Treasurer Jim Chalmers says inflation will "get worse before it gets better" as the RBA announces a sixth consecutive monthly rise of 0.25 of a percentage point.

Look back on the updates with our live blog.

Key events

Live updates

By Shiloh Payne

Here's where we'll leave our live coverage

Thank you for joining us today and for all of your questions.

We hope you learnt something from our expert Gareth Hutchens, I sure did!

You can continue to stay up to date with the latest news here on the ABC News website and on our app.

By Shiloh Payne

Westpac announces interest rate changes

Westpac has passed on the RBA's cash rate increase to its customers.

Here's what they are:

- Westpac Life total variable rate with bonus interest will increase by 0.25% p.a. to 2.60% p.a.

- Under Westpac’s Spend&Save offer for 18-29 year olds, eligible customers can earn a total variable rate of 3.75% p.a., an increase of 0.25% p.a.

- Westpac eSaver total variable rate will increase by 0.25% p.a. to 2.55% p.a. for new customers for the first five months.

- Home loan variable interest rates will increase by 0.25% p.a. for new and existing customers.

“We’re continuing to monitor the situation and bolster our customer support teams so we can help customers navigate the evolving rate cycle,” Chris de Bruin, Westpac Chief Executive Consumer & Business Banking, says.

By Shiloh Payne

Economist: Today's move a good one

AMP Capital chief economist, Dr Shane Oliver says today's move by the RBA was a good one.

"The RBA has dropped back from those super-sized 0.5 per cent hikes which we saw for four months in a row and we're quite pleased that they've done that," Mr Oliver says.

"I think it makes sense that they've done that, we have seen a massive increase in interest rates, highest level in 9 years, mortgate rates will still go up the highest level in a decade."

By Shiloh Payne

Why does the burden of stopping this inflation fall on mortgage holders?

Where does all that extra money in repayments go? And why does this burden of stopping inflation just fall on mortgage holders - not those who have paid off homes, or renters- although renters are getting indirect cost increases. And how will mortgage owners paying huge amounts of interest stop price rises due to a war in Ukraine?

- Michelle

Hi Michelle, thanks for your question.

Gareth Hutchens has put together an explanation for you:

That’s another great question.

Why does the burden of stopping this inflation fall on mortgage holders?

Again, this is the system past policymakers have built.

Under our inflation targeting regime, which has been in place since the early 1990s, the Reserve Bank has been given the task of managing demand in the economy by manipulating interest rates (ie monetary policy).

If you think back to the post-war period, the Federal Government also tried to manage demand with its spending and taxing decisions (ie fiscal policy). But Government demand-management fell out of favour in recent decades, except in recessions and when hit by major economic shocks.

So, it’s up to the RBA to manage demand.

But the main tool the RBA has for managing demand is interest rates: it can lift them or cut them.

And interest rate changes work their way through the economy in various ways – they directly impact households with mortgages, they impact the exchange rate, and they impact investment decisions.

That’s just the way it is.

If interest rates on mortgages increase, it doesn’t do anything about the war in Ukraine.

By Shiloh Payne

What will the banks do next

What should be the follow through with bank rates for savings accounts and fixed term deposits.

- Graham

Hey Graham, here's Gareth Hutchens to answer your question:

I’d expect the banks to lift interest rates again on their savings accounts etc.

That’s what they’ve been doing with the previous rate rises.

And some of the smaller banks, outside of the Big Four, have been competing strongly with the rates they’re offering on their savings maximiser accounts.

By Shiloh Payne

NAB announces change to home loan rates

NAB is the first to announce an increase in its home loans after today's RBA decision.

The standard variable NAB home loan interest rate will increase by 0.25 per cent from October 14.

NAB Group Executive for Personal Banking, Rachel Slade, says NAB is focused on supporting its customers.

“If you are worried about the impact of increasing interest rates, you have our full support,” Ms Slade says.

“Our home loan specialists can help with a financial health check to make sure you’re on the best rate for your situation and our NAB Assist team is on standby for those who need additional help.

“The best first step is a conversation with us so we can find the best way to look after you – the earlier the better.”

In September, NAB increased a number of savings rates by 0.50% and Term Deposit rates by up to 0.85%.

By Shiloh Payne

How much more will people with home loans be repaying?

