Shares of Advanced Micro Devices (AMD) are retreating on Wednesday, down about 2% at last check, even after the chipmaker posted better-than-expected second-quarter earnings.

While AMD beat on earnings and revenue expectations, free cash flow came up a bit short of estimates, as did revenue guidance for the third quarter.

It’s hardly the end of the world — and not as bad of a report as we got from Intel (INTC) last week. And after AMD's stock price rallied sharply, today’s dip makes sense.

Keep in mind: AMD stock rallied 24% last month and is working on its fifth straight weekly rally. From the June low to this week’s high, AMD has rallied more than 40%.

AMD is one of my favorite companies. It and Nvidia (NVDA), I believe, are some of the best names in tech. But we can’t ignore the size of the recent move and the (gently) disappointing guidance.

Trading AMD Stock

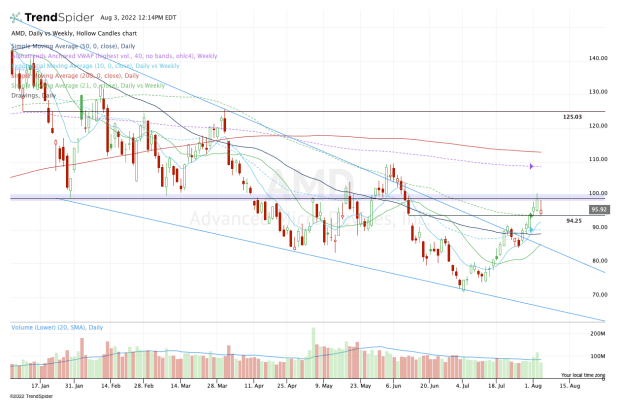

Chart courtesy of TrendSpider.com

What is the price action telling us? It's saying "pause," not "panic."

I’m not surprised where we’re seeing AMD stock pause, as it runs into the vital $100 area. Not only is this a key psychological level, but it’s also a major support and resistance zone from the past several years.

Just this year alone, notice how many rallies and pullbacks ended at or near this level. If the stock is struggling with this zone now, a bit of a pullback is reasonable. One could even argue that it’s healthy.

On the downside, I’m watching $94.25. Not only was that the gap-fill level from June (which has since been filled), but it’s now near where the post-earnings low comes into play, along with the 21-week moving average.

If AMD stock pushes lower, active traders will want to see it hold the 10-day moving average. Below that and $90 will be in play, where we find the 10-week and 50-day moving average.

On the upside, keep an eye on $101. That is just above this week’s high, but it’s also near that key $100 zone mentioned above. Clearing this level could open the door toward $110, which was resistance in May and where the weekly VWAP measure comes into play.

Above that could open the door to the 200-day moving average. Above all these levels and $125 is in play.

So what’s the bottom line? On the upside, keep an eye on $100 to $101. For now, that’s a ceiling for AMD stock.

On the downside, $94 and the 10-day are key. Below that puts $90 in play. If that fails as support, we’ll have to revisit the stock.