The Reserve Bank lifts interest rates for the seventh month in a row, taking the cash rate to 2.85 per cent.

Look back on the updates in our blog.

Key events

Live updates

By Shiloh Payne

That's all for today's blog

Thanks for joining us.

You can continue to stay up to date with the latest news here on the ABC News website and on our app.

By Shiloh Payne

Senior economist welcomes RBA decision

A senior economist has welcomed the Reserve Bank's decision to raise the cash rate by a quarter of a percentage point.

It's the bank's seventh month in a row of hiking interest rates, lifting the borrowing costs to its highest in nine years.

There had been concerns the bank would opt to increase rates by point-five per-cent to tame surging inflation, with new figures showing Australia had seen its worst annual rate since 19-90.

Chief economist with AMP capital, Shane Oliver, says the bank made the right decision by exercising restraint.

"It made sense for the Reserve Bank to continue raising rates but to do so at the more moderate pace of of the twenty five basis points," Dr Oliver says.

"The clear message from all of this is the Reserve Bank still thinks it has more work to do, but I guess it's started to give a bit more weight to the uncertainty."

By Shiloh Payne

When will the cash rate rises end?

When are we expecting the RBA to stop lifting the cash rate and how high are we expecting the cash rate to get?

- Martin

Hi Martin, Here's our business reporter Gareth Hutchens to answer your question:

Economists are currently arguing about this question.

Their arguments are based on their knowledge of how the RBA thinks, and what types of models the RBA is using to make its decisions about interest rates. But they’re also trying to second-guess how the RBA will respond to different economic developments.

The cash rate target is now 2.85 per cent.

Right now, ANZ’s economics team thinks the RBA won’t stop lifting the target until it hits 3.85 per cent in May next year.

Shane Oliver from AMP Capital thinks rates will peak at 3.1 per cent.

David Bassanese from Betashares expects rates to peak at 3.6 per cent.

And market expectations are for the cash rate to peak around 4.2 per cent in a year’s time

But the RBA hasn’t specified when they’ll stop lifting rates. It says it will be adaptable and willing to change its mind as more data comes in.

By Shiloh Payne

The main factors contributing to inflation

Is it correct to say that currently, the main drivers of inflation are external factors like the war in Ukraine? It seems like all increased interest rates will do is contribute further to the cost of living crisis. No matter how low the demand for gas gets in Australia, for example, gas prices globally will remain high for the foreseeable future -- so how exactly does the RBA expect higher interest rates to address inflation?

- Matt

Hey there Matt.

Here's Gareth Hutchens:

This inflation originated overseas, from the war in Ukraine and international energy prices, but Australia’s also started to generate its own inflation.

Think of the constant flooding that’s devastating different food bowls on Australia’s east coast. That’s having a huge impact on the price of food.

We’ve also got huge inflation in the cost of materials needed to build new homes, and noticeable price increases on menus at restaurants and for furniture, among other things.

The RBA governor Philip Lowe has said he’s concerned that the inflation has started to spread in recent months to more and more domestic goods and services.

Here's a look at some figures from The ABS's September Quarter CPI release:

By Shiloh Payne

Inflation biggest challenge in Australian economy: Jim Chalmers

If you missed Jim Chalmers speaking live, here's a recap of what he said:

By Shiloh Payne

How much extra could mortgage repayments cost now the cash rate is 2.85 per cent?

Check out our calculator to see how the latest interest rate rise could impact your mortgage repayments.

By Shiloh Payne

Interest rates will really bite when fixed-rate home loans expire

Surely when everyone comes off their 3 year fixed homeloans next year and the year after the current interest rate rises will really start to bite?

- Brett

Hey Brett,

Thanks for sending your question in for Gareth, here's his answer:

Yes that’s right.

In July, the RBA deputy governor Michele Bullock spoke about this very topic.

