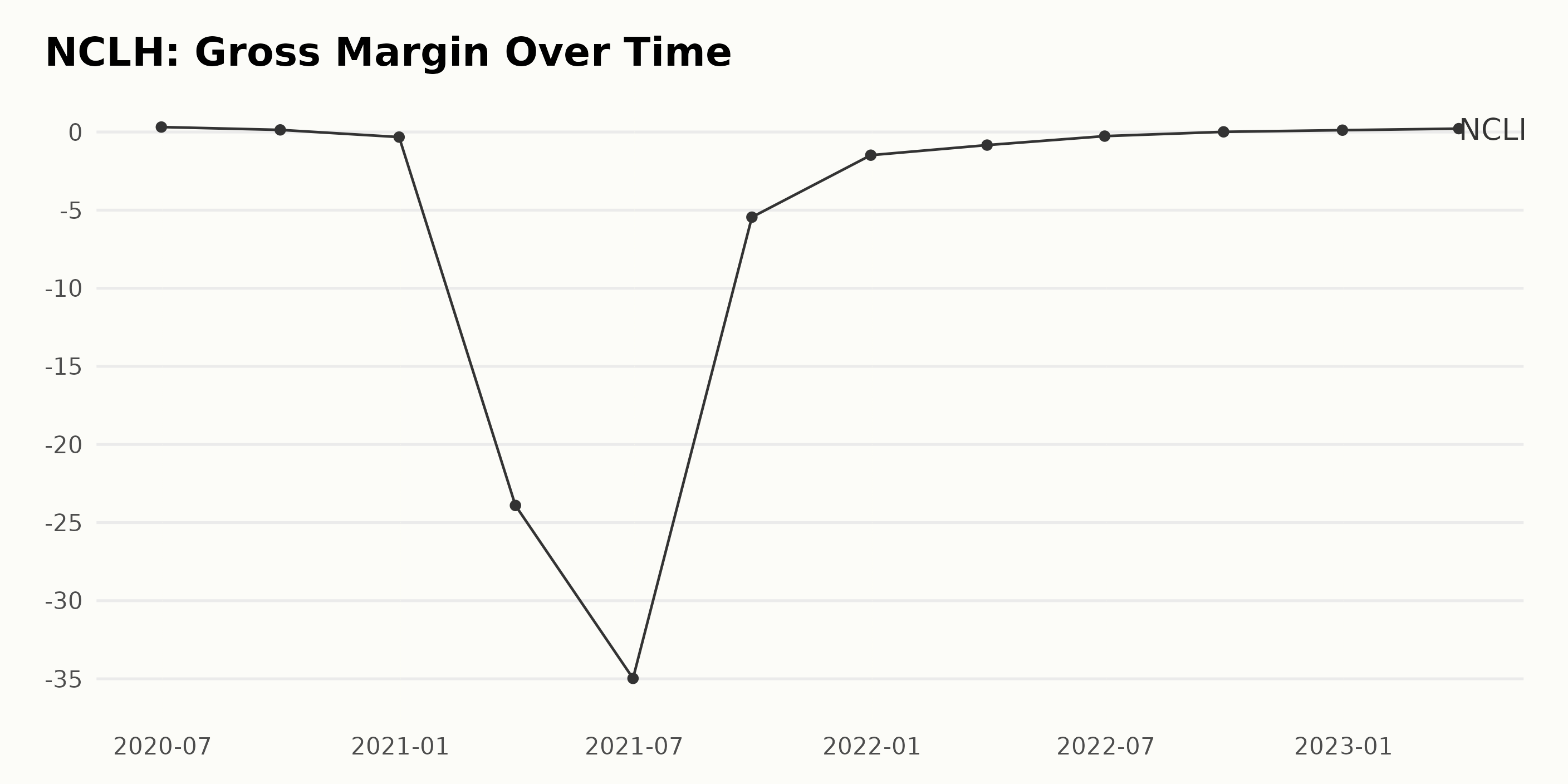

NCLH’s gross margin has fluctuated over the last three years, ranging from a high of 31.9% on June 30, 2020, to a low of negative 34.9% on June 30, 2021. The value has generally been negative since March 2021; however, there has been an overall growth of 2.3%, with the most recent value at 21.7% on March 31, 2023.

