UK inflation has increased to 5.5 per cent, the highest in nearly three decades, amid the tightening cost-of-living squeeze.

The rate of Consumer Price Index inflation hit 5.4 per cent in December and remains at a near 30-year high after rising to 5.5 per cent in January.

It comes as Britain remains in the grip of a tightening cost-of-living squeeze.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), said clothing and footwear was among the factors behind the rise.

But inflation is soaring across the economy, driving CPI up to more than double the Bank of England’s 2 per cent target.

“Clothing and footwear pushed inflation up this month and although there were still the traditional price drops, it was the smallest January fall since 1990, with fewer sales than last year,” Mr Fitzner said.

“The rising costs of some household goods and increases in rents also pushed up inflation. However, these were partially offset by lower prices at the pump, following record highs at the end of 2021.

“Some annual changes this year are affected by last year’s lockdown, when many services were unavailable.”

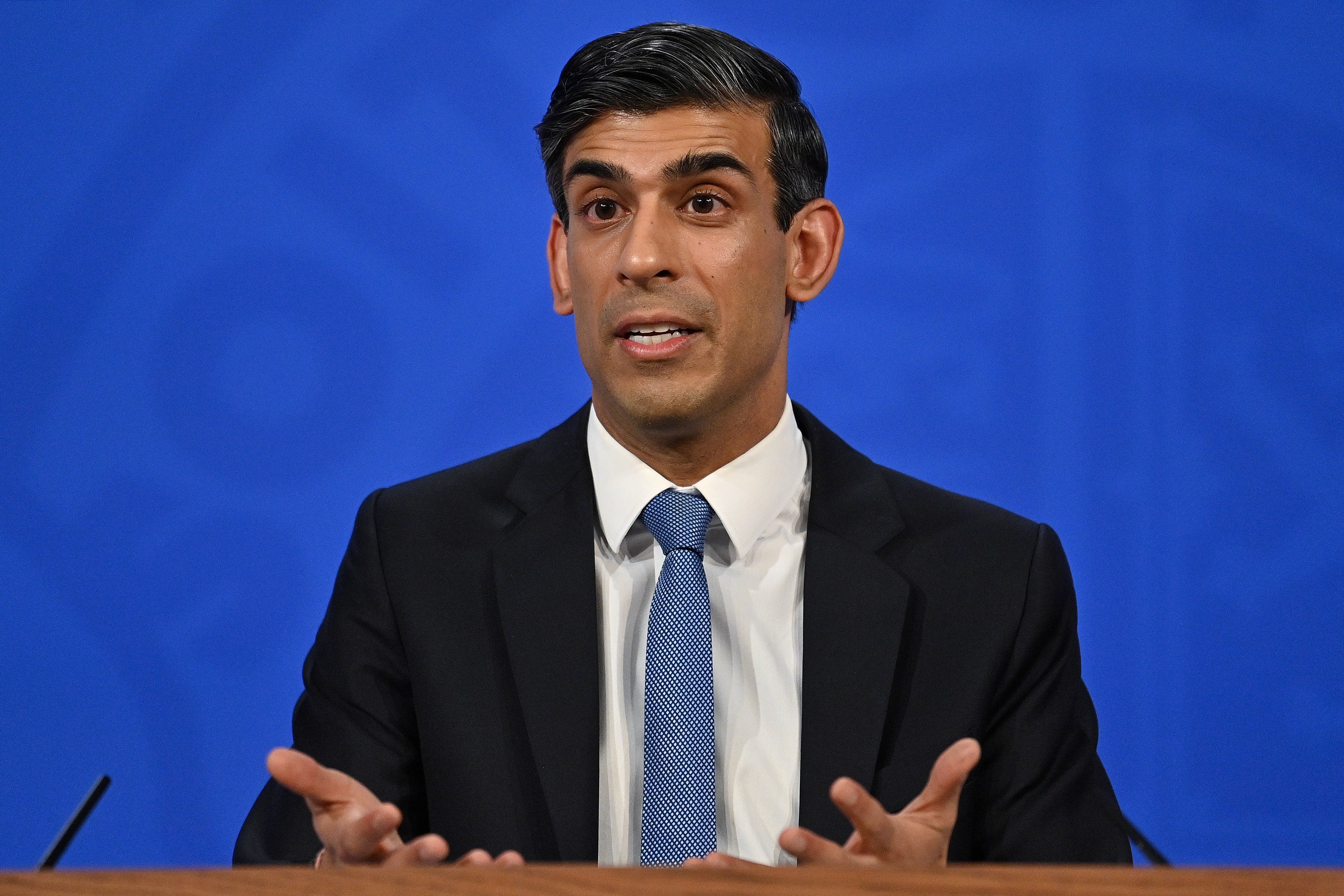

As the new inflation figures were released on Wednesday morning, chancellor Rishi Sunak said the government understands the “pressures people are facing with the cost of living”.

He added: “These are global challenges but we have listened to people's concerns and recently stepped in to provide millions of households with up to £350 to help with rising energy bills.

“We're also helping people on the lowest incomes keep more of what they earn by cutting the Universal Credit taper rate and freezing alcohol and fuel duties to keep costs down.

“In total, we're providing support with the cost of living worth over £20 billion across this financial year and next.”

Colin Dyer, client director at Abrdn Financial Planning, said households should brace themselves for further acceleration of the cost of living crisis.

“The Bank of England could also be justified in raising interest rates more than once over the next few months to defend these soaring prices – meaning even more challenges may lie ahead for households,” Mr Dyer said.

“The most important thing savers can do now is review how this environment will affect their finances, where they are keeping their savings, and make adjustments as necessary. For example, holding significant amounts of cash in a deposit account is effectively losing money in an inflationary environment, so depending on attitude to risk, investing in a Stocks and Shares ISA may provide a greater return if investing for the longer term.”

It comes as figures revealed that UK workers took a pay cut in the final three months of last year as the soaring cost of living outstripped wage increases.

Latest data from the Office for National Statistics made grim reading for British households, who face the biggest squeeze on living standards in decades.

Total pay growth rose to 4.3 per cent for the quarter to December – from 4.2 per cent for the three months to November – but continued to lag behind inflation.

Economists expect inflation to spike further to around 7 per cent by April when millions of households will be hit with a 54 per cent jump in their energy bills. Borrowers face a further squeeze after the Bank of England raised interest rates this month, with further hikes predicted.

Some of the pain is likely to be cancelled out by rising wages, with early estimates indicating employers were beginning to increase salaries in response to rising inflation.

Workers’ bargaining power is being boosted by staff shortages in a number of industries. Total vacancies rose to another record of 1.3 million between November and January, the ONS said.

“The good news is that the UK economy is continuing to create jobs,” said Matthew Percival, director for people and skills at the CBI. The bad news is that businesses are struggling to hire and pay is failing to keep up with inflation.”

Joanna Elson CBE, chief executive of the Money Advice Trust said households face a “triple threat” from rising inflation, energy price hikes and upcoming tax increases.

“For the many people whose budgets are already at breaking point, this is an incredibly worrying time, made harder knowing that energy prices are set to skyrocket in the coming months,” Ms Elson said.

“Government support announced last week, will help a little but will not be enough.”

She urged the government to “significantly” increase benefits and increase support through the Warm Homes Discount.