In its fiscal first quarter report released last month, BlackBerry Limited (BB) presented a strong performance, with earnings and revenue surpassing expectations by substantial margins, which drove up its stock.

The company reported an impressive 122% year-over-year growth in revenue, totaling $373 million and surpassing analyst estimates by a whopping $213.71 million. BB’s non-GAAP EPS was reported at $0.06, marking a turnaround from the loss of $0.05 seen in the same period of the previous year. This figure exceeded consensus forecasts by $0.11.

However, it’s important to note that this spike in revenue primarily resulted from the sale of its noncore patents, which boosted its licensing and other segment. This helped counterbalance the year-over-year decrease in revenues earned from BlackBerry’s cybersecurity and IoT segments.

While revenues gleaned from the licensing and other segment rose dramatically to $235 million, a stark contrast was seen in its cybersecurity segment, which declined 17.7% year-over-year to $93 million. Moreover, IoT revenues fell 11.8% year-over-year to $45 million.

Given the intensifying competition in both cybersecurity and automotive software markets, BB’s future growth trajectory seems unclear. Therefore, I think now might not be the optimal entry point in the stock. Let’s analyze the trends in some of its key financial metrics to understand the situation.

Analyzing BlackBerry’s Financial Performance Fluctuations: August 2020 to May 2023

The trailing-12-month net income of BB has widely fluctuated from August 2020 to May 2023, with a trend towards a significant decrease, especially in recent times.

- As of August 2020, BB recorded a net income of -$732 million.

- This figure deepened to -$830 million by November 2020 and dipped to -$1.104 billion by February 2021.

- After reaching a low point in February 2021, a brief recovery period was observed as the net income rose to -$530 million in May 2021. However, it fell slightly again to -$651 million in August 2021.

- The net income for BB began improving afterward, reaching -$447 million in November 2021 and bouncing into positive territory with $12 million by February 2022.

- Unfortunately, profitability did not sustain, and profits sank back into the negative zone by May 2022 with a net income loss of -$107 million. Net income was -$17 million in August and -$95 million in November 2022.

- BB’s financial position took a severe hit in February 2023, when the net income plummeted drastically to -$734 million. This downtrend continued, albeit slower, recording a net income of -$564 million in May 2023.

This undulates an overall declining phase in BB’s financial performance over the observed period.

The series shows a trend of fluctuation in the trailing-12-month revenue of BB. From August 2020 to May 2023, the reported revenue experienced mostly a decreasing trend but rebounded significantly in May 2023.

- August 2020: The revenue was at its highest with $1 billion. From this point, BB saw quite a consistent decline in revenue until May 2023.

- November 2020: Decreased slightly to $965 million.

- February 2021: Fall continues to $893 million.

- May 2021: Dropped further to $861 million.

- August 2021: Revenue reduced to $777 million.

- November 2021: Fell slightly to $743 million.

- February 2022: Decreased to $718 million.

- May 2022: A slight reduction to $712 million.

- August 2022: Minor drop to $705 million.

- November 2022: Down to $690 million.

- February 2023: Sharp decrease to $656 million. However, in May 2023, the revenue increased abruptly.

- May 2023: Jumped significantly up to $861 million.

Based on the first and last values during this term, the growth rate appears to be negative, indicating a loss over time. However, the dramatic increase seen in May 2023 marks a potential turnaround for BlackBerry’s revenue trend. The emphasis on recent data shows that despite the decline, BB’s revenue significantly surged in the concluding months of the series. Final revenue stands at $861 million, significantly up from earlier months but still down compared to the start of the period.

