The battered Alibaba Group Holdings, Inc. (NYSE:BABA) stock has a key catalyst this week, as the Chinese ecommerce giant prepares to release its March quarter and year-end financial results.

The Hangzhou, China-headquartered company is due to report its results Thursday, before the market open, and the earnings call is scheduled for 7:30 am ET.

Key Metrics To Look Out For: Analysts, on average, expect Alibaba to report earnings per ADS of $1.10, down from $1.59 a year ago and $2.65 for the previous quarter.

Analysts have tempered their EPS expectations over the quarter, with the consensus estimate dropping from $1.45 three months ago.

Revenue is expected to increase by a modest 3.5% year-over-year pace to $29.95 billion. This compares to the year-ago quarter's $28.93 billion and the previous quarter's $38.07 billion.

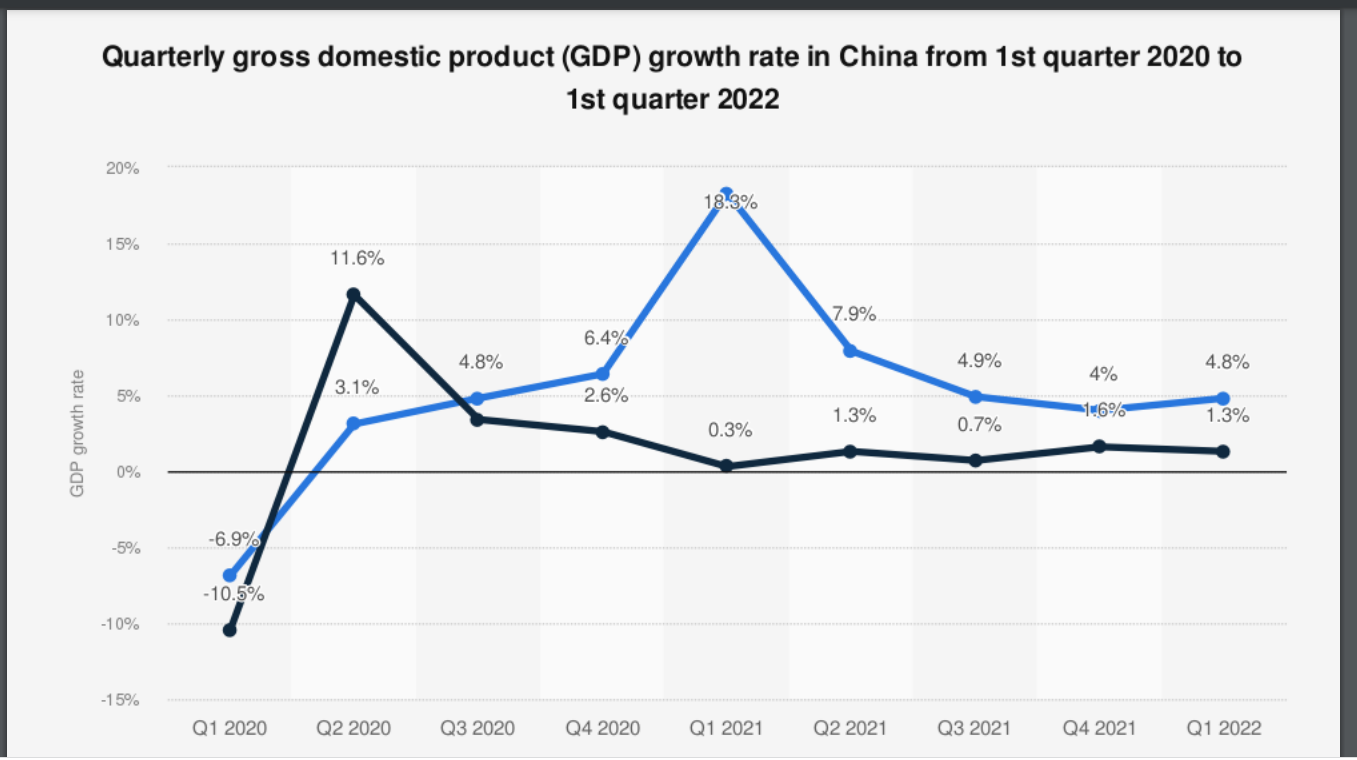

Expectations are muted, going into the earnings announcement. China's GDP growth, though improving in the first quarter, has not picked up enough momentum. Alibaba derives the bulk of its revenue from its core ecommerce business, and the segment's fortunes are tied to the economy.

Source: Statista

Related Link: One Of Warren Buffett's Favorite Fund Managers Exits Entire Alibaba Position

China retail commerce revenue, accounted for roughly 63% of the total revenue in the December quarter. Growth of the segment was at 33%. Customer management services revenue, which refers to pay-for-performance advertising services, made up 57% of the total China retail commerce revenue, but the bad news is that it rose merely 3%.

International commerce revenue, accounting for 5% of the total, climbed 33%.

Alibaba Cloud contributed 10% of the total revenue and saw 33% year-over-year revenue growth.

The Russia-Ukraine war has had a negative impact on consumer and business spending. And COVID began to rear its ugly head toward the end of the March quarter, leading to lockdowns in stricken regions across the country.

Tech peer Tencent Holdings Limited (TCEHY) last week reported disappointing quarterly results and also warned of continuing regulatory woes.

Looking Ahead: The consensus estimates call for Alibaba reporting revenue of $32.29 billion, a modest drop from the year-ago's $32.37 billion, and EPS of $1.74.

For the fiscal year ended March 2023, analysts target revenue of $142.37 billion and EPS of $7.94.

Related Link: Alibaba's March Quarter Earnings Estimate Falls By Over 20% Over 3 Months: What You Need To Know

Alibaba's Stock Take: Alibaba stock is on an extended downtrend since it peaked at $319.32 in October 2020. Clampdown by Chinese regulators, an economic slowdown exacerbated by the COVID resurgence this year and the threat of potential delisting from the U.S. market continue to concern investors.

Earlier in May, the stock dropped to nearly a six-year low of $78.01, but has cut a fraction of its loss since then.

On Wednesday morning, Alibaba stock was trading flat, up 0.13% to $82.58, according to Benzinga Pro.

Photo: Courtesy of Leon Lee on Flickr