/Capital%20One%20Financial%20Corp_%20ATM-by%20David%20Tran%20via%20iStock.jpg)

With a market cap of $139.3 billion, Capital One Financial Corporation (COF) is a financial services holding company that oversees Capital One, National Association, offering a wide range of financial products and services across the U.S., Canada, and the U.K. It operates through three main segments: Credit Card, Consumer Banking, and Commercial Banking, providing deposit accounts, loan products, and advisory and treasury services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Capital One Financial fits this criterion. It serves consumers, small businesses, and commercial clients through digital platforms, branches, cafés, and other channels.

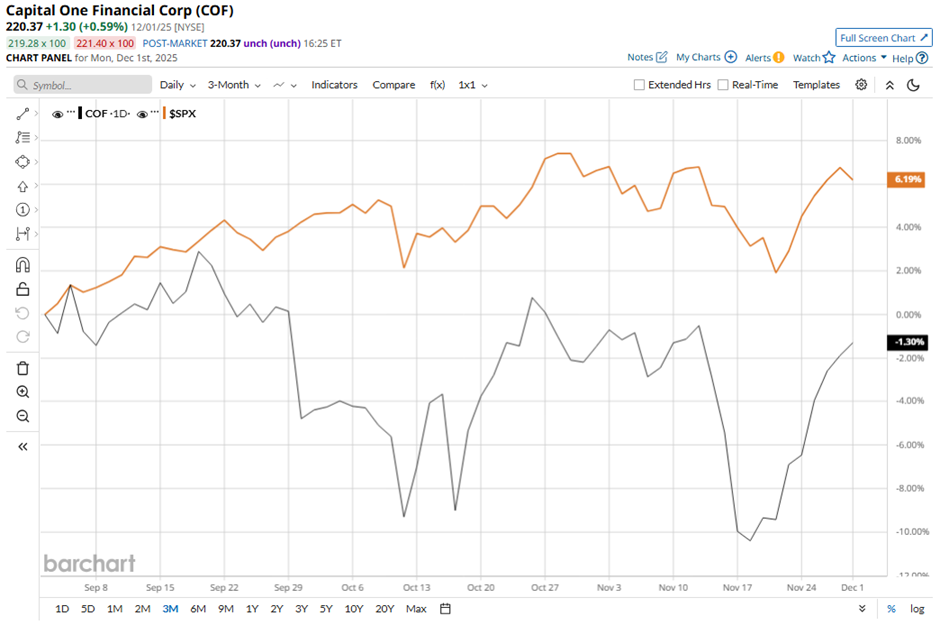

Shares of the McLean, Virginia-based company have fallen 5.2% from its 52-week high of $232.45. Capital One Financial’s shares have decreased 3% over the past three months, underperforming the broader S&P 500 Index’s ($SPX) 5.5% gain over the same time frame.

In the longer term, COF stock has surged 23.6% on a YTD basis, outpacing SPX’s 15.8% rise. Moreover, shares of the credit card issuer and bank have soared 14.8% over the past 52 weeks, compared to the 12.9% return of the SPX over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Shares of COF rose 1.5% following its Q3 2025 results on Oct. 21, with adjusted EPS of $5.95, far above analysts’ estimate and sharply improved from the prior quarter’s loss. Investors also reacted positively to the 23% increase in total net revenue to $15.4 billion, strong pre-provision earnings growth of 29%, and a sharp drop in the provision for credit losses to $2.7 billion, including a $760 million reserve release.

Additionally, management highlighted solid operating metrics such as an improved 8.36% net interest margin and noted that the Discover integration is progressing well.

In comparison, rival Visa Inc. (V) has lagged behind COF stock. Visa stock has gained 4.5% on a YTD basis and 4.9% over the past 52 weeks.

Due to the stock’s strong performance over the past year, analysts remain bullish on COF. The stock has a consensus rating of “Strong Buy” from the 23 analysts in coverage, and the mean price target of $263.27 is a premium of 19.5% to current levels.