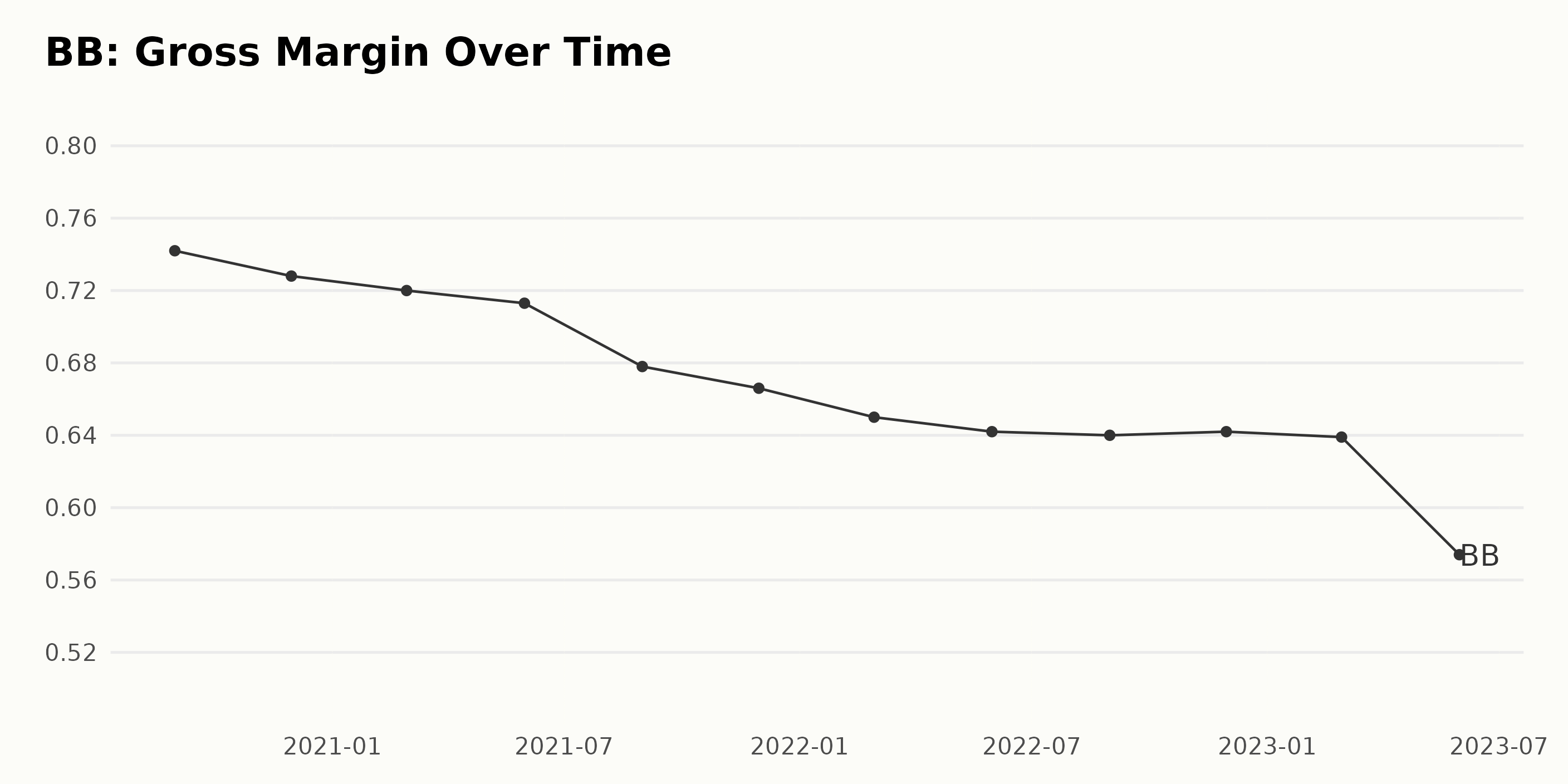

The gross margin of BB has demonstrated a consistent downward trend over the given period from August 2020 to May 2023, with noticeable fluctuations.

- In August 2020, the gross margin was 74.2%.

- Over the next three months, by November 2020, there was a slight decrease to 72.8%.

- February 2021 showed a continued fall in the gross margin to 72.0%.

- In May 2021, the gross margin dipped to 71.3%.

- By August 2021, a noticeable drop could be seen, with the gross margin falling to 67.8%.

- The value continued diminishing over the remaining span of 2021, sitting at 66.6% in November.

- As we moved into 2022, by February, this margin was at 65.0%, and it had dropped to 64.2% by May.

- By August 2022, the gross margin recorded a minimal decrease to 64.0%, indicating a slowing rate of decline.

- A minor increase in November 2022 brought the margin back to 64.2%.

- But by February 2023, there was another slight reduction, bringing the figure to 63.9%.

- May 2023, however, recorded the most significant drop during the reported period when the gross margin plummeted to 57.4%.

