Back in October, equity analyst Michael Nathanson pondered the subscriber growth benefits of Netflix's account sharing crackdown, determining a modest outcome of converting 25% of non-paying Netflix users into paid subscribers would yield Netflix 6.8 million additional U.S. subscribers and $567 million in incremental annual revenue.

But are the good times of explosive subscriber growth about to stop rollin' for Netflix?

On Thursday, Netflix reported a first-quarter addition of 9.33 million members globally, well over the 1.75 million added in Q1 of 2023, but less than the 13.1 million tacked on in the fourth quarter.

In the U.S. and Canada, Netflix added 2.5 million members in Q1, versus growth of just 100,000 customers in the region 12 months earlier.

“It added more subscribers than many analysts, myself included, expected,” eMarketer senior analyst Ross Benes told CNN. “This signals that password sharing was even more common than previously thought as Netflix keeps converting freeloader viewers into paid users.”

But Netflix informed investors that starting in the first quarter of next year, it will stop reporting quarterly membership numbers.

"As we’ve noted in previous letters, we’re focused on revenue and operating margin as our primary financial metrics — and engagement (i.e. time spent) as our best proxy for customer satisfaction," Netflix said in its Q1 letter to shareholders.

"In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential," the letter added. "But now we’re generating very substantial profit and free cash flow (FCF). We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact."

Still, earlier this week, two days before Netflix's published its earnings, Nathanson cautioned investors that the good times couldn't last forever. In fact, they might run out around the same time Netflix stops reporting quarterly subscriber data.

"The re-acceleration in UCAN growth sparked last year by the crackdown in password-sharing seems like it still has legs, leading us to raise our 2024 subscriber target for the region to +2 million," Nathanson said in an investor note. "That said, we continue to remain cautious of pie-in-the-sky forecasts that see this hockey stick continuing indefinitely -- the password-sharing crackdown was likely a pull-forward of growth and does not change the underlying fact that there are increasingly fewer and fewer households in UCAN yet to subscribe to the streamer."

Netflix stock is down 9% since it issued its Q1 report Thursday.

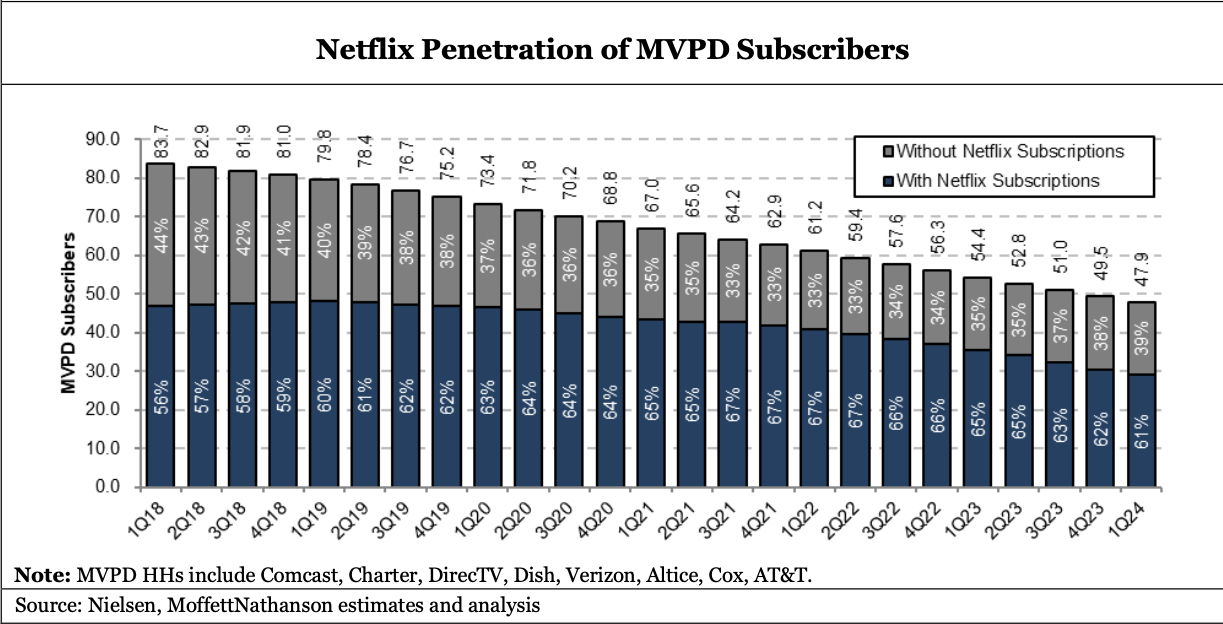

Another interesting data point made in Nathanson's somewhat bearish sub-growth forecast: The streaming giant's penetration into U.S. pay TV homes has peaked. For over a decade, Netflix feasted on a market that likes TV well enough to pay a monthly bill for it, with many of its consumers not yet having adopted streaming. But the remaining whittled base of pay TV homes, the analyst postulates, is now rich with older "streaming never" constituents.