Few stocks benefited more from the darkest days of the pandemic than Etsy (ETSY). Consumers and creators hunkering down at home flocked to the online crafts marketplace. Revenue, and ETSY stock, soared.

But now, like so many other pandemic-era darlings, ETSY stock has come back down to Earth. The lockdowns are over; brick-and-mortar retail traffic is back.

Even more daunting is the fact that Etsy has to contend with tough year-over-year comparisons at a time when retail spending is softening. Inflation peaked nearly a year ago, but it remains at a multi-decade high. That creates an especially difficult environment for any company selling mostly consumer discretionary goods.

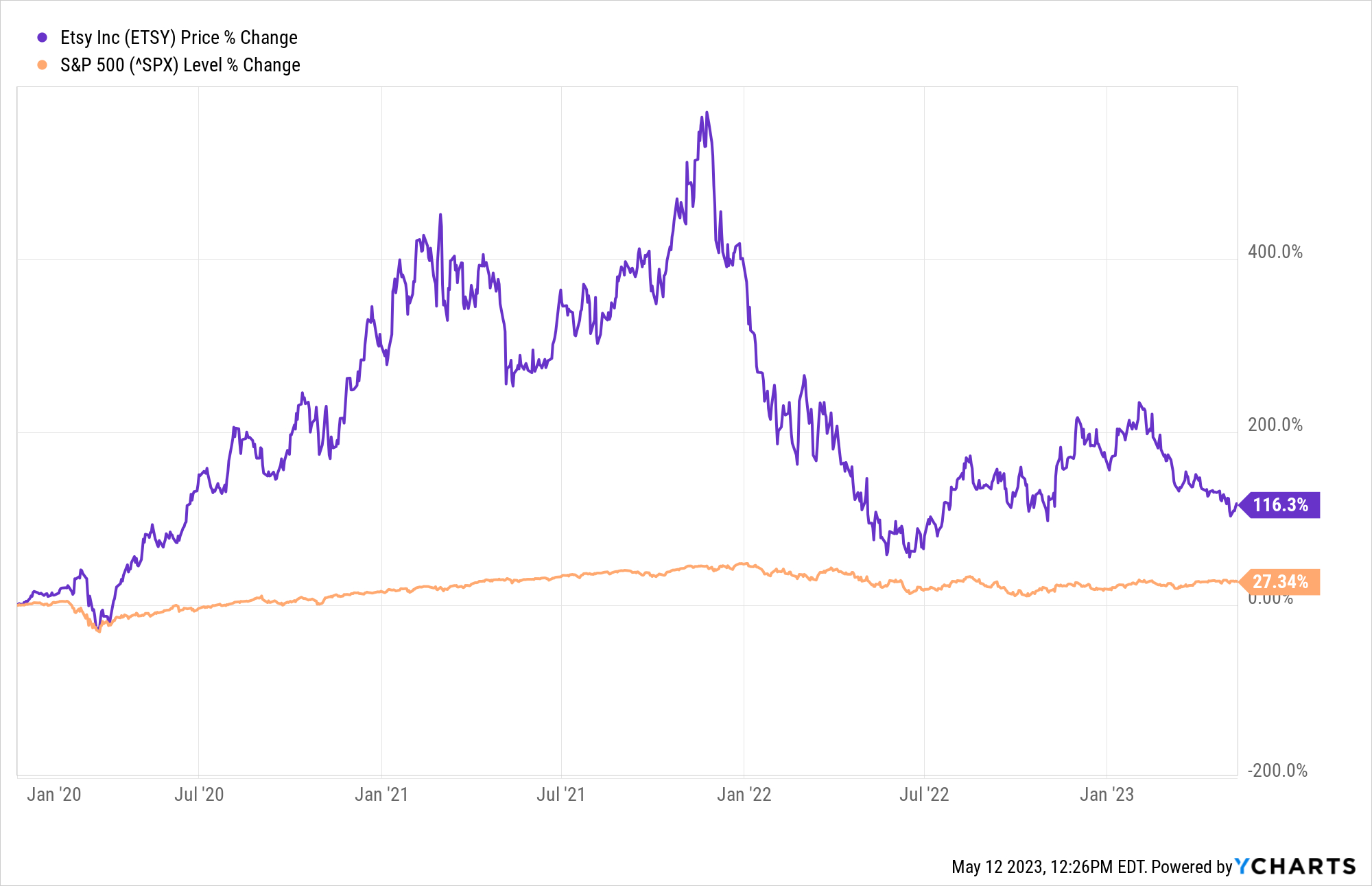

To recap: the first year of the pandemic was outstanding for ETSY stock, with shares more than quadrupling in 2020. The S&P 500, by comparison, gained 16% on a price basis that year.