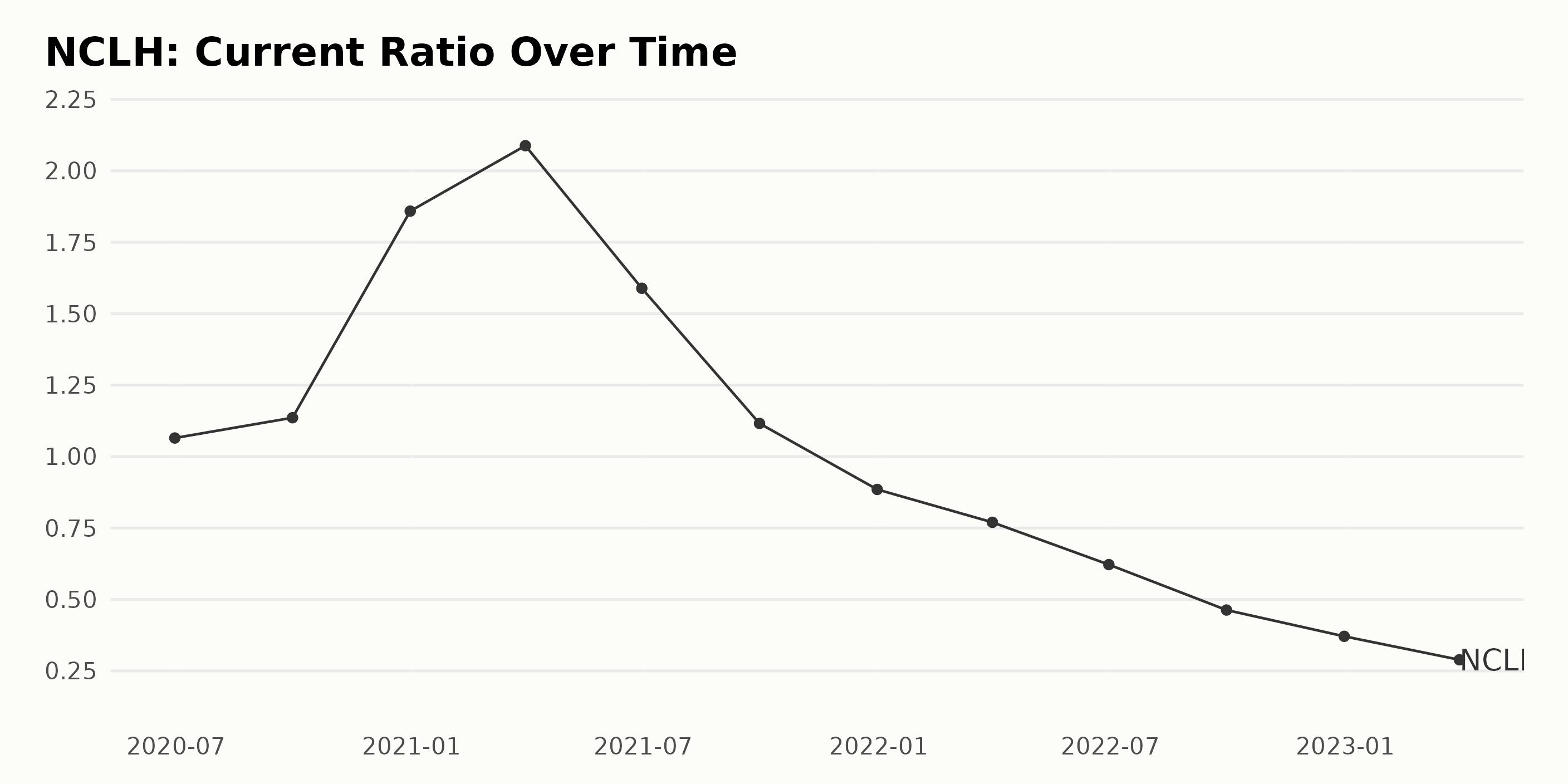

NCLH’s current ratio has fluctuated substantially over the past three years. From June 2020 (1.07) to March 2021 (2.09), there was a 95.7% increase, which suddenly reversed from June 2021 (1.59) and then experienced a slight upturn towards the end of 2021 before declining steadily to 0.37 in March 2023. Therefore, the overall growth rate is -64.4%.

