American Electric Power Company, Inc. (AEP), headquartered in Columbus, Ohio, is a prominent electric utility serving customers across multiple states. The company's operations focus on generating electricity from a mix of coal, natural gas, nuclear, and renewable energy sources. The company has a market capitalization of $62.78 billion, which classifies it as a “large-cap” stock.

AEP also manages one of the nation’s largest transmission networks, alongside an extensive distribution system. Its subsidiaries, including AEP Ohio and Appalachian Power, ensure reliable power delivery to residential, commercial, and industrial customers.

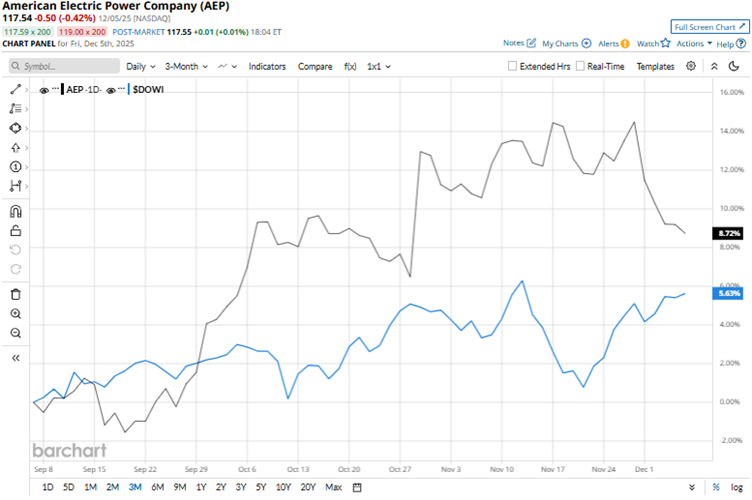

AEP’s stock reached a 52-week high of $124.80 on Nov. 18, but is down 5.8% from that level. Strong performance and positive market sentiment in the utilities sector have driven the stock up 8.7% over the past three months. The broader Dow Jones Industrial Average ($DOWI) is up 5.6% over the same period. Therefore, the stock has outperformed the wider index over this period.

Over the longer term, this outperformance persists. Over the past 52 weeks, the stock has gained 20.6%, while the Dow Jones index is up 7.1%. Over the past six months, AEP’s shares have increased 15.5%, while the index has gained 13.3%. The stock has been trading above its 200-day moving average since May and is hovering near its 50-day moving average.

On Oct. 29, AEP reported its third-quarter results for 2025. The company’s revenue increased 10.9% year-over-year (YOY) to $6.01 billion, beating the $5.65 billion Wall Street analysts had expected. However, its non-GAAP EPS (also called operating EPS) dropped from $1.85 in Q3 2024 to $1.80 in Q3 2025, missing the Wall Street analysts’ expected figure of $1.81.

The company increased its long-term operating earnings growth range to 7%-9% over the next five years, based on its new $72 billion capital plan, which is supported by 28 GW of new load backed by customer agreements. Due to the company’s strong outlook, the stock gained 6.1% intraday on Oct. 29.

We compare AEP’s performance with that of another electric utility stock, Dominion Energy, Inc. (D), which has gained 2.8% over the past 52 weeks and 4.5% over the past six months. Therefore, AEP has been the clear outperformer over these periods.

Wall Street analysts are moderately bullish on AEP’s stock. The stock has a consensus rating of “Moderate Buy” from the 21 analysts covering it. The mean price target of $128.78 indicates a 9.6% upside compared to current levels. The Street-high price target of $139 indicates an 18.3% upside.