/Danaher%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

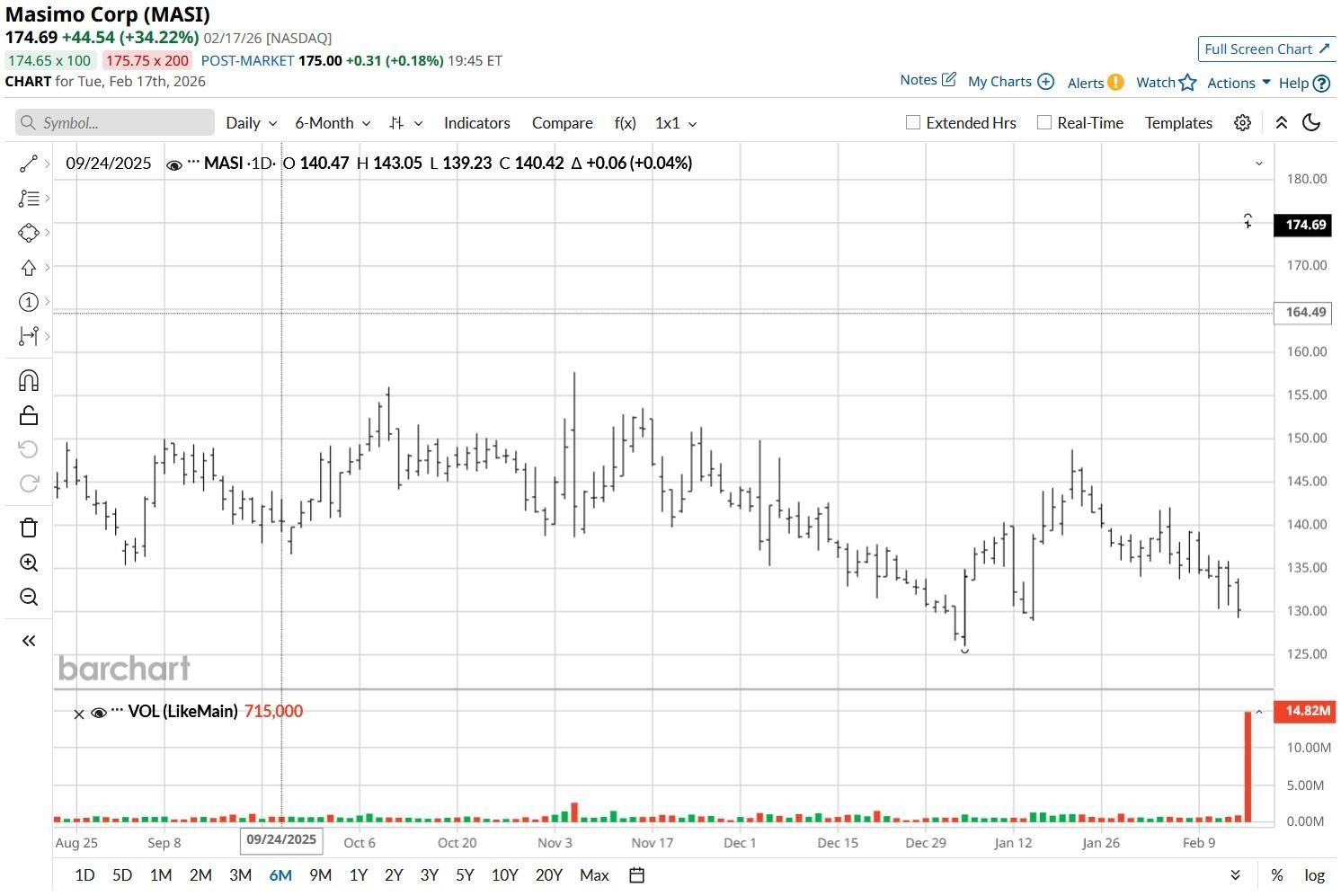

Masimo (MASI) shares ended their recent session up about 35% after science and technology giant Danaher (DHR) announced a definitive agreement to acquire the health tech firm.

For Masimo, this $9.9 billion all-cash deal means global scale, integration into DHR’s huge distribution network, and institutional backing to defend its IP against tech titans like Apple (AAPL).

Despite its latest rally, Masimo stock remains down roughly 8% versus its 52-week high.

Is There Any Further Upside Left in Masimo Stock?

For retail investors interested in chasing MASI stock’s recent surge, the hard truth is that the “easy money” has already been made.

Given that Danaher has valued the stock at $180, and it’s already hovering just below that price, the deal appears almost entirely baked into the Irvine-headquartered firm already.

And since Masimo is set to go private once the transaction completes in the back half of this year, further upside is unlikely unless a rare bidding war emerges. According to industry experts, however, that’s improbable, considering Danaher has already agreed to pay a hefty premium.