She said households with fixed-rate home loans were currently being shielded from these rate increases. But the majority of those loans would be expiring over the next two years, with the greatest concentration of them expiring in the second half of 2023.

She said assuming variable rate mortgage rates would going to rise by 3 percentage points by mid-2023, all of those households would suddenly be facing much higher interest repayments.

“Assuming all fixed-rate loans roll onto variable rates and new variable rates are broadly informed by current market pricing, estimates suggest that around half of fixed-rate loans would face an increase in repayments of at least 40 per cent,” she said in July.

By Shiloh Payne

NAB has increased its variable home loan interest rate

The standard variable NAB home loan interest rate will increase by 0.25 percentage points from 11 November.

NAB Group Executive for Personal Banking Rachel Slade says banks have a critical role to provide support for those finding the rises challenging.

"At NAB, we have dedicated financial counsellors who listen to each customer's individual situation and are able to offer tailored solutions — whether that be a reduced payment arrangement, payment break or restructuring their loan," Ms Slade says.

"Regardless of who you bank with, I encourage people to speak to their bank early if they are concerned."

By Shiloh Payne

Latest rise could tip borrowers into mortgage stress

Stephen Zeller, Compare the Market's General Manager of Money, is urging Australians to assess their financial situations as rates continue to rise.

"Aussies with a fixed-rate loan due to expire by the end of 2023 can expect a median increase of around $650 in their monthly repayments," Mr Zeller says.

"In this market complacency kills.

"Do your research to find the most cost-effective way out of this turbulent time.

"Great offers that were there yesterday are gone today, so do your research and do it fast. Advertised rates are moving quick."

Mr Zeller says households with "decent buffers" should be able to ride out the rate rise but those with low liquidity buffers should be reviewing costs beyond their home loan.

"Get into a habit of checking your budget and re-evaluating household living costs such as energy plans and insurances. But beware of the honey trap. It's vitally important to check the rate is competitive first before switching".

"This might seem tedious and tiring but it's the best way to tackle high living expenses and get on the front foot of what could be a really challenging time into Christmas."

By Shiloh Payne

A wider view of interest rates

Let's zoom out even further from our last graph and take a look at how the cash rate has changed over time since the 1990s.

By Shiloh Payne

Why will banks pass on the rate increase to borrowers but not on savings when the rate drops?

This is a question that comes up a lot, but why is it that the banks won't hesitate the pass on the rate increase to borrowers but never fully pass on the savings when the rate drops? I expect we will be seeing some big profit reports from the banks which will do little to inspire the common Australian as we foot the biggest cost of living increase while the rich continue to live in luxury.

- Tired of finances

Hey there, thanks for your question.

Here's Gareth Hutchens:

There’s a simple answer here: market power.

What happens to Australia’s banks when they don’t pass rate cuts on quickly and in full? How many customers do they lose? What genuine repercussions do they face?

The Australian market is really small by international standards, and the Big Four banks account for the lion’s share. There are smaller competitors, but the vast majority of Australians are still customers with the Big Four, and little bank-switching occurs.

That’s just the reality.

By Shiloh Payne

Video: RBA raises cash rate by 0.25 per cent - seventh consecutive hike in 2022

The ANZ's senior economist Felicity Emmett analyses the RBA's decision to hike the base interest rate for a seventh consecutive time.

By Shiloh Payne

Angus Taylor is speaking now

Shadow treasurer Angus Taylor says the RBA statement was "sobering".

"It said that they expect inflation to continue to go up, to peak at 8 per cent, that is an increase in what they had previously said and they expect more interest rate increases to follow beyond today," Taylor says.

"That will exacerbate pain for so many Australians."

"Interest rate decisions by the Reserve Bank are of course made by the Reserve Bank as it should be but they are made within the context of government policy and a great disappointment for so many Australians is that what we didn't see from the government last week in the budget is a clear and consistent plan that can take pressure off interest rates."