Overall, from August 2020 to May 2023, the gross margin of BB reflected a downward spiral, recording a notable drop of approximately 22.7%. The more recent data (2022-2023) shows both a slower rate of decline and a momentary increase, preceded by the sharpest drop towards the end of the reporting period.

The trend in BB’s current ratio can be summarised as follows:

- Starting from August 2020, there was a significant increase in BB’s current ratio for the initial year, recording a jump from 1.15 in August 2020 to 2.63 in February 2022.

- Post-February 2022, the current ratio entered a falling trend until November 2022, plummeting from 2.63 down to 1.003. This represents a substantial decrease of almost 62% within just nine months.

- From November 2022 until May 2023, BB’s current ratio seems to stabilize somewhat, moving between 1.003 and 0.946.

- The most recent current ratio recorded for BBin May 2023 is 0.946, considerably lower than its peak in February 2022 and even lower than the starting point in August 2020.

The period of greatest volatility was between February 2022 and November 2022, with the current ratio dropping sharply. The smallest fluctuation occurred between November 2022 and May 2023, where the current ratio was relatively stable.

When examining the overall growth rate of the current ratio from BB’s first value in August 2020 to the last value in May 2023, it decreased by approximately 18%. This general downward trend, despite the initial increase, suggests that BlackBerry’s ability to cover its short-term liabilities with its short-term assets has weakened over the observed period.

BlackBerry Limited (BB) Stock Performance: An Analysis of Six-Month Trends and Fluctuations

Upon observing the share prices of BB from January 13, 2023, through July 11, 2023, a few trends and growth rates became noticeable.

- Starting at $3.81 on January 13, 2023, the share price consistently increased, reaching $4.42 by February 3, 2023.

- From February, the share price experienced a decrease over the next few weeks. It hit a low of $3.69 on March 10, 2023, before starting to recover.

- March showed some volatility before ending strongly. There was a mild dip mid-month, but the value rose to $4.04 by the end of March.

- In April, the share price peaked at $4.56 on April 6, 2023. However, it could not maintain this and fell to $3.98 by the end of the month after a series of drops.

- May marked the beginning of a more positive trend, with prices climbing consistently throughout the month. Starting at $4.28 on May 5, 2023, it ended at its highest point at $5.30 on June 2, 2023.

- However, June brought some instability to the share price, which fluctuated downwards to reach $4.87 by June 23, 2023, before bouncing back to $5.18 by the end of the month.

- The price declined again in early July, falling to $4.92 by July 11, 2023.

The data shows an inconsistent growth rate for BB share prices over this period. The first quarter (January to March) saw fluctuations, with an initial rise, a fall, and a rise again. The second quarter (April to June) started with some volatility but May presented clear growth. This upward trend decelerated in June and continued into July. Here is a chart of BB’s price over the past 180 days.

Examining BlackBerry Limited’s Performance through POWR Ratings

BB has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #41 out of the 52 stocks in the Technology - Communication/Networking category. It also has a C grade for Sentiment, Quality, Momentum, and Value.

Key Observations:

- For most of the year's first half, from January to June 2023, BB consistently had a POWR Grade of D. Its rank varied slightly during this period, oscillating between 46 and 49 out of a total of 52 stocks in its category.

- In the week of July 8, 2023, there was a notable improvement in BB’s performance. The POWR Grade rose to C, and its rank in the category improved significantly to 41.

- This upward trend continued up to the latest data point available for the week of July 11, 2023, where BB maintained a POWR Grade of C and a category rank of 41.

Stocks to Consider Instead of BlackBerry Limited (BB)

Other stocks in the Technology - Communication/Networking category that may be worth considering are PC-Tel Inc. (PCTI), Extreme Networks, Inc. (EXTR) and Ceragon Networks Ltd. (CRNT) -- they have better POWR Ratings.

43 Year Investment Pro Shares Top Picks

Steve Reitmeister is best known for his timely market outlooks & unique trading plans to stay on the right side of the market action. Click below to get his latest insights…

Steve Reitmeister’s Trading Plan & Top Picks >

BB shares were trading at $4.92 per share on Wednesday afternoon, down $0.00 (0.00%). Year-to-date, BB has gained 50.92%, versus a 17.49% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Is BlackBerry Limited (BB) Showing Signs of Growth in July? StockNews.com