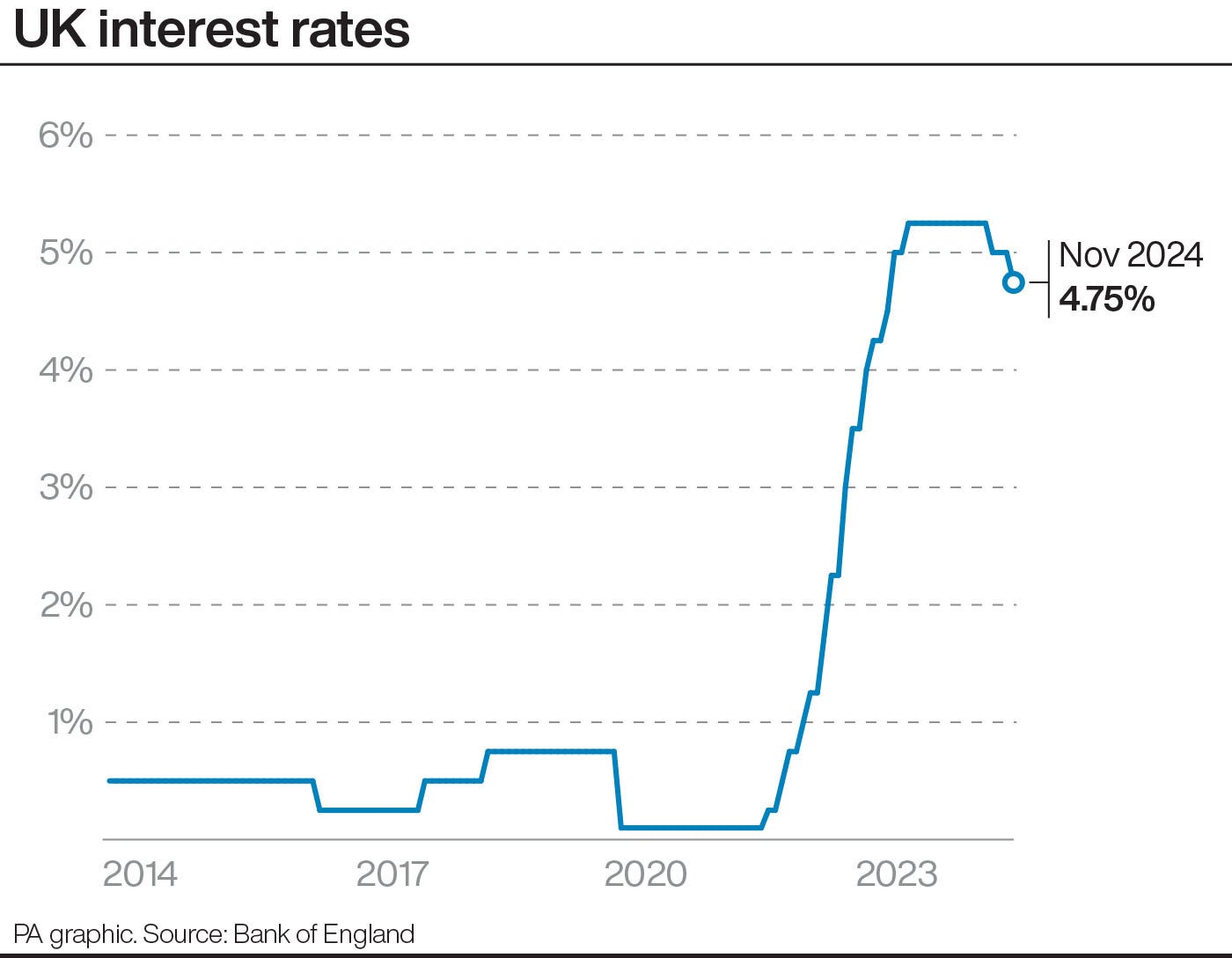

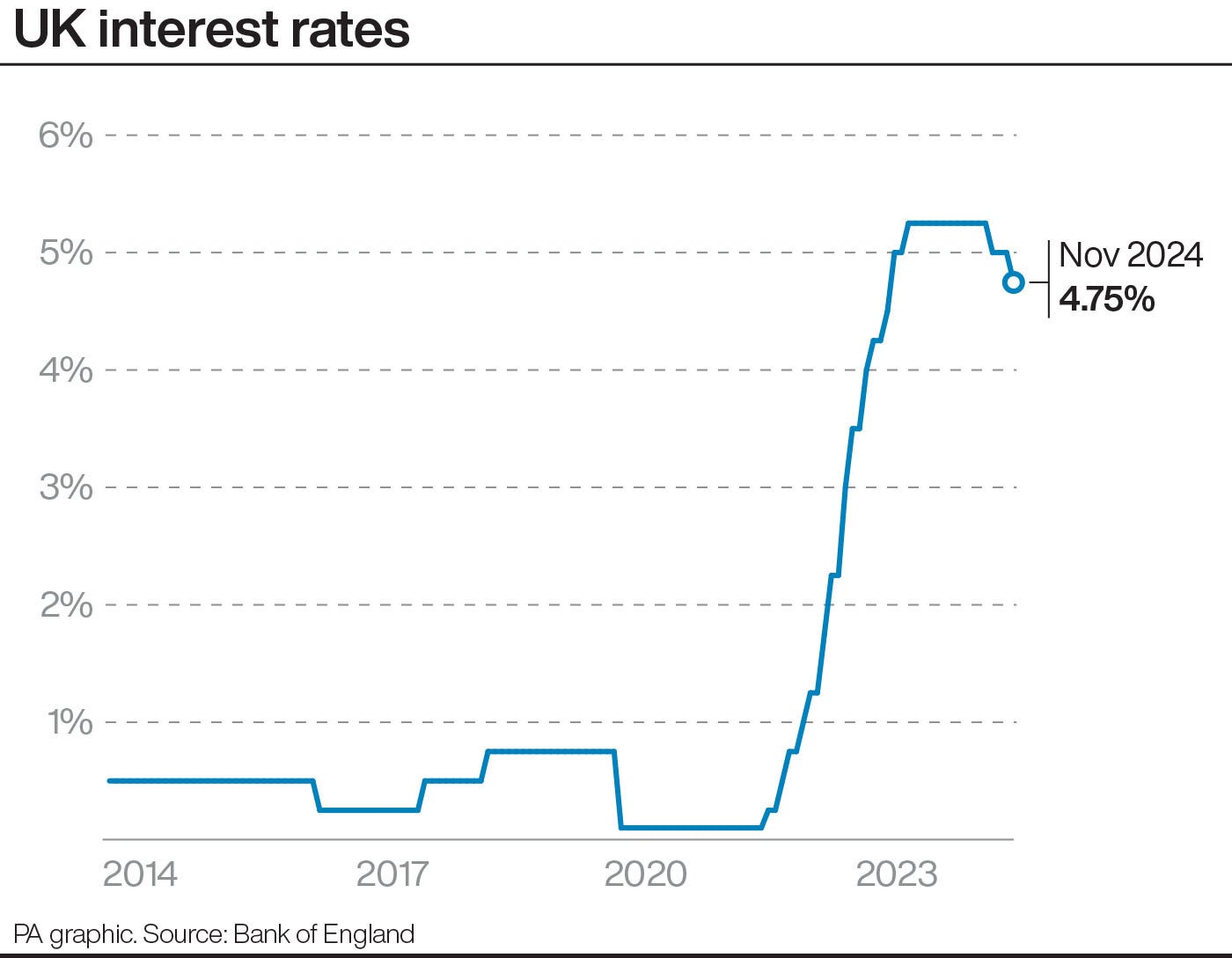

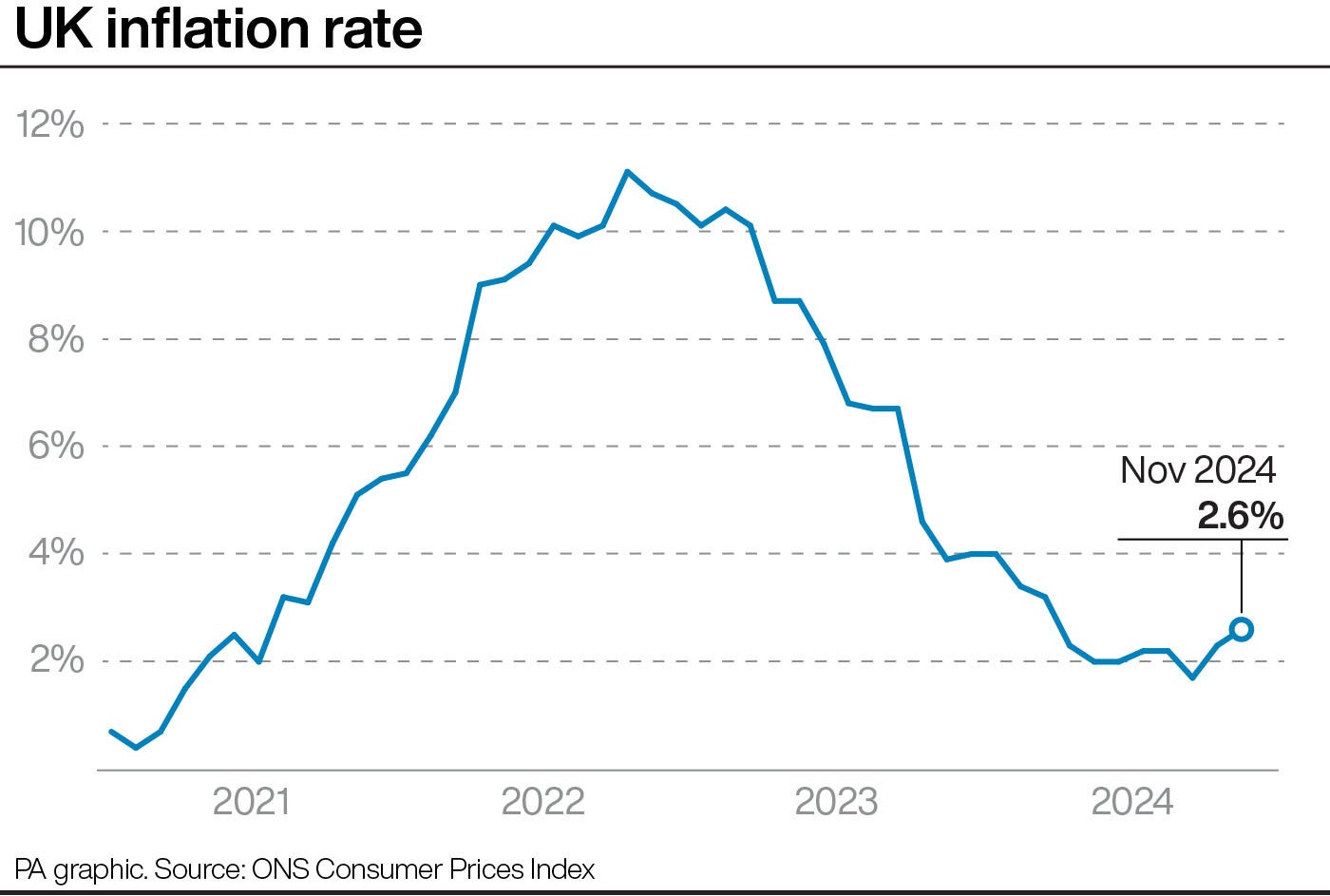

The Bank of England held interest rates steady at 4.75 per cent on Thursday after it was revealed that inflation in November rose to 2.6 per cent, above the central bank’s target.

The move keeps borrowing costs high for mortgage holders and also the government.

The central bank also expects no economic growth for the final three months of the year, further dampening Chancellor Rachel Reeves’s hopes of jump-starting the economy.

Bank Governor Andrew Beiley said: “We’ve held interest rates today following two cuts since the summer. We need to make sure we meet the 2 per cent inflation target on a sustained basis. We think a gradual approach to future interest rate cuts remains right, but with the heightened uncertainty in the economy we can’t commit to when or by how much we will cut rates in the coming year.”

The Bank’s Monetary Policy Committee voted by a majority of 6–3 to maintain the rate at 4.75 per cent. Three members preferred to reduce Bank Rate by 0.25 percentage points, to 4.5 per cent.