Business reporter Sue Lannin has analysed how much more people with home loans will be repaying after the latest rate rise.

Here's what she had to say:

By Shiloh Payne

A look at the bigger picture

If a recession is imminent while continuing this rate rise trend why is it happening or allowed to happen? What is the purpose and what does the bigger picture look like?

Here's ABC business reporter Gareth Hutchens to answer this question:

Fantastic question.

These kinds of rate rises aren’t being universally applauded. There are many economists who think this rate hiking cycle is nuts, and that it’s leading the global economy into recession.

Why is this allowed to happen? That’s out of our hands.

Past policymakers created this system. They decided that one of the most important things we could do in our economy was to have an independent central bank that prioritised keeping inflation low and steady. And the main tool the central bank has to do that is by manipulating interest rates.

And the bank’s “independence” means the government can’t tell it what to do.

You could say that’s undemocratic. But politicians are quite happy with that institutional arrangement because it means rates aren’t their responsibility. They can say they’re not the ones who are making the decision to lift or cut rates.

What’s the purpose of lifting rates like this?

The RBA thinks there’s a mismatch between demand and supply in the economy. It says there’s too much demand for the level of output our economy can achieve. So, it wants to squeeze some demand out of the system.

It also doesn’t want people to start believing that it’s lost control of inflation. That’s why it’s raising rates so quickly, to convince people that inflation will not be getting away from us.

What does the bigger picture look like?

The RBA knows that unemployment will be rising at some point, from these rate rises. But it hopes that inflation (which is currently 6.1 per cent) will be back down around 3 per cent in 2024.

By Shiloh Payne

Failing housing market may have impacted decision: Peter Ryan

Senior business correspondent Peter Ryan says the failing housing values may have had an impact on the RBA's decision.

By Shiloh Payne

Why does the RBA think this will work?

I guess my main question is; Why does the RBA think this will work? It has done literally NOTHING so far…

- Ryan M

Hi Ryan,

I put your question to our business reporter Gareth Hutchens and here's what he says:

It takes time for rate increases to work their way through the economy.

RBA governor Philip Lowe said recently that it could take somewhere between 18 to 24 months before we see the full impact of these rate rises on the economy.

So, you can see why there’s some danger in the RBA lifting rates so quickly in such a short amount of time, because it can’t say for sure what the full impact will be until well into the future.

But having said that, I don’t think it’s true to say these rate rises have done literally nothing.

We’re already seen that property prices have started falling, for instance.

