Oklahoma City-based Expand Energy Corporation (EXE) operates as an independent natural gas production company in the United States. With a market cap of $26.3 billion, the company engages in acquisition, exploration, and development of properties to produce oil, natural gas, and natural gas liquids.

Companies worth $10 billion or more are generally described as "large-cap stocks." EXE fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the energy sector.

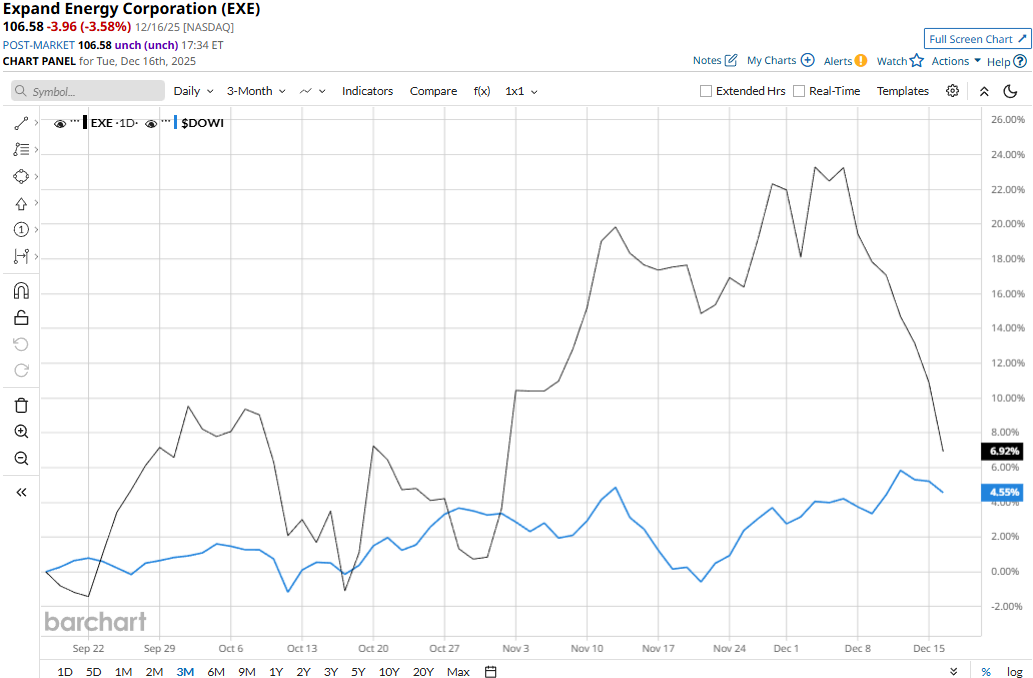

Expand Energy touched its all-time high of $126.62 on Dec. 5 and is currently trading 15.8% below that peak. Meanwhile, EXE stock prices have soared 9.3% over the past three months, outpacing the Dow Jones Industrial Average’s ($DOWI) 5.2% uptick during the same time frame.

Over the longer term, EXE stock has gained 7.1% on a YTD basis and 10.2% over the past 52 weeks, lagging behind the Dow’s 13.1% surge in 2025, but outpacing the index’s 10.1% returns over the past year by a small margin.

EXE has traded mostly above its 200-day moving average since early November and its 50-day moving average since late September, underscoring its recent uptick.

Expand Energy’s stock prices observed a marginal dip in the trading session following the release of its Q3 results on Oct. 28. The company observed a massive surge in oil, natural gas, and natural gas liquids sales, along with a notable growth in marketing revenues and a high contribution from derivatives. Overall, the company’s topline grew from $648 million in the year-ago quarter to approximately $3 billion. Meanwhile, its adjusted EPS skyrocketed 506.3% year-over-year to $0.97, beating the consensus estimates by 10.2%.

Further, when compared to its peer, EXE has notably outperformed EOG Resources, Inc.’s (EOG) 17% decline on a YTD basis and 18.3% plunge over the past 52 weeks.

Among the 28 analysts covering the EXE stock, the consensus rating is a “Strong Buy.” As of writing, EXE’s mean price target of $134.19 suggests a 25.9% upside potential from current price levels.