/Lockheed%20Martin%20Corp_%20TX%20facility-by%20JHVEPhpoto%20via%20iStock.jpg)

Lockheed Martin Corporation (LMT) is a leading aerospace, defense, security, and advanced-technology company. It is headquartered in Bethesda, Maryland. Lockheed Martin designs, develops, manufactures, integrates, and sustains a broad range of products and systems worldwide, including combat and support aircraft, missiles and fire-control systems, helicopters and naval systems, and space and satellite systems. Lockheed Martin’s market capitalization is $106 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and Lockheed Martin fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the aerospace and defense industry.

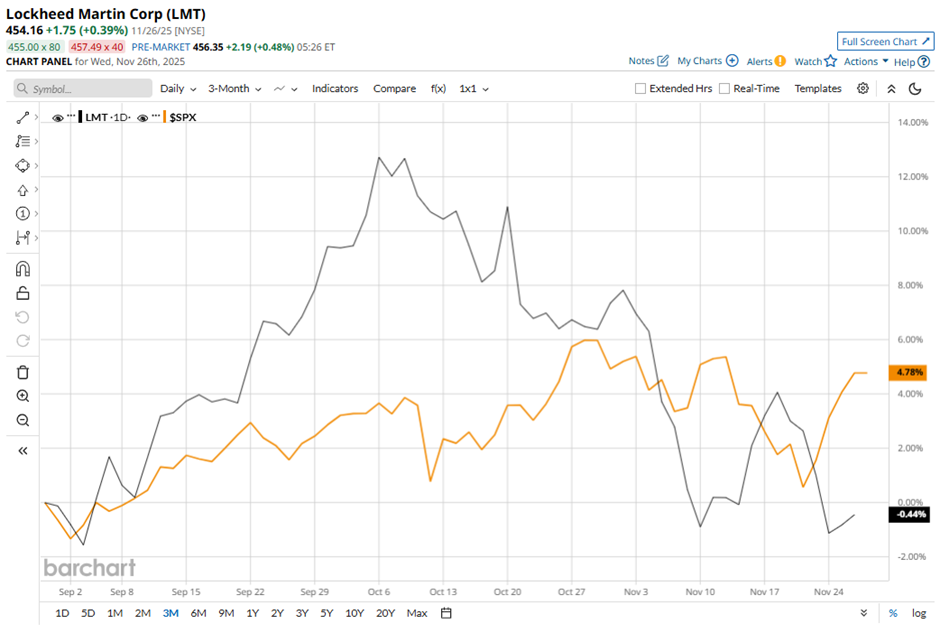

Lockheed Martin’s shares are 14.3% below their 52-week high of $529.99 on Nov. 27, 2024. LMT stock declined marginally over the past three months, underperforming the S&P 500 Index’s ($SPX) 5.1% gains during the same time frame.

Over the longer term, LMT declined 12.9% over the past 52 weeks and 6.5% in 2025, underperforming SPX’s 13.6% returns over the past 52 weeks and 15.8% gains on a YTD basis.

While LMT has traded mostly below the 200-day moving average, it has been above the line since mid-September, but with some fluctuations lately. The stock traded above the 50-day moving average since late August, but has again dropped below the line this month. It is a reminder that the stock’s momentum has tilted back toward the bearish side.

LMT stock slump can be attributed to growing investor concern over recurring program setbacks and missed expectations. A key factor is delayed progress on its flagship F‑35 fighter-jet program: the rollout of upgrades has lagged, creating uncertainty around future contracts and cash flow. Moreover, the company reported large losses on several classified aeronautics and helicopter projects, prompting lowered confidence in its ability to manage costs and execute complex fixed-price contracts reliably.

Lockheed Martin’s competitor, Huntington Ingalls Industries, Inc. (HII), has outperformed LMT, gaining 58.8% over the past 52 weeks and 66.3% YTD.

Among the 22 analysts covering LMT stock, the consensus rating is a “Moderate Buy.” The mean price target of $523.30 suggests an upside potential of 15.2%.