/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC), which was considered dead money until a few months ago, has seen a resurrection of sorts. INTC stock, which fell over 60% last year to record its worst ever year, has more than doubled this year. No one really expected such a bounce back from the once-iconic chipmaker, but a flurry of investment deals from the U.S. government, Softbank (SFTBY), and Nvidia (NVDA) helped buoy sentiment. The U.S. government, incidentally, is now Intel’s biggest shareholder after taking a nearly 10% stake in the company.

Meanwhile, while all the cash that Intel bagged from the recent investment deals helped bolster its balance sheet, there was one missing piece in the resurrection – the company’s financial performance. But the Lip-Bu Tan-led company came up with a strong set of numbers in Q3, which has sent its stock soaring today, Oct. 24.

Intel Reported Better-Than-Expected Q3 Earnings

Intel reported revenues of $13.7 billion in Q3, which were up 3% year-over-year and ahead of the $13.14 billion that analysts were expecting. Sales also came in above the high end of Intel’s guidance, marking the fourth consecutive quarter where it beat its guidance. The company also beat on the bottom line, delivering an adjusted earnings per share (EPS) of $0.23 versus its guidance of breakeven.

The Q4 guidance was in line with estimates. Intel expects to post revenues between $12.8 billion and $13.8 billion in the current quarter, slightly lower than Street estimates at the midpoint. The company, however, expects adjusted gross margins to fall to 36.5% in the quarter on unfavorable product mix, ramp up of Core Ultra 3, and deconsolidation of its high-margin Altera business following the majority stake sale to Silver Lake.

INTC Pitched Itself as an AI Play

Intel pitched itself as an artificial intelligence (AI) play during the Q3 earnings call and pointed to the 5% sequential increase in its artificial intelligence (AI) PC revenues. CFO David Zinsner talked about the “critical role” that CPUs play in the data center ecosystem with inference outpacing training workloads. Tan said that AI is still in its “early innings” and expressed confidence about the company’s role in the revolution.

Intel Sounded a Lot More Confident

Meanwhile, beyond the headline numbers and talks about Intel’s role in AI, Intel’s management sounded a lot more confident about its outlook, which I guess is partly because of the much-improved financial position, as the company exited Q3 with cash and cash equivalents of over $30 billion. This does not include the $5 billion Nvidia (NVDA) investment, which the company expects to close in the current quarter. Intel repaid $4.3 billion in debt in Q3 and is looking to further deleverage its balance sheet in 2026 by repaying the upcoming debt maturities next year.

The Investment Case for Intel

While Intel’s earnings were decent, I believe the company needs to deliver on two fronts for it to create value for investors.

Intel’s foundry business hasn’t been able to sign up any major customer despite the company pouring billions of dollars into building factories. The foundry business reported an operating loss of $2.3 billion in Q3, which, while being less than half of the $5.8 billion in the corresponding quarter last year, was ahead of estimates and simply too high for comfort. However, with the White House’s backing, we could see Intel bag some customers for its cash-guzzling foundry business soon, as President Donald Trump pushes for the onshoring of chip production.

Secondly, Intel has to meaningfully participate in the AI chip market, which so far has been yet another bus that the company has missed. While I would agree that these are still early days in AI, other players have significantly stepped up their game to take on Nvidia, which leaves little room to err for Intel.

INTC Stock Forecast

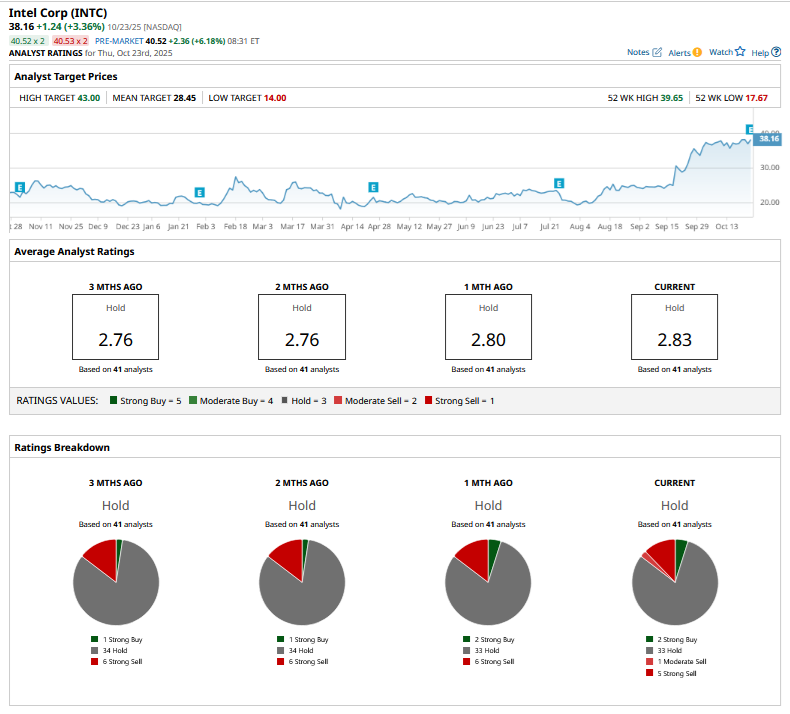

Most Wall Street analysts failed to spot the rally in INTC stock, and the majority rate it as a “Hold” or some equivalent. Only two of the 41 analysts covering Intel rate it as a “Buy” or higher, while the stock has long been trading above its mean target price. However, analysts have been gradually raising their target prices, and Cantor Fitzgerald raised its from $24.80 to $45 following the Q3 report, even as it maintained its “Neutral” rating.

I believe Intel’s turnaround is progressing in the right direction. To borrow a paraphrase from Intel’s management, I believe Intel is currently in the “early innings” of its latest round of turnaround, which has so far looked to be on the right track. The company is now backed by the world’s most powerful country and the most valuable company. Intel’s debt position is a lot more comfortable, with net debt falling sharply in Q3.

If Intel management can execute, the stock could see better days ahead. After the flurry of investment deals, I would now watch out for updates on the new customers it signs up for the foundry and custom chip business, which it is doubling down on with the newly formed Central Engineering Group.

All said, I find Intel’s risk-reward as now getting near unfavorable territory, as there is still execution risk that needs to be priced in. While I am currently invested in the stock, I will use any further rallies to start trimming my position and take profits off the table.