Shares of AT&T (T) are enjoying a strong post-earnings reaction on Thursday, up about 10% at last check.

The company delivered an earnings and revenue beat. Further, it raised its full-year adjusted-earnings outlook to $2.50 a share or higher from a prior range of $2.42 to $2.46 a share. That’s vs. consensus estimates of $2.55 a share.

Outside the earnings rally, though, it has been a pretty tough stretch for the telecom-service giant.

Even after the company split off its streaming-video assets in an effort to create value, both Warner Bros Discovery (WBD) and AT&T shares have sunk this year.

Before today’s rally, AT&T shares were down about 20% on the year and recently endured a 33% skid from its 2022 high. The sagging stock price has, however, swelled its dividend yield to 6.6%.

It’s got some investors wondering whether the telecom has finally bottomed. At the very least, it’s got me wondering whether it can continue to rally. Let’s look.

Trading AT&T Stock

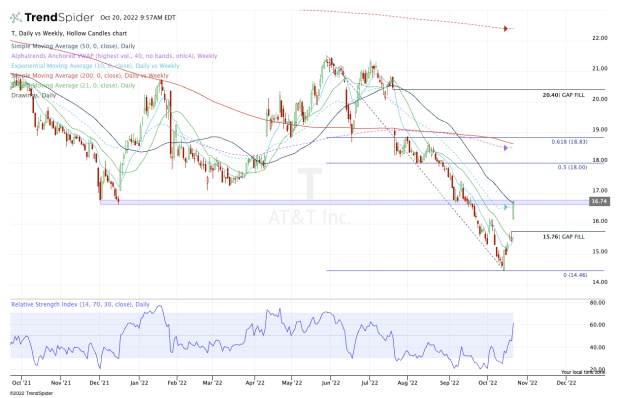

Chart courtesy of TrendSpider.com

With its yield approaching 7%, I took a look at AT&T a bit more than a month ago as its shares were testing into a critical support area.

Initially, there was not a big reaction out of this zone, but we have since seen a pretty powerful 15%-plus rally with today’s action.

I can’t help but notice that AT&T stock is ramming into the 10-week and 50-day moving averages, as well as the $16.50 to $17 area, which formerly was support.

The bulls now want to know whether this area will flip to resistance.

If AT&T stock can reclaim this area, then the bulls will be in control. That will open the door up to the 50% retracement at $18. Above that puts the 61.8% retrace, 200-day moving average and weekly VWAP measure in play between $18.75 to $18.85.

If AT&T can’t push through the current zone, however, investors must keep a few downside areas in mind.

On the downside, today’s low would be on watch at $16.12, followed by the post-earnings gap-fill at $15.76.

For now, the stock is trading pretty well, but these are the levels to know going forward.