Inflation may come for the weed and the overseas vacations but, when it comes to changing habits, those Friday night drinks with friends are often the most difficult to break.

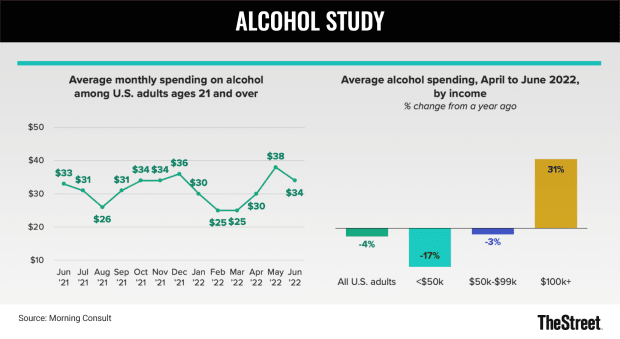

Alcohol has, largely, not been subject to the kind of drastic inflation seen for food items such as eggs and avocados. A new study by business intelligence company Morning Consult found that the average American adult over 21 spent $34 on alcohol in June — only $1 more than at the same time in 2021.

That number has wavered between $26 in August 2021 and $38 in May 2022.

Are We Drinking Less (Or Just Spending More?)

While either number may seem incredibly low for anyone who has ever gone out for cocktails in a big city, they reflect an average between both heavy drinkers and those who abstain from alcohol entirely.

Out of the 368 adults polled for the study, only 58% said they consume alcohol at all. That number dropped from 63% in October 2021.

A further 29% said that they started drinking less in July than the month before. While the reasons had to do with everything from health to changing social habits during the summer, one third of those who drank less said they did this to save money.

An earlier study from insurance company Breeze found that that 73% of U.S. households cut back on restaurants and takeout while a 62% decreased their social spending. Another 57% even cut spending on groceries.

TheStreet

"Saving money, fewer social plans and managing weight top the list of reasons for this change in behavior," Emily Moquin, a food and beverage analyst for Morning Consult, wrote in the study. "Cost pressures in other categories, from gas to groceries, are impacting consumers’ purchasing behaviors in alcohol, despite the fact that price growth hasn’t been as pronounced in this category."

Inflation is impacting almost everyone but, in the usual story of two Americas, some are navigating the rising cost of alcohol while others are using nights out to compensate not being able to go on vacation or do other things that they could previously afford.

In the first three months of 2022, sales of the popular Italian apéritif Aperol saw a 72% boost in sales as some bar and restaurant owners bought out entire crates to avoid inflation.

Is Alcohol Consumption The Next Class Divide?

"In difficult times, you cannot treat yourself, maybe you skip the vacation but you can go for the nice bottle of Scotch, cognac or bourbon," Campari CEO Bob Kunze-Concewitz told Reuters back in May.

While 20% of those earning more than $100,000 a year said that they drank more in the past month, only 12% of those earning below $50,000 said the same. By contrast, 37% of those in the latter earning category drank less.

"Changes to alcohol spending and drinking behaviors are most pronounced among lower-income consumers, but general stock market volatility and prolonged inflation have the potential to impact consumers across the income spectrum," Moquin wrote.

Across the months, relatively even spending indicates an average in which some people are spending a lot more on alcohol while others are cutting back.

"Even higher-income consumers have experienced declining financial well-being, so while premium product purchases may not have slipped yet, prolonged pressure may cause this group to make adjustments," Moquin wrote.