It comes after the Office for National Statistics revealed inflation had risen to 2.6 per cent from 2.3 per cent, pushed higher by pricier petrol and clothing.

The central bank uses higher interest rates as a tool to try and tame inflation, forcing families to spend more on borrowing rather than pushing up the prices of goods.

Another pressure on inflation comes from rising wages. Pay packets are now growing at 5.2 per cent, up from 4.9 per cent three months ago, according to data from the Office for National Statistics released earlier this week.

Money market traders have pushed back their expectation of a rate cut to May. Previous market activity suggested that a cut could have come in March.

Commercial lenders like high street banks and building societies use the bank base rate as a guide on how much to charge borrowers and how much to reward savers.

Key Points

- Interest rates held at 4.75 per cent

- Cuts are expected in 2025 but that will depend on inflation

- Yesterday the US Federal Reserve cut rates by 0.25 basis points

Savers take note

While borrowers get much of the attention, savers are also in for a rougher ride and should take a look at locking in good savings rates before they disappear, says Myron Jobson, Senior Personal Finance Analyst, at interactive investor.

He said: “The best savings rates appear to be on borrowed time. Barring any economic shocks, the only likely direction for interest rates is downward, which means Britons are set to earn even less on their savings in the future.

“The simple message for savers is to act quickly to secure the best deals before they disappear. Those who can afford to lock away their money for at least five years or more should consider investing for the potential of long-term, inflation-beating returns that far outstrip current savings rates.”

‘Tricky year’ for growth

Anna Leach, Chief Economist of the Institute of Directors, said 2025 could be a “tricky year” for growth.

She said: “Inflationary pressures have now shifted for the coming year, with wage growth and price-setting expected to lend more persistence to inflation. But it’s unclear whether stronger public sector spending will fill the gap left by a weaker private sector.

“Geo-political developments add further uncertainty to the outlook and markets will remain sensitive to any upward pressure on government borrowing, adding volatility to borrowing costs for businesses and households. As the new government seeks to change the growth trajectory for the UK, 2025 is set to be a tricky year, with a lot hanging on how well it spends the additional money it has allocated itself.”

Bank of England ‘should have cut rates’

The Bank should have cut rates, according to the Institute for Public Policy Research think tank.

Reacting to today’s decision by the Bank of England’s Monetary Policy Committee to hold interest rates at 4.75%, Carsten Jung, principal research fellow and head of macroeconomics at IPPR, said:

“With growth stalling and the labour market slowing down, the Bank of England should have cut interest rates today. Given the Bank now expects zero growth in last quarter of this year, the Bank’s policy stance is simply too tight.

“Inflation is broadly on track with expectations. It was always expected to go up slightly toward the end of this year. But price pressures should now ease more quickly given weaker than expected growth. The Committee should have put more emphasis on this.”

Reeves: ‘I know you are struggling’

Chancellor of the Exchequer Rachel Reeves has responded to rates being held at 4.75 per cent.

She said: “I know families are still struggling with high costs.“We want to put more money in the pockets of working people, but that is only possible if inflation is stable and I fully back the Bank of England to achieve that.“Improving living standards across the country is our number one focus, and is why I chose to protect working people’s pay slips from tax rises, froze fuel duty and increased the national living wage for three million people.”

Bank ‘could be backed into a corner’

Higher rates for longer are a blow to borrowers, said Suren Thiru, ICAEW Economics Director, although the main news could be the Bank backing itself into a corner. If inflation keeps creeping up and growth stays low - that’s stagflation - it could make raising rates tricky.

“The bank’s decision to keep interest rates on hold, while expected, will still come as a palpable blow to households battling with burdensome mortgage bills and businesses facing a jump in costs following the autumn budget.

“The split vote decision and the dovish tone of the minutes suggest that a February interest rate cut remains very much in play, if not yet a done deal.

“The Bank of England risks backing itself into a corner over the pace of policy loosening because, with inflation likely to drift higher, the timing of future interest rate cuts could become increasingly complex, especially if stagflation fears become reality.