By Shiloh Payne

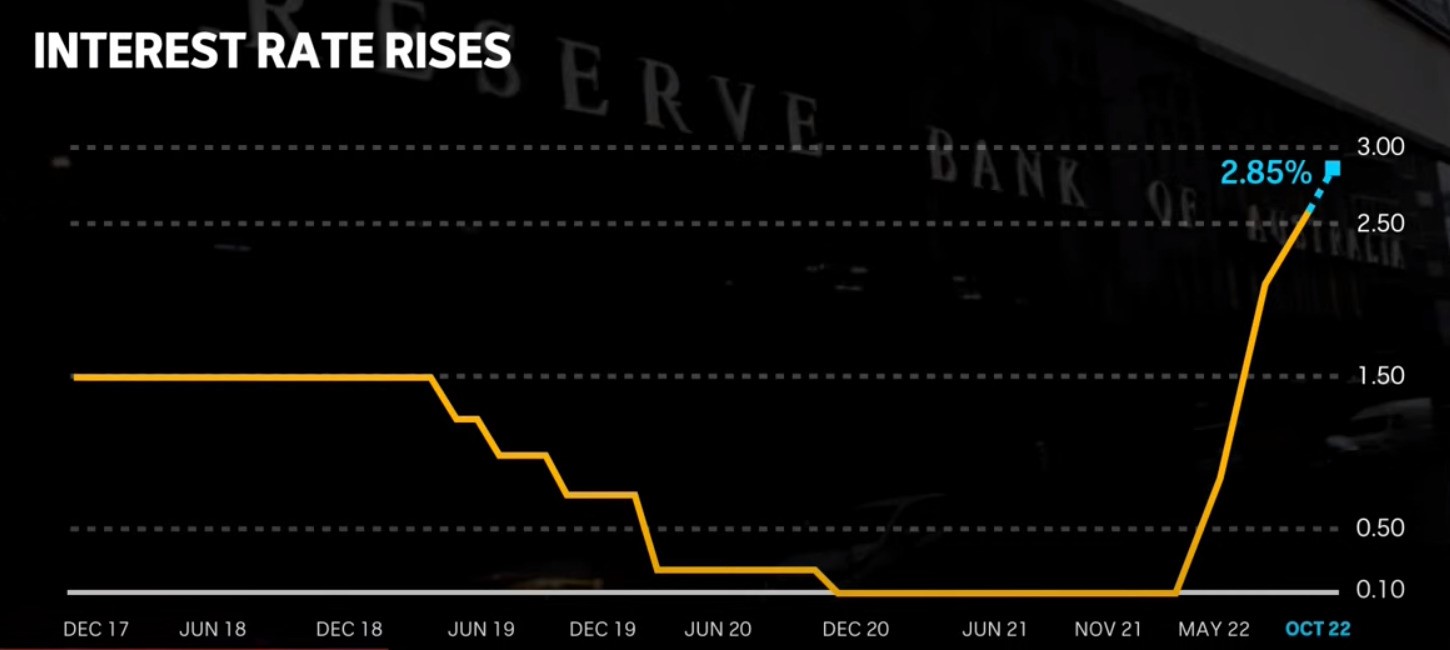

Interest rates trajectory "very steep", expert says

ABC finance journalist Alicia Barry says despite the 0.25-percentage-point increase, there has still been a rapid rise in rates.

"The trajectory has been very steep," she says.

"If we look over the last five years of interest rate increases, you can see that the cash rate was running around that 1.5% level before it came down during the pandemic, then bottomed at the record low of 0.1%.

"Since May, it's just jumped very steeply up to that 2.85% cash rate.

"Even going back to 2017, it's still much steeper than people have been used to.

"When you factor in the $1,100 + per month that people are having to dig in and payout to their mortgage, it's only going to decrease the available amount of disposable income that people have to spend in the economy, which is the idea — but of course, there is a risk that the RBA does go too far and we do see a recession."