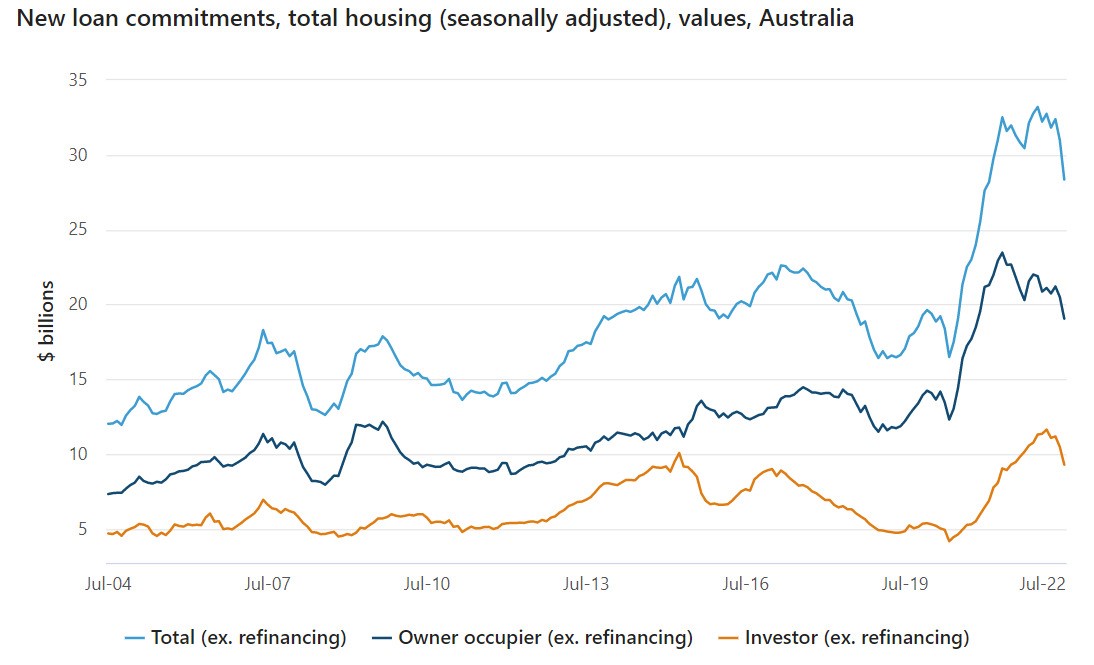

You can see that in graphs like this one, where the value of new loan commitments is heading downwards:

By Shiloh Payne

Shadow Treasurer reacts to latest rate rise

Federal shadow treasurer Angus Taylor says while the rate rise was less than expected, it's still a significant increase.

"We will be seeing payments increasing by Christmas and the end of the year at exactly the time when we see people buying their Christmas presents, Christmas meals and going on holidays," Mr Taylor says.

"That is when the pain is really going to be hitting, so this is a tough time for Australians but it also has enormous implications for government and policy.

"We need to see policies and plans that are going to alleviate those pressures on Australian budgets."

By Shiloh Payne

Do we know how much the interest rate could rise again?

Is there an ultimate target the RBA is aiming for? I've heard 2.5pc from some people, 3.5pc from others, and random internet influencers fearing 10pc or more like the 1990s

- Tony

Hey Tony, thanks for your question.

Here's our business reporter Gareth Hutchens:

Less than a month ago, when the cash rate was 2.35 per cent, the RBA governor Philip Lowe said it was still too low.

He said he could probably see the cash rate averaging around 2.5 per cent over coming years, but an average of 3 per cent was “possible” too.

And you know what that means.

For the cash rate to average 3 per cent over the cycle, it means we’d have to have a cash rate higher than 3 per cent at times, by definition.

But things can change every quickly.

The RBA will be guided by global and local economic events, and the global economy is not in a good place at the moment.

By Shiloh Payne

Try our mortgage repayment calculator

Want to know how your loan repayments will change? Try out our mortgage repayment calculator with the link below.

By Shiloh Payne

Treasurer: Inflation will get worse before it gets better

Treasurer Jim Chalmers says there is clearly still an inflation problem in this economy.

"[The RBA has] made it clear that they think there is more work to be done by tightening interest rates," Dr Chalmers says.

"Our own Treasury forecast expects it to get worse before it gets better and will moderate it during the course of next year."

By Shiloh Payne

Treasurer: Budget to be about ' difficult decisions in difficult time'

The latest interest rate rise comes three weeks ahead of the federal budget.

Treasurer Jim Chalmers says it will be about "difficult decisions in difficult times".

"We do need to make the budget more responsible, affordable, sustainable and is targeted as possible to deal with cost of living pressures that Australians face, to deal with the deteriorating global situation and to deal with these persistent structural pressures on the budget which had been ignored for too long," Dr Chalmers says.

By Shiloh Payne

Treasurer Jim Chalmers is speaking

Federal Treasurer Jim Chalmers is speaking after the RBA announcement.

He says just because the rise is less than what was expected, it won't make it much easier for Australians finding room in their household budgets to meet the increasing cost of servicing a budget.

"Ever since interest rates started rising before the election, it was clear from the independent Reserve Bank that there would be a number of interest rate rises," Dr Chalmers says.

"This is now the sixth in as many months and the statement from the Reserve Bank governor today indicates that it is likely that there will be more interest rate rises as well."

By Shiloh Payne

Do Australians have a 'financial buffer'?

Last month Philip Lowe said Australian households have a ‘financial buffer’ to deal with the interest rate rises. Do they really?

Here's our business reporter Gareth Hutchens to explain:

RBA has frequently pointed to the fact that Australian households accumulated more than $270 billion in excess savings during the pandemic.

However, the distribution of those savings is very uneven.

About 80 per cent of that $270 billion has gone to the top 40 per cent of households by income.

So, most of the run-up in excess savings in the pandemic went to higher-income households.

By Shiloh Payne

A 'slowdown' as RBA lifts cash rate

Senior economist Sarah Hunter says Australia is seeing a "slowdown" in the size of the hike.

By Shiloh Payne

How much of a difference to inflation will further rate rises make?