Why Danaher Is Now a Better Pick Than MASI Shares

The smarter play now is Danaher stock. DHR plans on integrating MASI as a standalone unit within its high-margin diagnostics segment, applying the Danaher business system (DBS) to scale operations.

Management expects this deal to boost earnings by $0.70 on a per-share basis within five years.

Loading up on Danaher shares, investors get Masimo’s tech at a discount, powered by a massive global distribution engine that could re-rate them significantly higher as synergies materialize.

Note that DHR’s relative strength index (14-day) has crashed to about 30, indicating downward momentum is now near exhaustion.

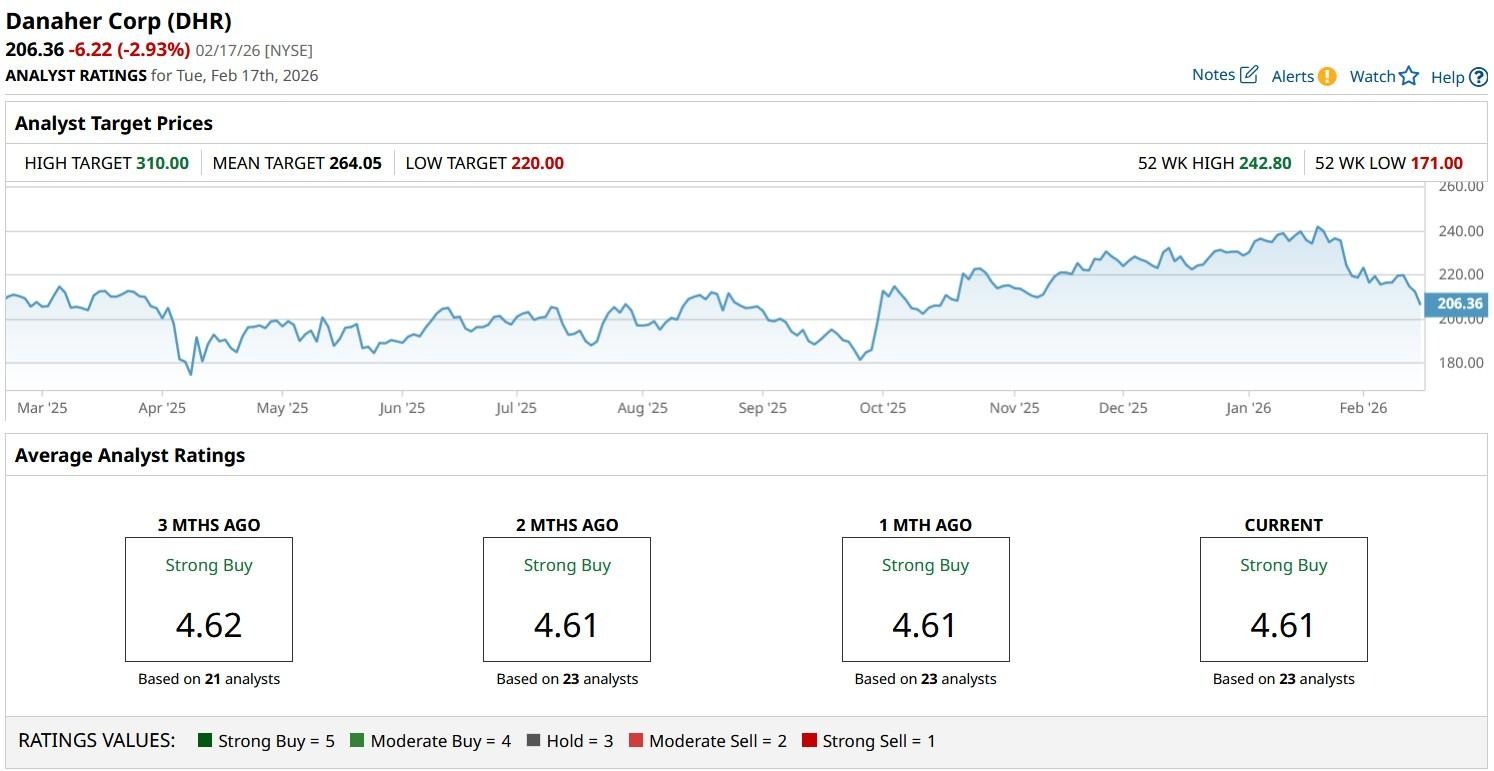

Wall Street Sees Significant Upside in DHR Stock

Wall Street analysts also expect DHR stock to push meaningfully higher following the Masimo deal in 2026.

According to Barchart, the consensus rating on Danaher Corp remains at a "Strong Buy,” with the mean target of about $264 suggesting potential upside of nearly 30% from here.