Department store operator Nordstrom, Inc. (JWN) in Seattle, Wash., is a fashion retailer that offers apparel, shoes, beauty, accessories, and home goods for its customers. The company provides various brand name products and private label merchandise through several channels.

In its first quarter, JWN topped analysts’ revenue estimates. According to a Refinitiv survey, while the Street was expecting revenue to come in at $3.28 billion for the quarter, JWN reported $3.57 billion revenue. The company expects fiscal-year revenue growth in the range of 6%-8% compared with the prior expectation of 5%-7%. The company also reported a $20 million first-quarter profit, or 13 cents per share, while analysts expected it to report a loss of 5 cents per share. It has also raised its EPS to a range of $3.38 - $3.68, up from a prior expectation of $3.15 - $3.50.

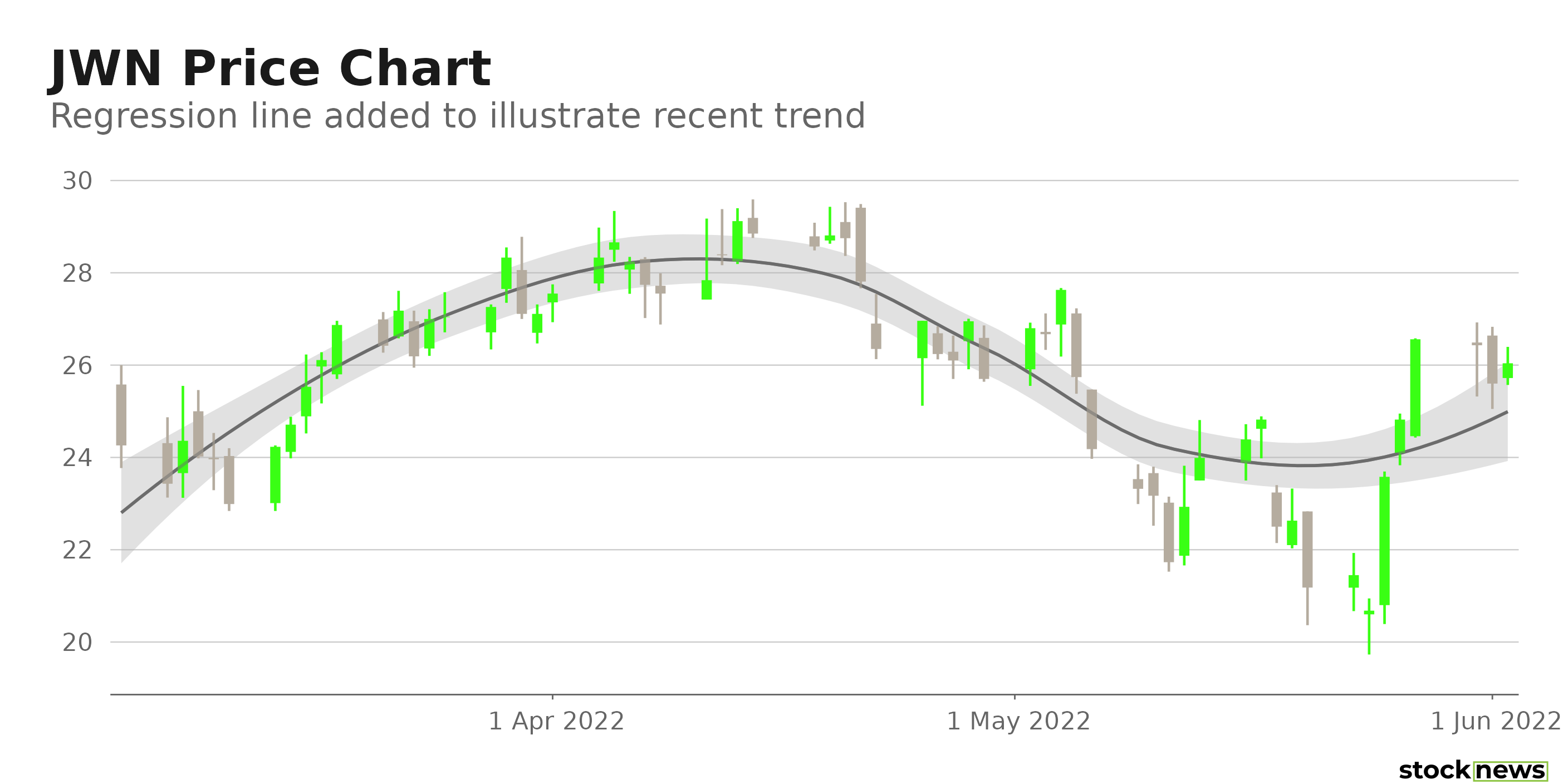

JWN’s stock has gained 13.2% in price year-to-date and 31% over the past three months to close yesterday’s trading session at $25.60. However, it is down 25.2% over the past year.

Here are the factors that could affect JWN’s performance in the near term:

Strong Financials

For its fiscal first quarter, ended April 30, JWN’s total revenues increased 18.6% year-over-year to $3.57 billion. Its net earnings and EPS came in at $20 million and $0.13, respectively, up substantially from their negative year-ago values. And its adjusted EBITDA rose 191.2% from the prior-year quarter to $166 million.

Favorable Analyst Sentiments

The $3.13 consensus EPS estimate for its fiscal year 2023 indicates a 108.7% year-over-year increase. And the $15.75 billion consensus revenue estimate for the same year reflects a 6.5% improvement from the prior year. Furthermore, the Street’s $3.20 EPS estimate for its fiscal 2024 reflects a 2.2% rise year-over-year. And the Street’s $16.07 billion revenue estimate for the same year indicates a 2% increase from the prior year. Its EPS is expected to increase 34.5% per annum over the next five years.

Cheap Valuation

