/Centene%20Corp_%20logo%20on%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $19.1 billion, Centene Corporation (CNC) is a U.S.-based healthcare enterprise that serves under-insured and uninsured individuals, as well as commercial organizations. It operates through four key segments: Medicaid; Medicare; Commercial; and Other, offering a wide range of health programs and related services.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Centene fits right into that category. The company delivers care through networks of physicians, hospitals, and specialized providers.

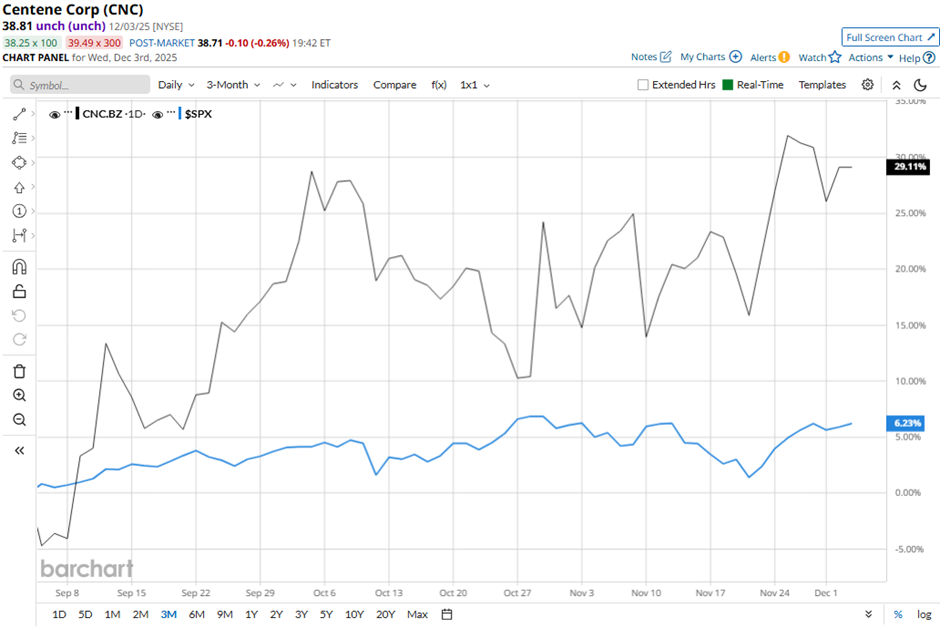

Shares of the Saint Louis, Missouri-based company have dropped 41.9% from its 52-week high of $66.81. Centene’s shares have increased 29.1% over the past three months, exceeding the broader S&P 500 Index’s ($SPX) 6.2% gain over the same time frame.

In the longer term, CNC stock is down 35.9% on a YTD basis, underperforming SPX’s 16.5% rise. Moreover, shares of the company have dipped 34.7% over the past 52 weeks, compared to the 13.2% return of the SPX over the same time frame.

Despite a few fluctuations, the stock has been trading below its 50-day and 200-day moving averages since last year. Yet, it moved above its 50-day moving average since early September.

Centene’s shares jumped 12.5% on Oct. 29 because the company raised its 2025 adjusted profit forecast to at least $2 per share, well above the estimate, easing investor fears after July’s weak outlook. Investors were further encouraged by stronger-than-expected Medicaid performance, including a 93.4% Medicaid HBR and a total HBR of 92.7%, along with signs that high-cost drug trends were stabilizing. The company also beat expectations with Q3 2025 adjusted EPS of $0.50.

In comparison, rival Elevance Health, Inc. (ELV) has shown a less pronounced decline than CNC stock. ELV stock has decreased 10.3% on a YTD basis and nearly 19% over the past 52 weeks.

Due to the stock’s weak performance over the past year, analysts remain cautious on CNC. It has a consensus rating of “Hold” from the 20 analysts in coverage, and the mean price target of $40.53 is a premium of 4.4% to current levels.