“Against this backdrop, rate setters are likely to take baby steps in cutting interest rates over the next year, particularly in the face of growing domestic and international inflation risks.”

Savers are looking for clarity too

Jonny Black, Chief Commercial & Strategy Officer at abrdn adviser, said:

“Predictably, the Bank of England has held interest rates at 4.75 per cent in its final announcement of 2024. However, what lies ahead is what matters and many are already looking to 2025 after Andrew Bailey confirmed more cuts are on the cards.

“Exactly what this will look like will depend on inflation and the performance of the economy as we head into the New Year but, for now, it’s evident that a steady decline could be seen soon.

“As ever, interest rates decide the fate of many homeowners looking at remortgaging and can impact the decision-making of those sitting on cash savings too.”

Three MPC members dissent

The Bank of England said that its Monetary Policy Committee voted by a majority of 6–3 to maintain Bank Rate at 4.75 per cent.

Three members preferred to reduce Bank Rate by 0.25 percentage points, to 4.5 per cent.

It said: “Since the MPC’s previous meeting, twelve-month CPI inflation has increased to 2.6% in November from 1.7% in September. This was slightly higher than previous expectations, owing in large part to stronger inflation in core goods and food.

“Services consumer price inflation has remained elevated. Headline CPI inflation is expected to continue to rise slightly in the near term. Although household inflation expectations have largely normalised, some indicators have increased recently.”

The Bank of England has held interest rates steady at 4.75 per cent.

Pound gains against the dollar

Traders are busy unwinding bets of a Bank of England rate cut in February, which would be the next time policymakers meet to set rates.

It’s now evenly balanced after traders’ bets indicated an 80 per cent likelihood only a week ago.

Meanwhile, the pound has regained some ground against the dollar. Sterling climbed 0.7 per cent to $1.26.

FTSE drops

The FTSE 100 has had a wobble ahead of the looming interest rate decision, due in a little under an hour. It has slid 1.4 per cent to 8,085.82. The index of 100 biggest companies listed in London has been on a downslide for the last month.

Government borrowing costs have also climbed. The Labour government does have some skin in this game, since the BoE’s decision will inform how much the Treasury will have to pay to borrow.

Yields - the interest available should you buy a bond in the secondary market right now - have risen to 4.604 per cent. At the start of the month they were closer to 4.2 per cent.

Bank CEOs should be forced to have a framed version of this image on their desks. pic.twitter.com/MT7pXzpCRN

— Aurelius (@Aureliusltd28) December 18, 2024

Before the big announcement - and to cover our backs in case rates do go up or down - here is an excellent chart from the Financial Times’ Alphaville blog, charting expectations from the markets on what rates will do in the US and what they actually did.

This is for US interest rates, but you bet that Bank of England predictions are similarly fallible.

Wall Street had a minor meltdown yesterday after that rate decision, with the S&P500 ending the day down 2.95 per cent. The slow down in interest rare cuts was well flagged, said Russ Mould, investment director at stockbroker AJ Bell

“Markets are normally good at reading the signs, but the sell-off on Wall Street last night would suggest investors had started on the Christmas sherry a bit early and were caught out by the Fed’s announcement about where rates might go in 2025,” says Mr Mould.

“The prospect of a slowdown in interest rate cuts was front and centre days before the Fed’s latest update, but investors seemed to miss the signs.

“The US economy has been holding up well and Donald Trump’s policies are inflationary, meaning the Fed has no reason to keep snipping away on a regular basis.

The Federal Reserve, which is the US central bank, decided to cut rates yesterday,. The Fed uses a range, and cut its range by 0.25 percentage points to 4.24-4.5 per cent.

Pushpin Singh, Senior Economist, Centre for Economics and Business Research said: “The Federal Reserve (the Fed) opted to cut interest rates for the third consecutive meeting, by 25 basis points, yesterday evening. The decision was accompanied by the Federal Open Market Committee’s (FOMC) publication of its latest projections.

The Fed said it expects the US economy to grow by more than expected and that inflation may also be higher than thought. Rate cuts may not come as thick and fast as previously thought.

