/Ameriprise%20Financial%20Inc%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Valued at a market cap of $42.3 billion, Ameriprise Financial, Inc. (AMP) is a diversified financial services company based in Minneapolis, Minnesota. It specializes in wealth management, asset management, and retirement planning for individuals and institutions.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and AMP fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the asset management industry. With a focus on personalized advice, disciplined capital management, and strong advisor productivity, the company continues to position itself as a leading player in the industry.

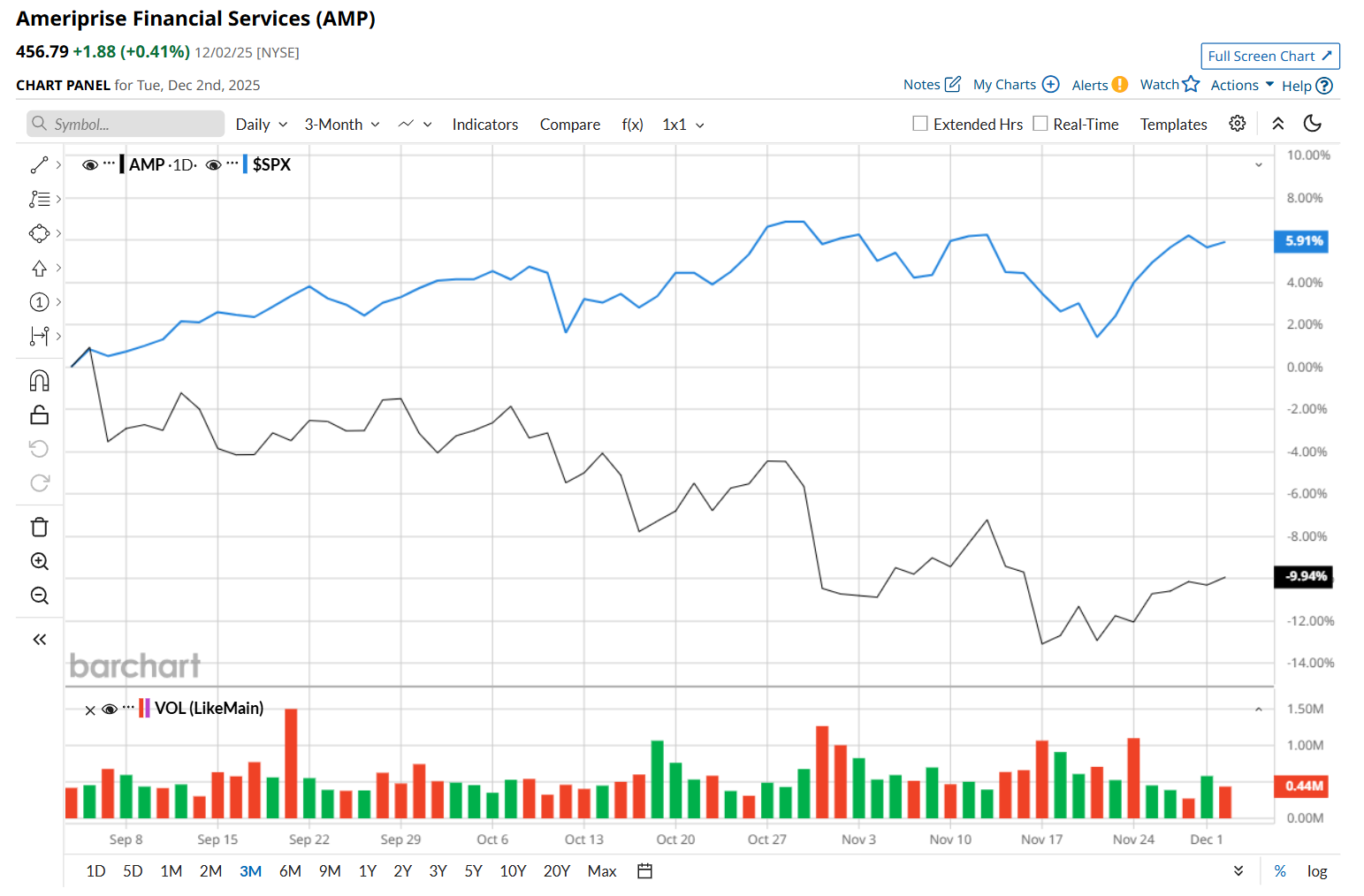

This asset management company has slipped 21.5% from its 52-week high of $582.05, reached on Jan. 30. Shares of AMP have declined 10.9% over the past three months, considerably lagging behind the S&P 500 Index’s ($SPX) 6.5% rise during the same time frame.

In the longer term, AMP has fallen 19.2% over the past 52 weeks, notably underperforming SPX's 12.9% uptick over the same time period. Moreover, on a YTD basis, shares of AMP are down 14.2%, compared to SPX’s 16.1% return.

To confirm its bearish trend, AMP has been trading below its 200-day and 50-day moving averages since late July.

On Oct. 30, AMP delivered better-than-expected Q3 results. Due to solid growth in its management and financial advice fees, distribution fees, and premiums, policy, and contract charges, the company’s total net revenue improved 9% year-over-year to $4.8 billion, handily exceeding consensus estimates. Moreover, on the earnings front, its adjusted EPS also climbed 12.3% from the year-ago quarter to $9.92, beating analyst estimates by 3.3%. However, despite these positives, its shares plunged 5.1% after the earnings release.

AMP has also considerably lagged behind its rival, Raymond James Financial, Inc. (RJF), which declined 6.8% over the past 52 weeks and gained marginally on a YTD basis.

Looking at AMP’s recent underperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 15 analysts covering it, and the mean price target of $534 suggests a 16.9% premium to its current price levels.