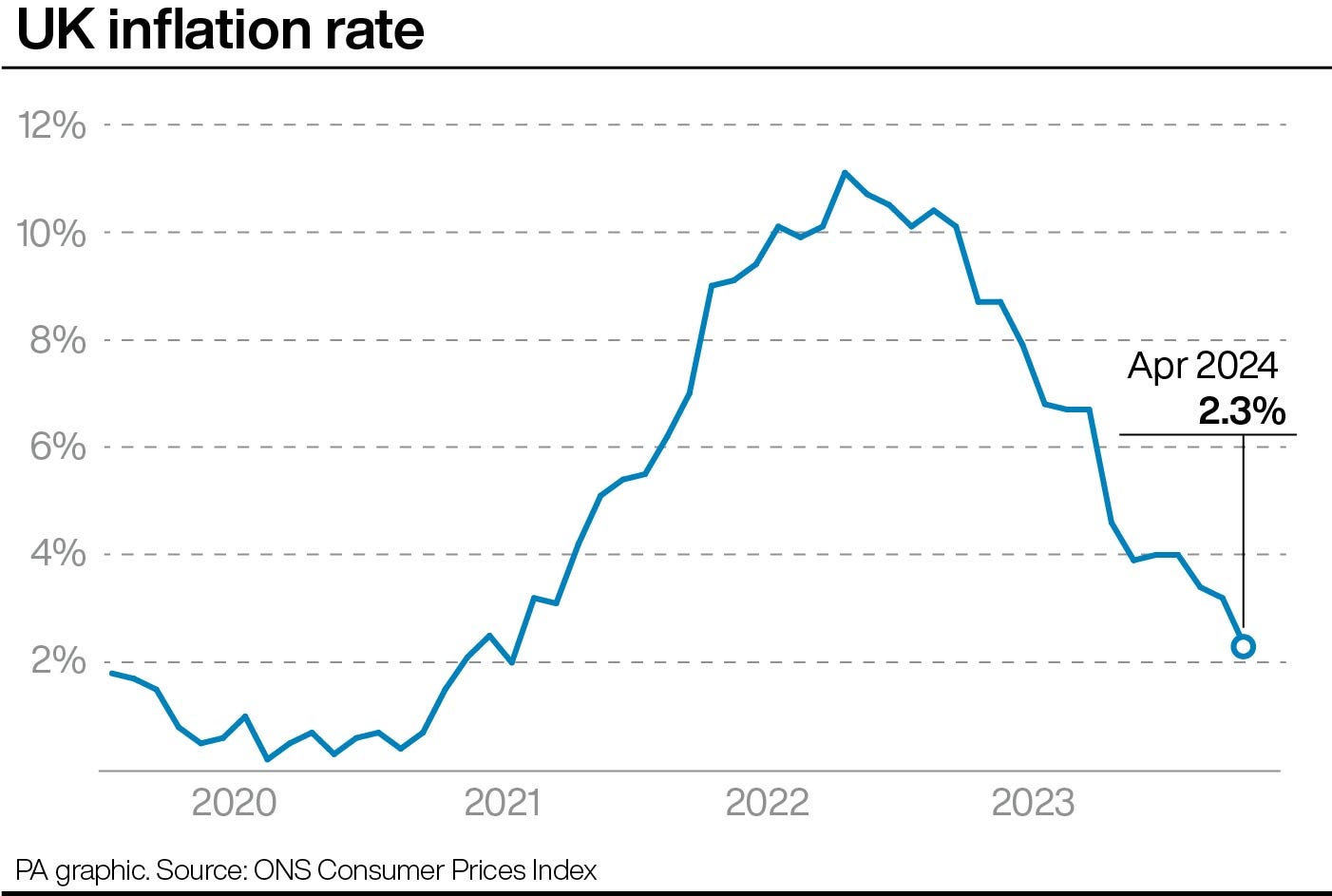

UK inflation slowed to 2.3% in April, the lowest level since July 2021, according to new official figures.

