/Intuitive%20Surgical%20Inc%20logo%20on%20phone-by%20Ralf%20Liebhold%20via%20Shutterstock.jpg)

With a market cap of $205.2 billion, Intuitive Surgical, Inc. (ISRG) is a prominent technology and medical device company that is widely regarded as the global leader in robotic-assisted, minimally invasive surgery. Its headquarters are in Sunnyvale, California, and its flagship offerings include the da Vinci Surgical System and the Ion endoluminal system, supported by a comprehensive portfolio of instruments, accessories, services, and digital solutions.

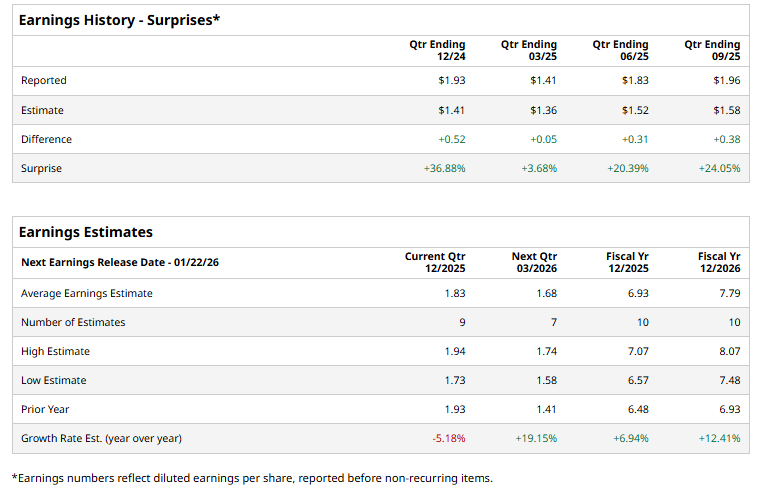

The med-tech titan is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect Intuitive Surgical to report an EPS of $1.83, down 5.2% from $1.93 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the company to report an EPS of $6.93, a 6.9% rise from $6.48 in fiscal 2024. Moreover, EPS is anticipated to grow 12.4% year over year to $7.79 in fiscal 2026.

Shares of Intuitive Surgical have surged 10.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16% gain and the Health Care Select Sector SPDR Fund’s (XLV) 12.5% return over the same period.

On Dec. 11, shares of Intuitive Surgical fell more than 1% after Citigroup Inc. (C) downgraded the stock to “Neutral” from “Buy,” signaling a more cautious near-term outlook despite the company’s strong fundamentals.

Analysts' consensus view on ISRG stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 18 suggest a "Strong Buy," two give a "Moderate Buy," eight recommend a "Hold," and one has a "Strong Sell." The average analyst price target for Intuitive Surgical is $614.04, implying a 5.9% upside from current price levels.