Golden, Colorado-based Molson Coors Beverage Company (TAP) manufactures, markets, and sells beer and other malt beverage products under various brands. Valued at $9.4 billion by market cap, TAP produces many beloved and iconic beer brands, including Coors Light, Miller Lite, Madri, Staropramen, Miller High Life and Keystone, and more.

Companies worth $2 billion or more are generally described as “mid-cap stocks,” and TAP perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the beverages - brewers industry. TAP’s emphasis on innovation, operational efficiency, and the consistent introduction of new products aligns with evolving consumer preferences.

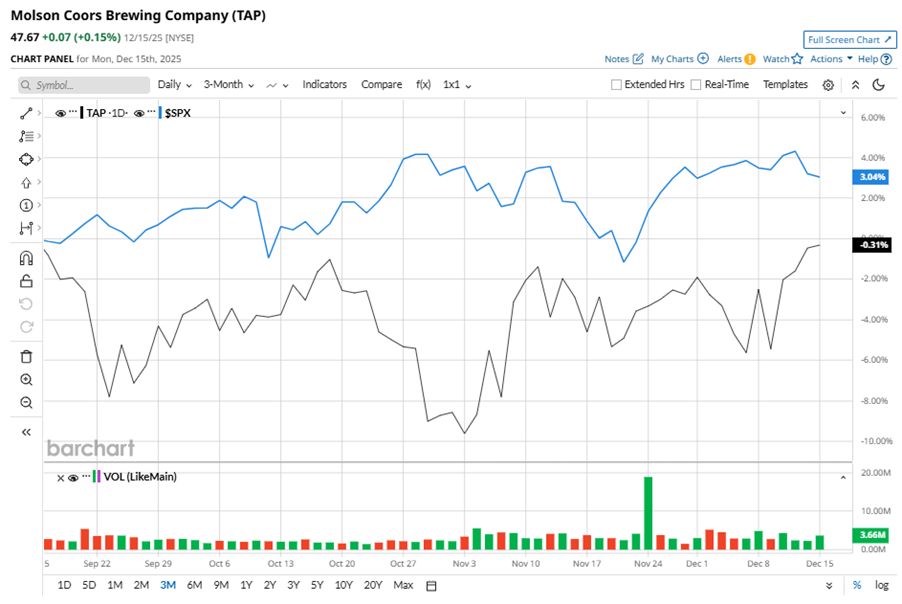

Despite its notable strength, TAP slipped 26.3% from its 52-week high of $64.66, achieved on Mar. 10. Over the past three months, TAP stock declined marginally, underperforming the S&P 500 Index’s ($SPX) 3% gains during the same time frame.

In the longer term, TAP shares fell 5.8% over the past six months and dipped 21.9% over the past 52 weeks, underperforming SPX’s six-month gains of 14.1% and 12.7% returns over the last year.

To confirm the bearish trend, TAP has been trading below its 200-day moving average since early May. However, the stock is trading above its 50-day moving average since early November, with slight fluctuations.

On Nov. 4, TAP shares closed up more than 1% after reporting its Q3 results. Its adjusted EPS of $1.67 missed Wall Street expectations of $1.72. The company’s revenue was $2.97 billion, falling short of Wall Street forecasts of $3.02 billion.

In the competitive arena of beverages - brewers, Compañía Cervecerías Unidas S.A. (CCU) has taken the lead over TAP, showing resilience with a marginal uptick on a six-month basis and 11% gains over the past 52 weeks.

Wall Street analysts are cautious on TAP’s prospects. The stock has a consensus “Hold” rating from the 20 analysts covering it, and the mean price target of $50.30 suggests a potential upside of 5.5% from current price levels.