Given Inflation is being pushed so much by constrained supply and our slumped dollar, how much of a difference to inflation will further rates make? Is curbing demand even possible when we are getting back to bare basics?

- James

Thanks for your question James.

Here's Gareth Hutchens:

Two points to make here.

Part of the reason why the RBA is lifting rates so quickly is because it’s trying to keep up with the US Federal Reserve’s rate rises.

If we kept rates steady in Australia while the US Fed kept pushing rates higher in the US, the Australian dollar would lose even more value against the US dollar, and that could see a lot of inflation being imported into Australia.

Why? Because people overseas would suddenly feel like Australia’s goods and services were relatively cheap, so they’d try to buy more of them – and that would push prices up in Australia.

So, the RBA is lifting rates to try to prevent Australia’s dollar losing too much value, thereby preventing more inflation being imported to Australia.

And on the second point, curbing demandispossible in this situation, it’s just that it’s being done in a brutal way.

Whenever the RBA lifts interest rates and the major banks pass the higher rates onto their mortgage customers, it means people with variable rate mortgages are being forced to give more of their disposable income to their bank each month (via higher interest payments).

That process is literally forcing people to give more money to their banks every month, which means they have less money to spend in other markets – which curbs demand.

I guess that question is how many more rate rises can people take?

Every household is different. It depends on your level of personal savings, and how large your weekly income is.

By Shiloh Payne

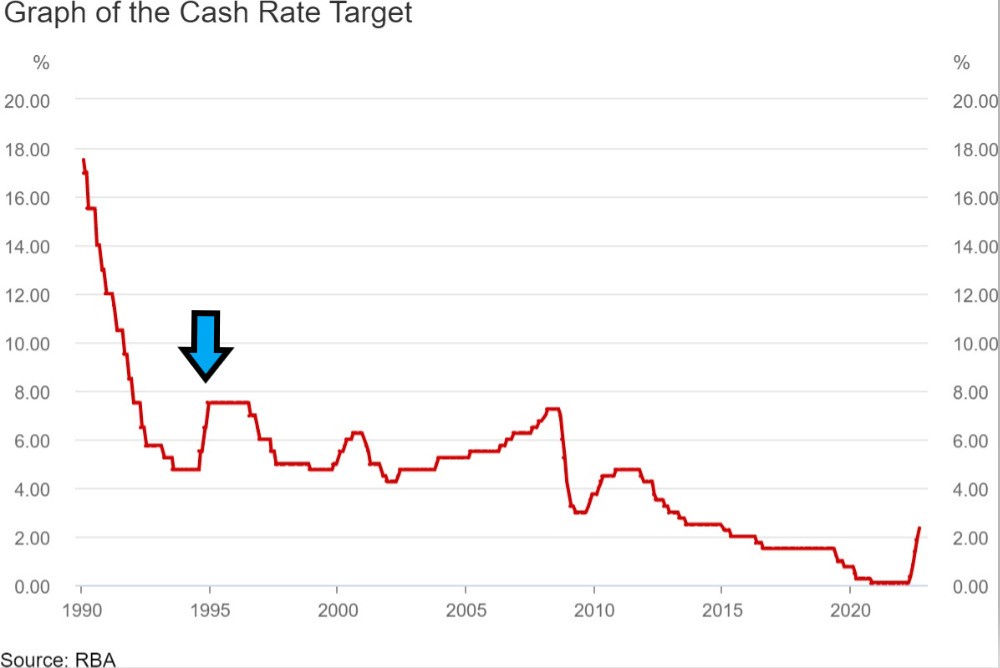

Have we seen interest rates rise this fast before?

Here's our expert Gareth Hutchens with a look at previous rate rises:

In the inflation-targeting era, the only time interest rates have risen this quickly was in 1994.

Back then, the RBA lifted rates by 2.75 percentage points in the space of five months.

And they started lifting rates when the cash rate was already 4.75 per cent, so within five months they’d lifted it to 7.5 per cent (and that’s where they kept it for 18 months).

This was their rate rise schedule:

- August 1994: +0.75

- September 1994: 0.00

- October 1994: +1.00

- November 1994: 0.00

- December 1994: +1.00

See the graph below. The blue arrow points to that period in 1994 when rates were lifted extremely quickly.