Valued at a market cap of $73.8 billion, Mondelez International, Inc. (MDLZ) is a leading global snack food and beverage company. Headquartered in Chicago, Illinois, the company operates across multiple regions and offers a diverse portfolio of products, including biscuits, chocolates, gum, candy, beverages, and cheese & grocery items.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Mondelez International fits this criterion perfectly. Mondelez distributes its products through supermarket chains, wholesalers, club stores, online retail platforms, and direct-to-consumer channels. It has also collaborated with Post Consumer Brands to launch cookie-inspired breakfast cereals.

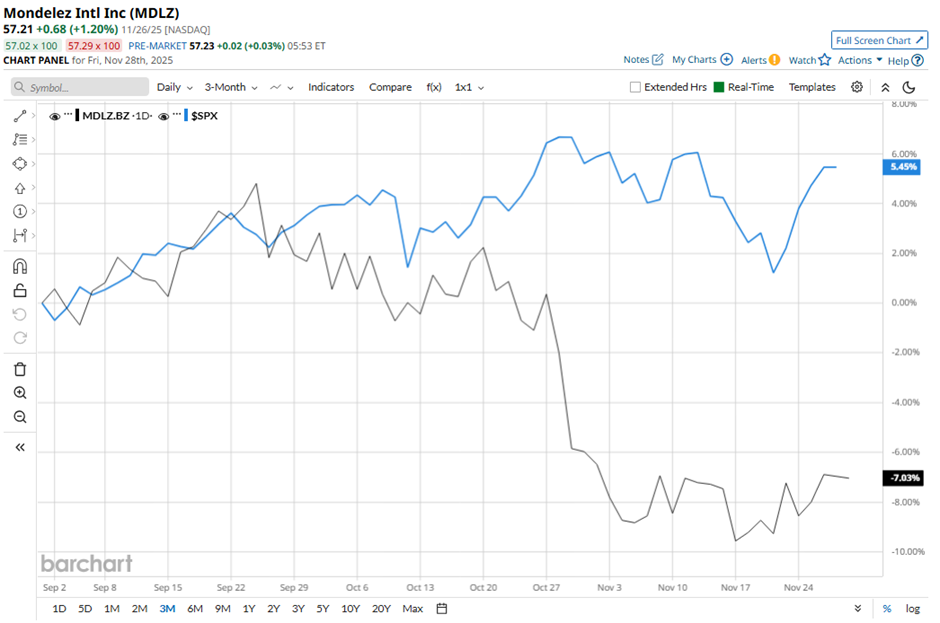

However, the Oreo cookies, Cadbury chocolate and Trident gum maker has fallen 19.6% from its 52-week high of $71.15. Over the past three months, its shares have dropped 6.8%, underperforming the broader S&P 500 Index’s ($SPX) 5.1% rise during the same period.

Longer term, shares of the packaged snacks company are down 4.4% on a YTD basis, lagging behind SPX's 15.8% increase. Moreover, shares of Mondelez have declined 12.2% over the past 52 weeks, compared to the 13.6% return of the SPX over the same time frame.

MDLZ has been in a bearish trend, consistently trading below its 50-day and 200-day moving averages since August.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.73 on Oct. 28, shares of MDLZ fell 3.9% the next day because the company cut its 2025 profit outlook, warning adjusted EPS would drop about 15% instead of the previously guided 10%. Mondelez also lowered its organic net revenue growth forecast to “4% plus” from about 5%, signaling weakening demand. In addition, volumes deteriorated as inflation, higher cocoa costs, and price-sensitive consumers hurt sales momentum.

In comparison, MDLZ stock has lagged behind its rival, The Hershey Company (HSY). HSY stock has gained 11.1% YTD and 8.6% over the past 52 weeks.

Despite Mondelez’s underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $69 is a premium of 20.6% to current levels.