“ The central bank now expects only 50 basis points worth of cuts next year, down from the 100 basis points in its last projection, signalling a hawkish stance on monetary policy and underscoring concerns of lingering inflationary pressure more broadly.”

Most City-watchers are convinced interest rates will be held at 4.75 per cent today, but what about after that?

Analysts at investment bank Goldman Sachs said that the Bank is likely to cut interest rates every three months, “given firmer near-term inflation numbers and uncertainty around the impact of the employer national insurance hike”.

Nomura analysts think rates will settle in the longer term at about 3-3.5 per cent.

Rates have been on a merry journey since the financial crisis, when borrowing was close to free for some debtors, including various governments.

The record high was 17 per cent in November 1979, which remained the rate until July 1980.

The record low was 0.1 per cent in March 2020 in the wake of Covid.

From 1719 to 1822 rates were fixed at 5 per cent.

If you are just joining us, we are counting down to noon, to see which way the Bank of England will go on interest rates. Centre for Economics and Business Research Senior Economist Charlie Cornes thinks they will be held at 4.75 per cent.

Mr Cornes said: “CPI inflation in the UK rose for a second consecutive month in November, to 2.6 per cent, driven by higher prices for motor fuels and clothing. Meanwhile, core and services inflation, both indicators carefully monitored by the Bank of England (BoE) as measures of underlying price pressure, remain elevated, at 3.5 per cent and 5.0 per cent respectively. He said recent wage growth data are “all signs are pointing towards the BoE holding off on cutting interest rates.” “Instead, Cebr maintains that the next rate cut will be in Q1 2025.”

Higher inflation pushed the pound down, which aided valuations for FTSE 100 companies, many of which earn on dollars and euros, being massive multinationals.

“A weaker pound following the latest UK inflation figures gave a boost to the FTSE 100 and its bounty of dollar earners. The UK index rose 0.2 per cent to 8,208, led by Shell and BP, with Ashtead among the big US-focused players giving support,” says Russ Mould, investment director at stock broker AJ Bell.

“UK inflation at an eight-month high sounds dramatic yet the annual 2.6 per cent rate is bang in line with expectations and core inflation, which excludes food and energy, at 3.5 per cent came in lower than the 3.6 per cent consensus figure.

“As such, we haven’t had what the market would describe as an ‘inflation shock’. That explains why shares in interest rate-sensitive sectors like housebuilding haven’t retreated on the latest figures.

Chancellor Rachel Reeves said there is “more to do” to combat cost-of-living pressures.

“I know families are still struggling with the cost of living and today’s figures are a reminder that for too long the economy has not worked for working people,” she said on Wednesday.

“Since we arrived real wages have grown at their fastest in three years. That’s an extra £20-a-week after inflation.

“But I know there is more to do. I want working people to be better off which is what our Plan for Change will deliver.”

What went up and down in the inflation figures from yesterday?

The rate of CPI inflation for food and non-alcoholic drinks, alcohol and tobacco, clothing and footwear, recreation and culture all edged higher over the year to November, compared with the year to October.

It follows a hike to tobacco duties at the end of October.

Petrol prices also rose by 0.8p per litre between October and November to stand at 134.8p per litre, and diesel prices increased 1.4p per litre to 140.5p per litre.

Overall prices across the transport sector fell by 1.1 per cent in the year to November, but at a slower rate than the 2 per cent fall in the year to October, meaning it was the biggest factor pushing inflation higher last month.

In better news, air fares tumbled by 19.3 per cent in November, largely driven by falls in ticket prices on European routes, the Office for National Statistics said.

Just to hedge our bets ahead of the announcement, traders in the financial markets are expecting about a 10 per cent chance of a rate cut, Investec Economics said on Wednesday

Rob Wood, chief UK economist for Pantheon Macroeconomics, said: “Inflation rising above the MPC’s (Monetary Policy Committee’s) target is one reason why we expect rate-setters to cut interest rates gradually.”

Rate cuts next year are far more likely, assuming inflation is brought to heel.

Rates have been on a merry journey since the financial crisis, when borrowing was close to free for some debtors, including various governments.

The record high was 17 per cent in November 1979, which remained the rate until July 1980.

The record low was 0.1 per cent in March 2020 in the wake of Covid.

