/Adobe%20Inc%20logo%20on%20phone%20on%20desk-by%20Tattoboo%20via%20Shutterstock.jpg)

With a market cap of $133.8 billion, Adobe Inc. (ADBE) is one of the world’s largest software companies. The company operates through three core segments: Digital Media; Digital Experience; and Publishing and Advertising, delivering solutions that empower individuals and enterprises to create, manage, and optimize digital content.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Adobe fits this criterion perfectly. Its flagship offerings, including Creative Cloud and Document Cloud, drive the majority of revenue through subscription and licensing models, serving a wide range of creative professionals, businesses, and consumers worldwide.

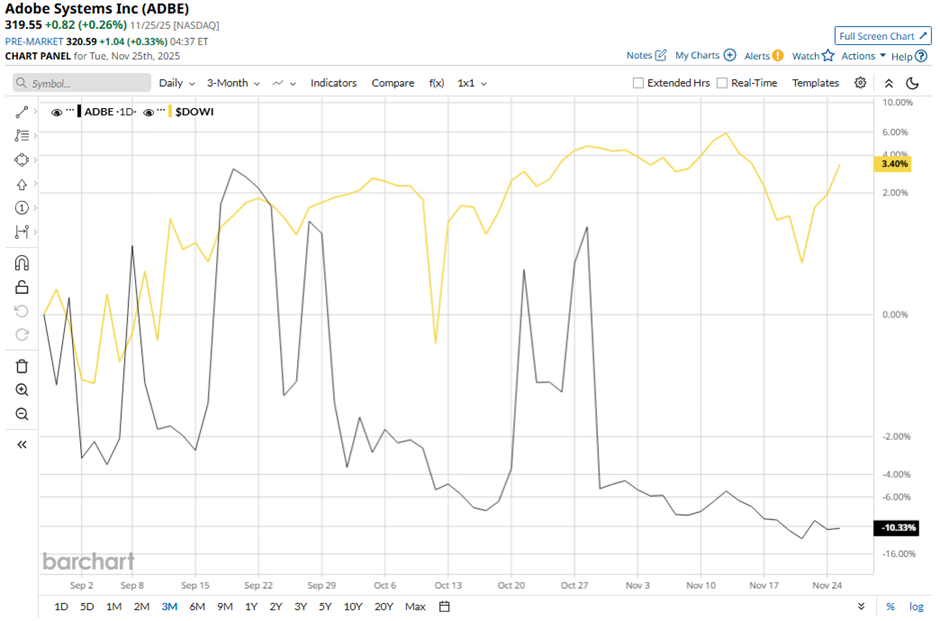

Despite this, shares of the San Jose, California-based company have declined 42.7% from its 52-week high of $557.90. ADBE stock has decreased over 12% over the past three months, lagging behind the broader Dow Jones Industrials Average's ($DOWI) over 4% rise over the same time frame.

In the longer term, Adobe stock is down 28.1% on a YTD basis, underperforming DOWI’s 10.7% gain. Moreover, shares of the software maker have dropped 38.4% over the past 52 weeks, compared to DOWI’s 5.3%return over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since early December last year.

Adobe reported better-than-expected Q3 2025 adjusted EPS of $5.31 and revenue of $5.99 billion Sept. 11. The company raised its fiscal 2025 revenue forecast to $23.65 billion - $23.70 billion and boosted its adjusted EPS outlook to $20.80 - $20.85. However, the stock fell marginally the next day.

In comparison, ADBE stock has shown a more pronounced decline than its rival Automatic Data Processing, Inc. (ADP). ADP stock has dipped 15.9% over the past 52 weeks and 12.4% on a YTD basis.

Despite the stock’s weak performance, analysts remain moderately optimistic on Adobe. The stock has a consensus rating of “Moderate Buy” from 36 analysts in coverage, and the mean price target of $465.72 is a premium of 45.7% to current levels.