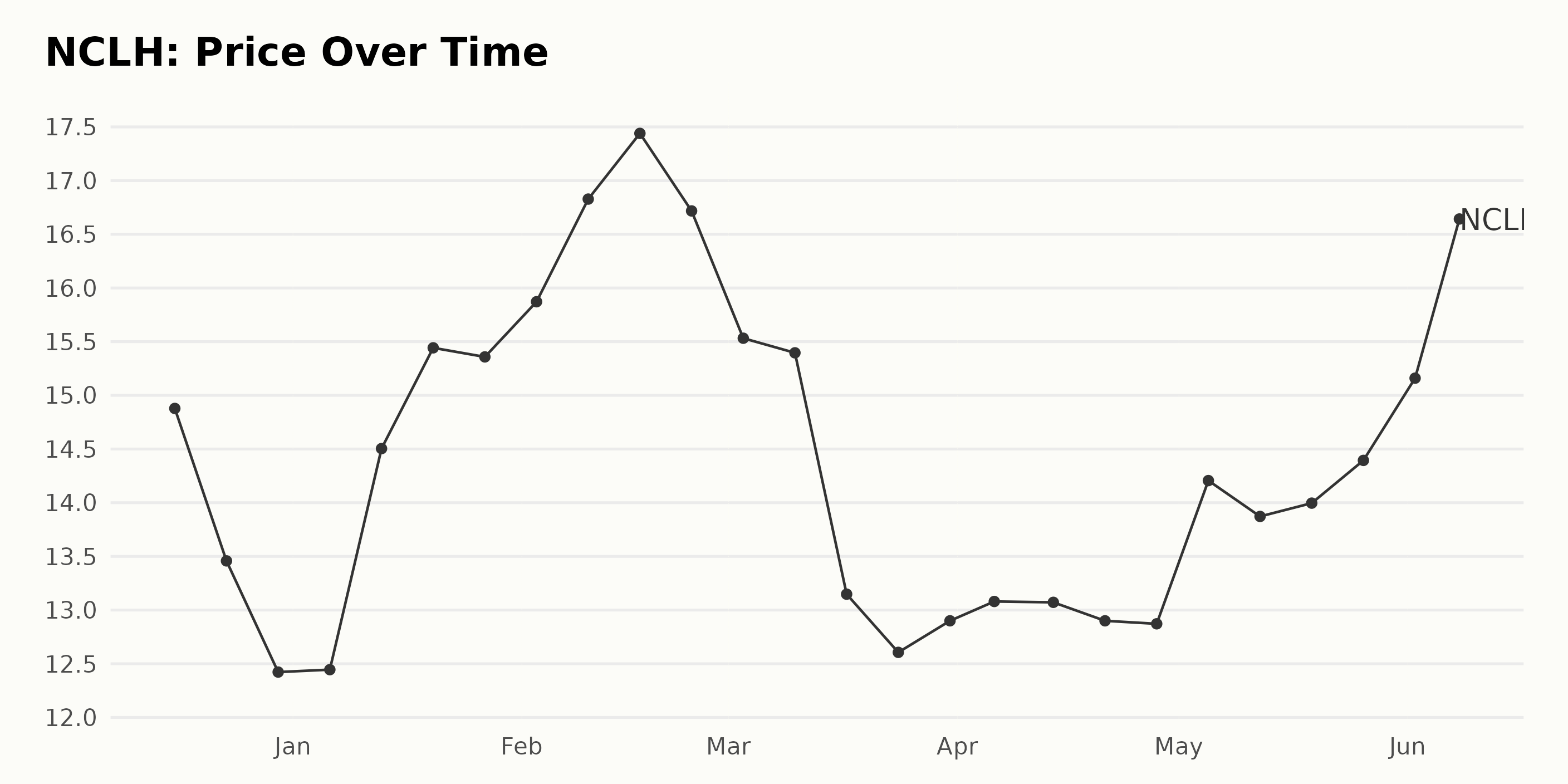

NCLH Share Price Rose Significantly in 6 Months

NCLH’s share prices over this period increased. The price was $15.49 on December 9, 2022, and rose to $17.02 on June 7, 2023, representing an increase of $1.53. Here is a chart of NCLH’s price over the past 180 days.

