Redwood City, California-based Electronic Arts Inc. (EA) develops, markets, publishes, and delivers games, content, and services for consoles, PCs, mobile phones, and tablets worldwide. With a market cap of $50.8 billion, Electronic Arts distributes its products through multiple distribution channels as well as directly to consumers through its online portals.

Companies worth $10 billion or more are generally classified as “large-cap stocks.” Electronic Arts fits right into that category, reflecting its substantial size, dominance, and influence in the gaming industry.

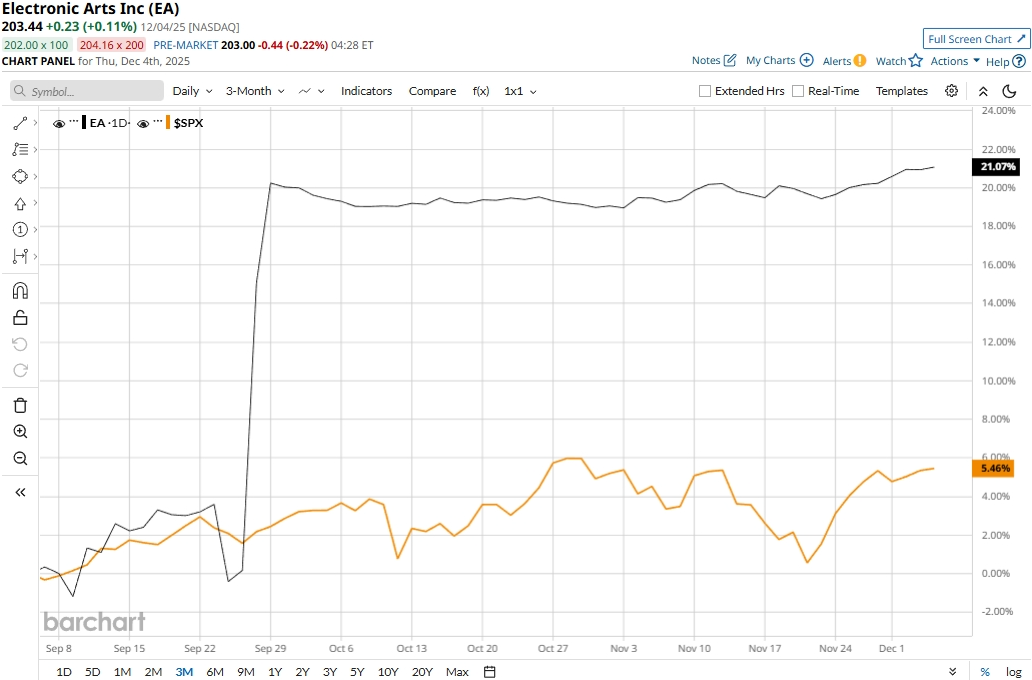

Electronic Arts touched its all-time high of $203.75 on Sept. 29 and is currently trading marginally below that peak. Meanwhile, EA stock prices have soared 21.1% over the past three months, compared to the S&P 500 Index’s ($SPX) 5.5% uptick during the same time frame.

Electronic Arts has outperformed over the longer term as well. EA stock prices have soared 39.1% on a YTD basis and 21.5% over the past 52 weeks, compared to SPX’s 16.6% gains in 2025 and 12.7% returns over the past year.

EA stock has traded above its 50-day moving average since early March and above its 200-day moving average since April, with some fluctuations, underscoring its bullish trend.

Electronic Arts’ stock prices observed a marginal dip in the trading session following the release of its Q2 results on Oct. 28. The company observed a notable decline in its revenues; its topline for the quarter declined 12.6% year-over-year to $1.8 billion, missing the Street’s expectations by 2.5%. Meanwhile, its cash flow from operations declined 44.4% to $130 million, and earnings plummeted 53.4% year-over-year to $137 million, missing the consensus estimates by a notable margin.

Meanwhile, EA stock has outperformed its peer, Take-Two Interactive Software, Inc.’s (TTWO) 34.5% surge in 2025, but outperformed TTWO’s 31.5% gains over the past 52 weeks.

Among the 24 analysts covering the EA stock, the consensus rating is a “Hold.” As of writing, EA stock is trading marginally below its mean price target of $203.10.