By Shiloh Payne

There's more than just interest rate rises going on this afternoon

It's hard to miss it, but if you have...

The winners for this year's Melbourne Cup have just been announced, here's a breakdown on the top three:

- 1.Gold Trip

- 2.Emissary

- 3.High Emocean

We've got a live blog dedicated to the action here.

By Shiloh Payne

Australian home prices fall for six months in a row as interest rate rises bite

National property prices have fallen for the sixth month in a row as higher interest rates make the cost of borrowing more expensive.

CoreLogic said that, if official interest rates rose to 3.1 per cent, that implied an average, variable, owner-occupier mortgage rate of around 5.21 per cent for new borrowers, and 5.69 per cent for existing customers.

In its latest Financial Stability Review, the RBA said that its rapid rate hikes could see some home owners forced to sell their homes because they could not meet their mortgage repayments, with first home buyers and those on fixed-rate mortgages among those at risk.

Property data firm CoreLogic said home values across the country fell a further 1.2 per cent in October from a month earlier, with the median home price now at $721,018.

Prices fell in every capital city — and nearly every region as well — as the 2.5-percentage-point increase in rates by the Reserve Bank of Australia since May's record low rate of 0.1 per cent began to bite.

-

You can continue reading this article from business reporters Sue Lannin and Rhiana Whitson here

By Shiloh Payne

Here's a graph of interest rate rises since 2017

By Shiloh Payne

Analysis: the RBA's seventh consecutive rates hike

Alicia Barry breaks down the RBA's rate increase of 0.25 per cent and the trajectory of rates decisions.

By Shiloh Payne

Is there a better way to calculate inflation?

Is there a better way to calculate inflation? Coz it seems like these interest rate hikes aren’t working as well as the RBA would like!!! - Justine

Thanks Justine for sending in your questions for our expert Gareth Hutchens, here's his answer:

There are a couple of points to make here.

Firstly, there are different ways to measure inflation.

But the inflation the RBA is targeting refers to the prices faced by households when they buy goods and services for consumption.

Consumption accounts for more than 50 per cent of Australia’s economy activity, so the RBA is trying to stamp down on price pressures inthatpart of the economy.

This measure of inflation doesn’t include the price of pre-existing residential property. So, the soaring property prices we’ve seen during the pandemic era (and more recently, the property price declines we’ve seen), aren’t considered inflation. They’re asset prices, so they’re counted in measures of wealth instead, rather than inflation.

Secondly, we’re all impatient to see inflation falling but it’s going to take time unfortunately, under current policy settings.

According to the RBA, it could take between 18 and 24 months before we see the full effect of its rate hikes on economic activity. That’s because there are lots of dynamics at play.

It will take time for the rate hikes to flow through to all residential mortgages. It will take time for businesses to adjust to a higher level of interest rates. It will take time for households to adjust their spending behaviour to the higher rates.

Thirdly, you may be wondering if there are faster ways to bring inflation down, or alternative ways other than just relying on interest rate increases.

Well, take a look at what’s happening in Western Australia.

In Perth in the September quarter, inflation declined by 0.5 per cent, while all other capital cities saw positive inflation. And for the last 12 months, Perth’s annual inflation, at 6 per cent, has been the slowest of any major city in Australia.

That’s because WA is using different policies to combat inflation. WA has a gas reservation policy, which provides cheaper energy. And the WA Government’s most recent budget had cost-of-living measures, like a $400 energy bill credit for households, which has kept inflation much lower over there.

By Shiloh Payne

RBA ‘will do what is necessary’ to curb inflation, Philip Lowe warns

The post-meeting statement from RBA governor Philip Lowe has warned borrowers that they should brace for more rate rises.

"The board expects to increase interest rates further over the period ahead," Mr Lowe wrote.

"The size and timing of future interest rate increases will continue to be determined by the incoming data and the board's assessment of the outlook for inflation and the labour market.

"The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that."