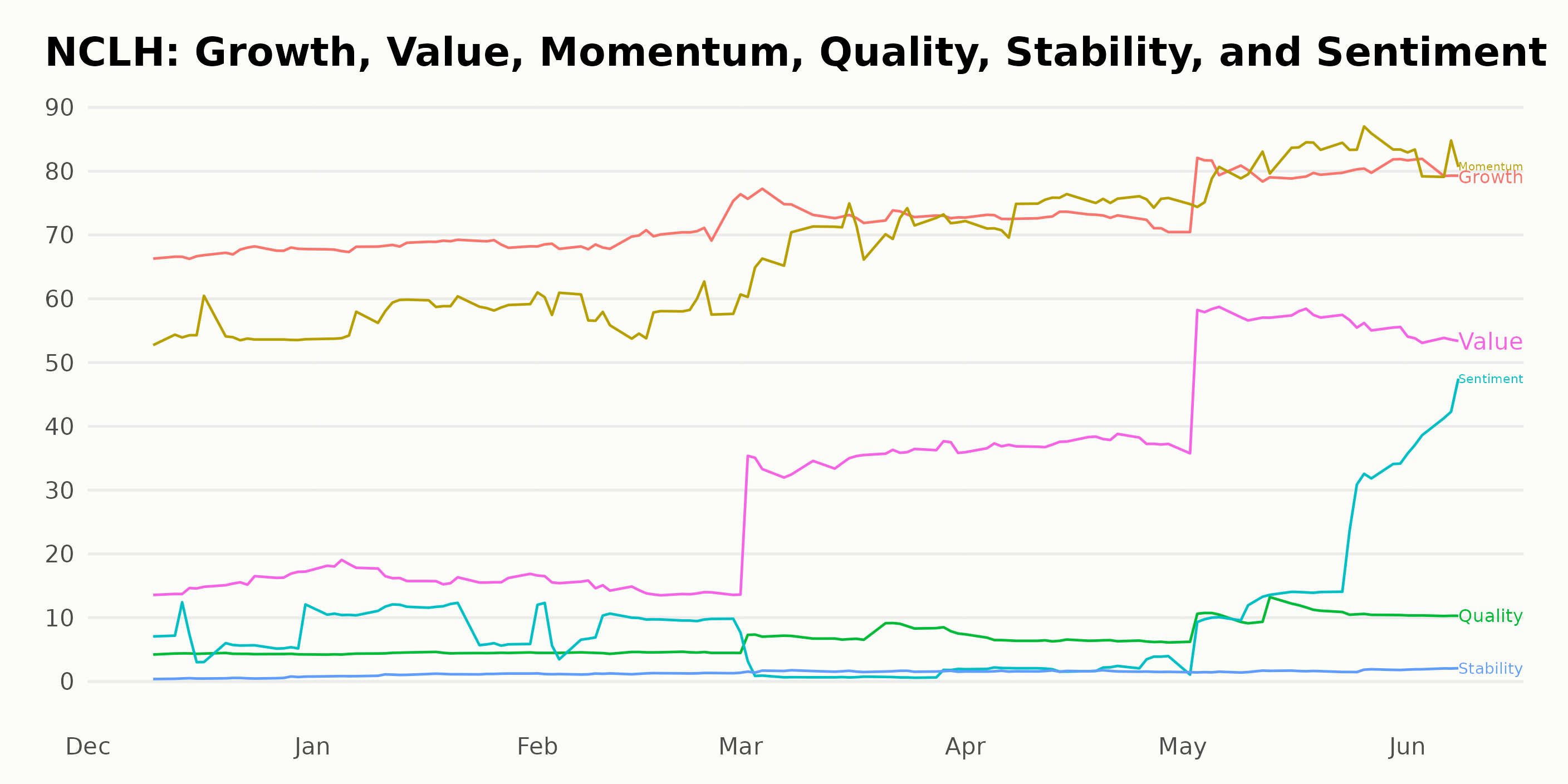

Unfavorable POWR Ratings

NCLH has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #3 out of the four stocks in the Travel - Cruises category. NCLH has an F grade for Stability and a D for Quality.

Stocks to Consider Instead of Norwegian Cruise Line Holdings Ltd. (NCLH)

Other stocks that may be worth considering are Bluegreen Vacations Holding Corp. (BVH), Playa Hotels & Resorts N.V. (PLYA), and Marriott International Inc. (MAR) -- they have better POWR Ratings.

Is the Bear Market Over?

Investment pro Steve Reitmeister sees signs of the bear market’s return. That is why he has constructed a unique portfolio to not just survive that downturn...but even thrive!

Steve Reitmeister’s Trading Plan & Top Picks >

NCLH shares were trading at $16.99 per share on Thursday afternoon, down $0.03 (-0.18%). Year-to-date, NCLH has gained 38.81%, versus a 12.60% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Is Norwegian Cruise Line (NCLH) the Travel Stock to Buy This Summer? StockNews.com