From 1719 to 1822 rates were fixed at 5 per cent.

What this means for mortgages

Sarah Coles, head of personal finance, Hargreaves Lansdown says:

“Mortgage rates have struggled to settle in recent weeks, with each piece of economic news – and each utterance from the Bank of England – sending rates slightly up or down within a fairly narrow range.

“Higher inflation is likely to mean another small fluctuation upwards in fixed rates, but given that rate expectations should remain largely unchanged, there’s every chance it’s nothing to write home about. We could see average 2-year fixed rates remain about the 5.5 per cent point.

“This is more bad news for buyers, faced with record-high prices and relatively high mortgage rates that show no sign of significant easing. The HL Savings & Resilience Barometer shows that people in their early 30s have the biggest sums outstanding on their mortgage – with 45% more mortgage debt than people in their early 50s – so they may be at most risk of being overstretched.

If you’re in the market for a remortgage, there’s no sign of imminent relief either. And with some uncertainties remaining about the trajectory of rates and inflation, it may be worth locking in a rate as soon as you can. That way if rates fall, you can shop around, and if they’re higher when your remortgage rolls around, you’ll have secured a better rate.”

Economics Expert, Professor Andrew Angus at Cranfield School of Management is also sceptical about any rate cut.

“A combination of increased public spending, infrastructure investments and the approaching winter is expected to drive inflation higher, making an interest rate cut this Thursday about as likely as a White Christmas.

“Despite predictions of economic growth, a palpable sense of uncertainty remains about how businesses will cope in the wake of the recent budget. Many are already feeling the pinch from rising costs, including higher business rates, increased minimum wages and National Insurance contributions, which may overwhelm many businesses. With an early Christmas present in the form of a rate cut off the cards and the next announcement not due until February, businesses will be eager to see how the Bank of England acts to promote stability and growth.”

