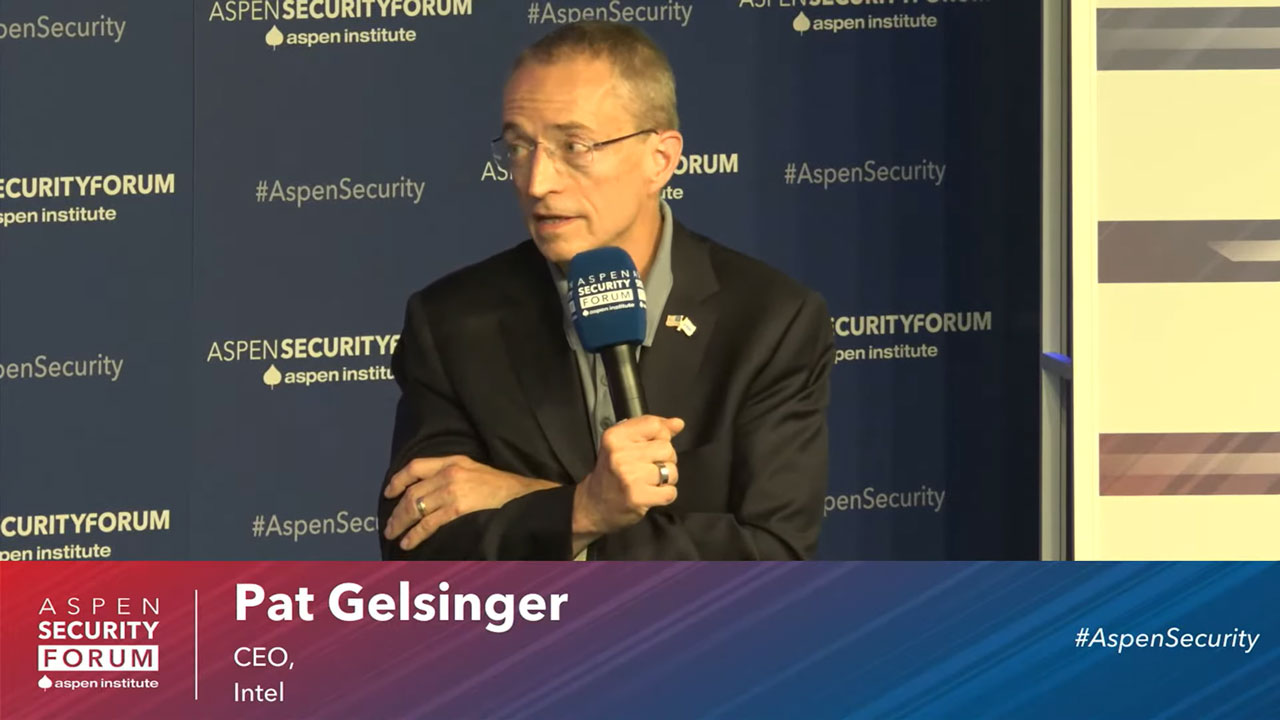

Intel CEO Pat Gelsinger spoke at the Aspen Security Forum 2023 in July; The topic under the spotlight was that of semiconductors and national security, and the issues that have arisen from the passing of the CHIPS Act. One of Gelsinger’s most eyebrow-raising assertions was that Intel deserves a bigger slice of the $52 billion US CHIPS Act pie than foreign rivals TSMC and Samsung. It was a bold claim, and he put forward a convincing case in what could be a high-stakes / high-reward gambit (h/t to EETimes).

Security, and China export controls particularly, is a thorny topic for successful global semiconductor businesses with their roots in the US. As US sanctions on China tighten, business becomes more difficult for the likes of Intel (and Nvidia, Qualcomm and AMD). Last month we reported on US semiconductor industry bosses having negotiations with senior US government economics and national security figures.

At Aspen, Gelsinger put forward the case for Intel to face fewer restrictions from trade regulation and get a larger portion of the US CHIPS Act cash. His multi-pronged argument appeared designed to hammer home the following points:

First, China represents 25% to 30% of Intel’s market, and the company's current $30 billion US expansion plans were partly put in place to address this demand, according to Gelsinger. If trade restrictions tighten and further cut this geographic revenue stream, Intel may not want to continue making significant investments in US projects, which have been touted to be good for US jobs, the US economy, and even US national security. Overall, the point was that China export controls unfairly target Intel business -- and that's bad for the US.

Second, Gelsinger described the current set of trade restrictions as excessive and badly targeted. “Today we have over 1,000 companies on the Entity List, many of which have nothing to do with national security, and nothing to do with security concerns in China,” noted the Intel CEO. So, in essence, Gelsinger was arguing for a loosening of the restrictions now in place, to refocus tightly on areas of undeniable national security.

Finally, and probably most controversially, Gelsinger made his case that Intel should get a bigger slice of the US CHIPS Act's $52 billion pie. The Intel CEO’s argument was quite clear and reasoned. He said the US should celebrate the fact that TSMC and Samsung were investing in building in the US, but there is a glaring difference in their operations and Intel’s. “All of my essential R&D is done here. Most of their work is done overseas,” Gelsinger underlined. “We should benefit more.”

If you care to watch the video embedded above, you can see Gelsinger underline the necessity for the CHIPS Act, and provide some of the history leading up to its passing. Moreover, you can listen to him make Intel's key arguments for loosening the current trade restrictions, while being more generous to Intel - and his reasoning.

As well as the interviewer Steve Clemons, an editor at Semafor, you will see Penny Pritzker, the US Commerce Secretary, sitting alongside Pat Gelsinger. As a representative of US government, Pritzker discussed the Fed's thinking and strategy. For the US to reinvigorate the semiconductor industry, it isn’t all about throwing money at chipmakers. For example, there is the widening chasm in skilled worker requirements compared to actual labor availability.