And Etsy stock was just getting started, powering ever higher through the first 11 months of 2021. Indeed, between Dec. 31, 2019 and its all-time closing high set in late November 2021, ETSY rose 570%. The broader market added 46% on a price basis over the same span.

We all know what happened next. ETSY remains almost 70% below its record high of late 2021. Heck, shares have lost a fifth of their value in 2023 alone.

So where does ETSY go from here? Some analysts argue that the painful selloff in Etsy stock is overdone. Others contend that rising prices and looming recession make ETSY a bad idea at this moment in the cycle.

Let's have a look at what Wall Street and the data make of Etsy stock at current levels.

Etsy stock: Buy, Sell or Hold?

Etsy's days of extraordinary top-line growth are long gone, that's for sure. Annual revenue more than doubled during the first year of the pandemic, soaring to $1.7 billion in 2020 from $818.4 million the prior year. Revenue increased by another 35% in 2021.

Etsy's top line expanded by just 10% last year, however, and analysts forecast revenue to increase by just 7.6% in 2023.

Earnings per share (EPS) followed a similar trend, and they too have stalled out. The Street forecasts Etsy to generate adjusted EPS of $4.33 in 2023, or a decline of more than 6% from the $4.61 a share it earned last year.

On the bulls' side of the debate stands Truist Securities analyst Youssef Squali. He rates Etsy stock at Buy, citing data that suggests the company is adjusting well to the post-pandemic marketplace.

"User metrics show that Etsy is retaining most of the gains achieved during COVID-19, positioning it well for a more normalized setting," Squali writes in a note to clients. The analyst adds that the guidance Etsy offered when it reported earnings in early May was "appropriately conservative given potential risks to consumer spending from high inflation, rising rates, a weak macroeconomic environment and [unfavorable] foreign exchange."

Other analysts aren't quite as comfortable about Etsy's prospects.

"Etsy is an innovative company with a compelling business model, and a huge addressable market, that saw a tremendous benefit from shopping at home and economic stimulus, as well as from its sellers' enterprising ability to fill an unprecedented demand for COVID masks," writes Argus Research analyst Chris Graja.

Nevertheless, Graja rates shares at Hold, saying he is "looking for a more favorable entry point." Although Etsy is a company with "tremendous growth potential and a great business plan," the traders who originally drove shares higher appear to have cashed out, he notes.

"The change in the macro environment has caused investors to become more conservative in their assumptions," Gaja says. "We have probably seen a shift in Etsy's investor base from aggressive growth investors to growth-at-a-reasonable-price investors, who may use lower assumptions for long-term growth."

Collectively, the Street gives Etsy stock a recommendation of Buy, but with less than stellar conviction. Of the 29 analysts covering the stock tracked by S&P Global Markets Intelligence, 10 rate it at Strong Buy, six say Buy, 11 have it at Hold and two call it a Strong Sell.

With an average target price of $124.90, analysts give Etsy stock implied upside of about 30% in the next 12 months or so. For context, the Street's highest target price of $186 implies that shares will gain more than 90% over the next year. Conversely, Etsy stock would fall by more than 50% if the Street's lowest price target were to come to pass.

And while Etsy's valuation has come down markedly from some previously eye-watering levels, it's not exactly a screaming bargain, either.

Shares change hands at 19.4 times analysts' average next-12-months EPS estimate. That's well below ETSY's five-year average of 26 times expected earnings. On the other hand, 19.4 times future earnings seems a bit pricey for a company forecast to generate average annual EPS growth of 13.4% over the next three to five years.

Keep in mind that this is not a market where investors can bank on multiple expansion. If anything, recessionary fears could cause multiples to contract.

Etsy stock is a tough call, to be sure. Analysts lean toward bullishness on the name, but without great conviction. Ultimately, there are probably more surefire places to allocate capital than a past pandemic hero.