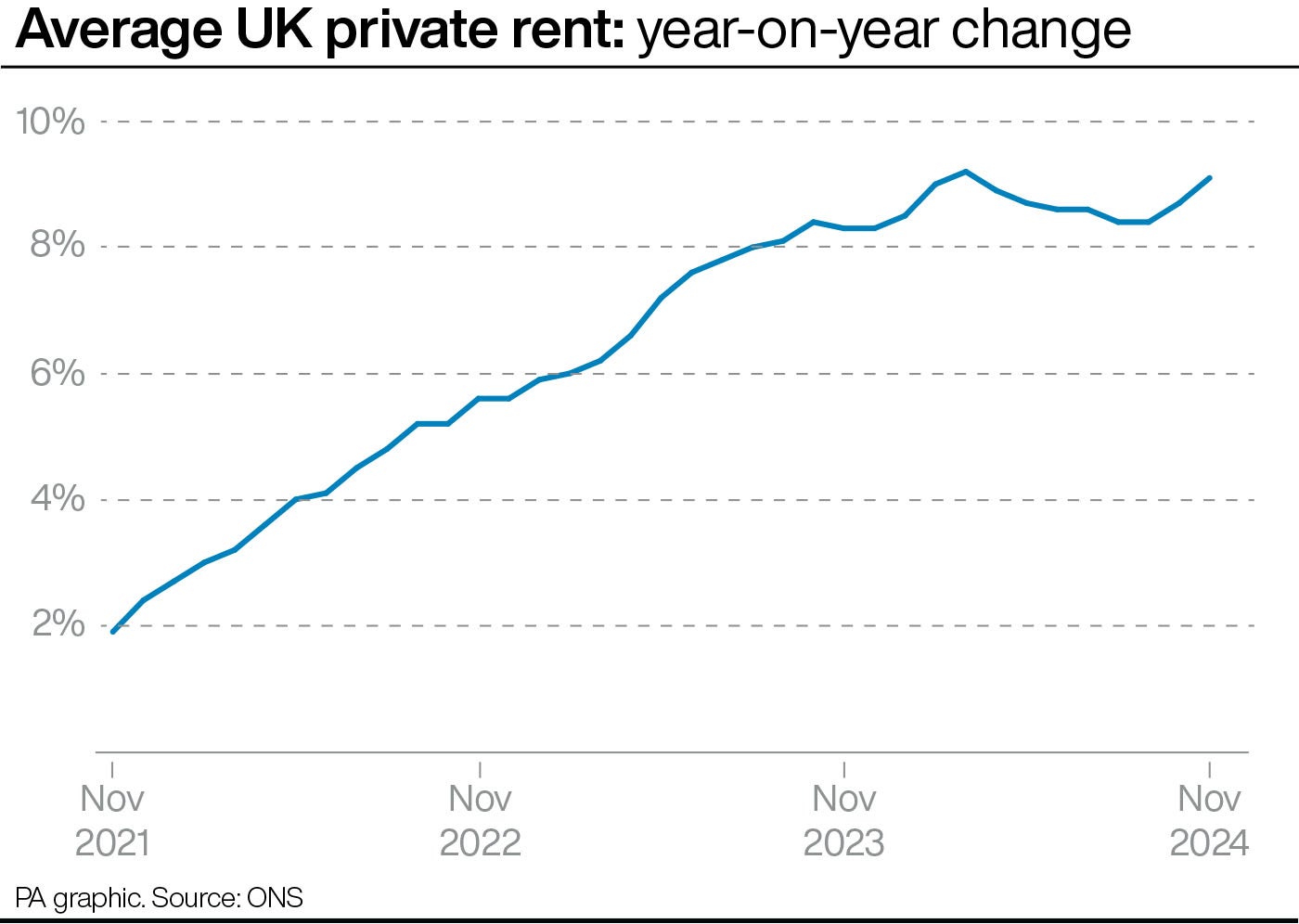

One thing CPI inflation does not capture is housing costs, which are also rising. Although this is more closely linked to supply.

Annual growth in UK house prices and rents has accelerated, with rental price inflation in England and London hitting record highs, according to official figures.

The average house price increased by 3.4% in the 12 months to October, ticking upwards from 2.8% in September, according to Office for National Statistics (ONS) data.The report also showed annual growth in private rental prices accelerated to 9.1% in November, from 8.7% in the 12 months to October.

ONS head of housing market indices Aimee North said: “Rental prices climbed again in the year to November with the average private rent in Great Britain now around £1,300 per month.

Higher inflation should be seen in the broader context - under 3 per cent is way below the recent highs we have seen.

Most economists expect some relief for borrowers next year. The current rate of 4.75 per cent is only slightly lower than the 5.25 per cent that rates topped out at following the inflation shock the UK suffered.

Monica George Michail, National Institute of Economic and Social Research Associate Economist said: “We expect the MPC to keep rates on hold in tomorrow’s meeting, and to gradually cut rates in 2025.

“However, we think the Bank will remain cautious given elevated wage growth, global uncertainty around the Trump presidency, and inflationary pressures introduced in the latest budget. Interest rates may therefore remain higher for longer than previously thought."

New figures out today will also add to the feeling of gloom. Manufacturing output volumes fell at the fastest pace since mid-2020, according to the Confederation of British Industry, the business lobby group.

Production of cars, glass, ceramics, furniture and upholstery led the fall, the CBI said.

Its survey of 331 manufacturers said output fell by 25 per cent ni the three months to December.

Ben Jones, CBI Lead Economist, said: “Manufacturers are facing a perfect storm of weakening external demand on the one hand, amid political instability in some key European markets and uncertainty over US trade policy. And on the other hand, domestic business confidence has collapsed in the wake of the Budget, which has increased costs and led to widespread reports of project cancellations and falling orders.”

Interest rates are expected to be held steady later today after a glut of gloomy economic data, notably that inflation was climbing again and that the economy shrank last month.

Sarah Coles, head of personal finance at stockbroker Hargreaves Lansdown said:

“Inflation is staying put for now, like an unwelcome Christmas party guest hogging the sofa into the small hours. The question is whether it can be shifted, or if it’s going to hang around to ruin our plans for months – eating us out of house and home and driving up the cost of everything again.

“Food and drink price inflation rose to 2%. Poor harvests in a number of areas have pushed up the prices of trolley favourites, including olive oil, up 26.6 per cent in a year and chocolate up 9.9 per cent.”