In terms of its forward non-GAAP P/E, JWN is currently trading at 7.94x, which is 34.7% lower than the 12.17x industry average. The stock’s 0.53 forward EV/Sales multiple is 51.7% lower than the 1.10 industry average. In terms of its forward Price/Sales, it is trading at 0.26x, which is 70.9% lower than the 0.89x industry average.

Wide Profit Margins

JWN’s trailing 12-month gross profit margin and levered FCF margin of 37.09% and 6.79%, respectively, are 2.5% and 88.4% higher than their 36.18% and 3.60% industry averages. And its 96.42% trailing 12-month ROE is 442.3% higher than the 17.78% industry average.

POWR Ratings Reflect Promising Prospects

JWN’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall B rating, which equates to Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

JWN has a Value grade of A, which is in sync with its discounted valuations. The stock has a B grade for Growth and Quality, consistent with its financial growth in the last reported quarter and its sound profitability margins.

In the 68-stock Fashion & Luxury industry, it is ranked #17. The industry is rated B.

Click here to see the additional POWR ratings for JWN (Momentum, Stability, and Sentiment).

View all the top stocks in the Fashion & Luxury industry here.

Click here to checkout our Retail Industry Report for 2022

Bottom Line

JWN posted sound top- and bottom-line growth in its last reported quarter, while also raising its full-year outlook, citing momentum in its business as in-person shopping gains traction. Furthermore, Street analysts are bullish about the company’s near-term prospects. Hence, I think the stock might be a solid bet now.

How Does Nordstrom, Inc. (JWN) Stack Up Against its Peers?

While JWN has an overall POWR Rating of B, one might consider looking at its industry peers, J.Jill, Inc. (JILL) and Hugo Boss AG (BOSSY), which have an overall A (Strong Buy) rating, and Weyco Group, Inc. (WEYS) and PVH Corp. (PVH), which have an overall B (Buy) rating.

JWN shares were trading at $26.11 per share on Thursday afternoon, up $0.51 (+1.99%). Year-to-date, JWN has gained 17.14%, versus a -12.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Is Nordstrom Stock Still a Buy After Beating Earnings Estimates? StockNews.com