Prime Minister Rishi Sunak declared that inflation is “back to normal” and said it is a “major milestone” for the country.

The Prime Minister added: “The economy grew in the first quarter of this year, faster than France, Germany and America.

“Wages have been rising faster than prices for almost a year now, energy bills are down hundreds of pounds now from where they were, mortgage rates are down from the peak and today’s news on inflation being back to normal is very welcome.

“If you put all of that together it shows we have got momentum, it shows that the plan is working but of course there is more work to do for people to really feel the benefits of all these things.

“That is why it is important that we stick to the plan. As I have said, these things don’t happen by accident.”

Analysts say the chances of a cut in June are now slim after inflation fell to 2.3 per cent in April from 3.2 per cent in March - the lowest level in nearly three years - but above the 1.9 per cent to 2.1 predicted by some analysts.

But Sir Jacob Rees-Mogg, the former Conservative business secretary, argued the Bank should have cut rates already because “inflation is a lagging indicator.”

Paul Scully, a former minister, said cutting the rate would “bring relief to many who are fixing their mortgages for the next few years”.

Why has inflation fallen?

Inflation is the term used to describe the rising price of goods and services.

The inflation rate refers to how quickly prices are going up.

April’s inflation rate of 2.3% means that if an item cost £100 a year ago, the same thing would now cost £102.30.

It is lower than the 3.2% inflation rate recorded in March, meaning that prices are rising more slowly than they previously were.

However, it is higher than the 2.1% rate that some economists had been expecting.

What does inflation mean for the cost of living?

The cost of living is still rising, just at a much slower rate than it has in recent years.

In fact, about two years ago, prices were soaring by around a 10th, largely because of significantly higher gas and electricity costs.

Inflation has been steadily easing back over the past year-and-a-half.

The Government does not want prices to fall. It sets the Bank of England, the UK’s central bank, a target to keep the inflation rate at 2%.

It says this is the ideal level to help people and businesses plan their spending.

