Levi’s (LEVI) is a comeback story that, full disclosure, I already bought into last year. The apparel stock has risen 23.5% in the last 52 weeks and is up 3.5% since the beginning of this year. But currently, even with those stats, Levis is in a period of low volatility, known as the TTM Squeeze – a condition that typically precedes high-volatility breakouts.

As a caveat, the TTM Squeeze indicator doesn't predict which direction the market will move, but merely that the conditions exist for such a breakout. However, looking at a few other key

Indicators would suggest that the path of least resistance for Levi’s could be higher.

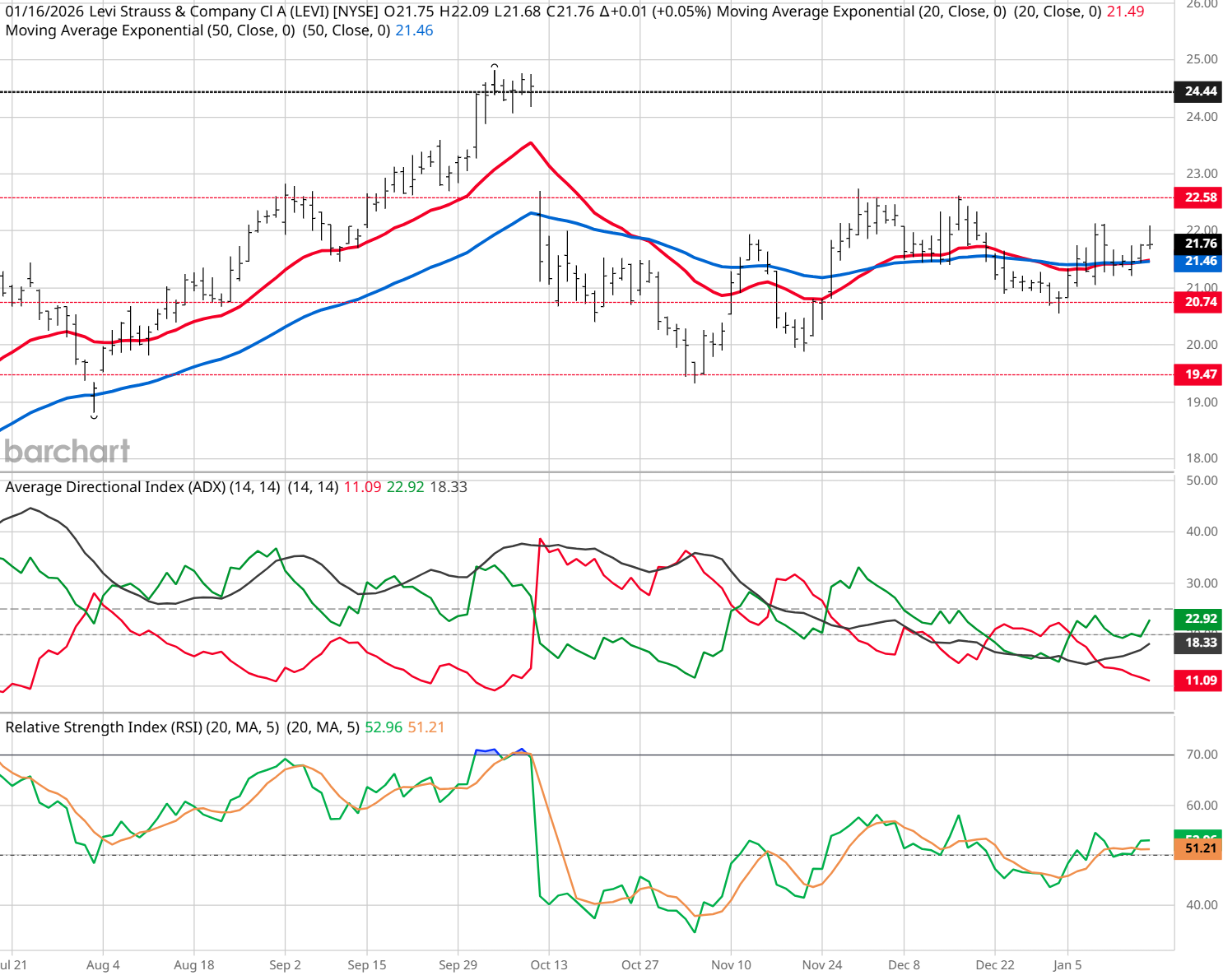

LEVI is currently trading above both its 20- and 50-day moving averages, while the 20-day is merging with its 50-day counterpart as both begin to slope higher, which is typically a bullish indicator. Plus, the stock has a “Buy” signal from Barchart's Trend Seeker, and is in a rising ADX and RSI environment.

Though Levi has been rangebound between 20.74 and 22.60, a breakout above the multi-week high of 22.74 should send Levi on a rapid ascent into a gap fill above $24 and position it to challenge the multi-year high of $24.82 (a roughly 10% gain). The key here would be the "firing" of the “Squeeze,” which should occur above $22.25.

Could this prophetic signal be telling us the time is right to slip into our favorite jeans, Levi's?

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.