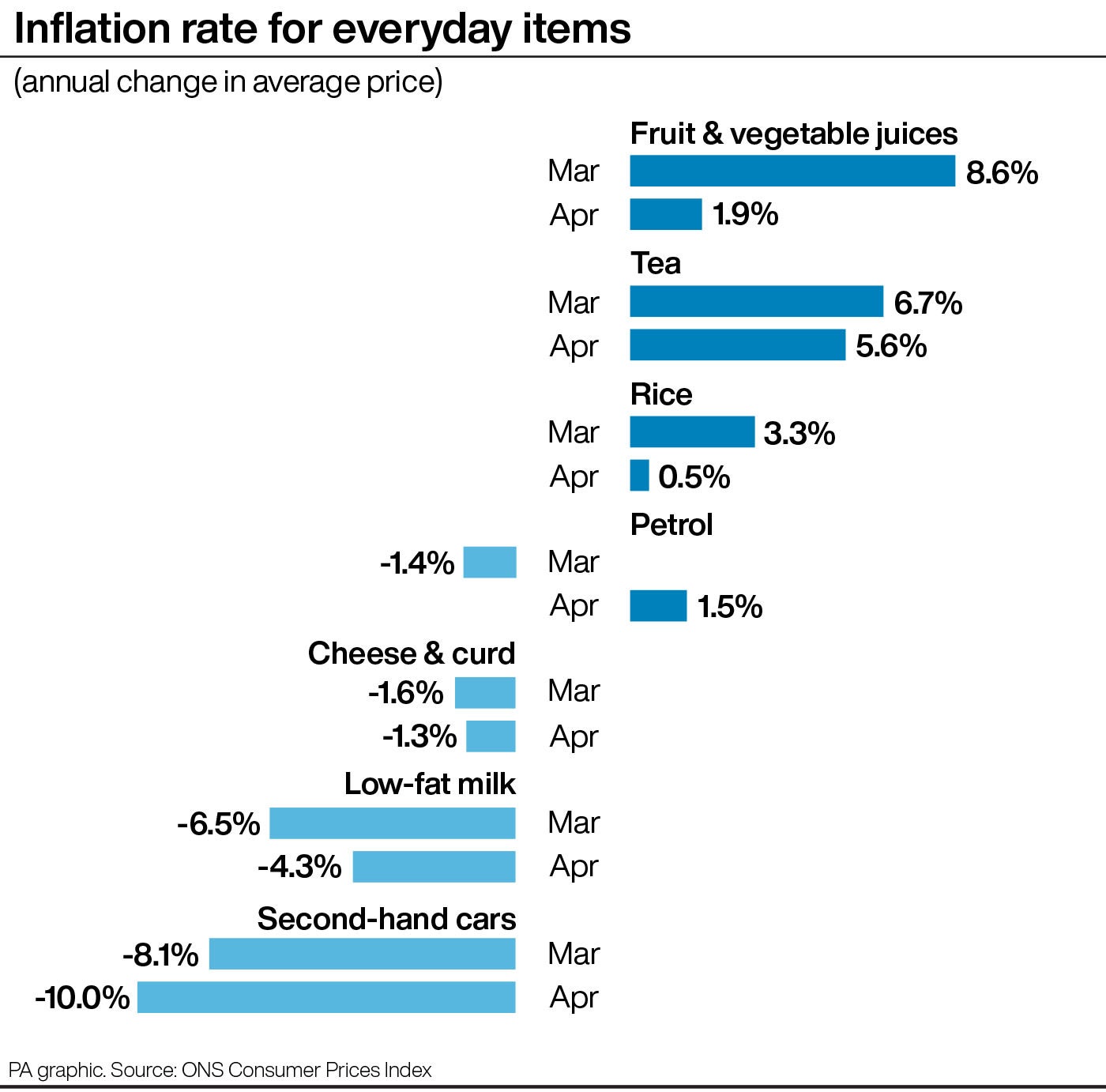

However, some items have been going down in price. Gas and electricity prices were about 27% lower in April, compared with the previous year, the Office for National Statistics (ONS) said on Wednesday.

Some food prices also fell last month, such as fish, milk, cheese and eggs.

Other food prices, like meat, vegetables and bread, have just risen at a slower rate.

What does the fall in inflation mean for business rates?

Interest rates are used by the Bank of England as a tool to help control inflation.

Rates are currently at 5.25%, having been held at the level for the past six votes by the Bank’s policymakers.

Economists had thought April’s inflation data could persuade the Bank to cut interest rates when the Monetary Policy Committee next meets in June, if it showed that prices were under control.

However, services inflation, which looks only at service-related categories like hospitality, culture and education, declined by significantly less than economists had predicted.

James Smith, developed markets economist for ING, said services inflation is “the single most important indicator for the Bank of England”.

Mr Smith said the latest inflation data reduces the chances of interest rates being cut in June.

Daniel Mahoney, UK economist at Handelsbanken, said it “seems very unlikely now that we’ll see a rate cut in June”.

“Before this latest data on inflation was released, markets thought it was probably about 50/50 as to whether we would see an interest rate cut in June or not,” he said.

The higher-than-expected rate, and services inflation figure, reinforces the prediction that an interest rate cut will come in August, he added.

What is happening with house prices?

Average UK house prices have increased for the first time since June last year, signalling potential green shoots in the UK’s property market.

Meanwhile, rampant rent price inflation also slowed down slightly in the latest set of official data.

The Office for National Statistics (ONS) found average house prices increased by 1.8% in the 12 months to March.

This lifted the average house price across the UK to £283,000, up from £281,000 in the previous month.

The annual rise represented a recovery in pricing after house prices had fallen by 0.2% in the 12 months to February.