The industrial real estate asset category has been, undoubtedly, playing a crucial role for the past few years in the growing e-commerce market, transforming how consumers shop and receive their goods. Moreover, the companies are making immense efforts to improve supply-chain efficiencies, propelling demand for logistics infrastructure and efficient distribution networks.

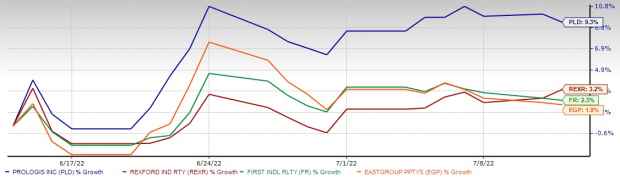

This brings our focus on industrial landlords like Prologis PLD, Rexford Industrial Realty, Inc. REXR, First Industrial Realty Trust, Inc. FR and EastGroup Properties, Inc. EGP that are poised to benefit from this favorable environment. And with the Q2 reporting season around the corner, it's time to check how they are placed ahead of their earnings.

What is encouraging is that despite the economic headwinds in the second quarter, demand in the U.S. industrial market outpaced supply for the seventh straight quarter, per a report from Cushman & Wakefield (CWK). There was a net absorption of 120.4 million square feet (msf) of space in the June-end quarter and 236.3 msf through the first half of the year. Moreover, new leasing activity touched 408.2 msf in the first half of the year.

The U.S. industrial vacancy rate reached a new low of 3.1% in the April-June period. This marks a decline of 10 basis points (bps) quarter over quarter and 120 bps year over year. Moreover, it represents the second straight quarter when every region in the United States reported vacancy below 4%, with the lowest in the West region at only 2.4%.

Continued tight market conditions and solid demand supported rent growth of 19% year on year during the June-end quarter. Asking rent of $8.36 per square foot during the quarter under discussion turned out to be the first quarter to surpass the $8.00 psf mark in 20+ years of tracking rental data, the CWK report noted.

Resilience is essential to the future supply chain and so, over the long term, apart from the fast adoption of e-commerce, logistics real estate is expected to benefit from a likely increase in inventory levels.

However, with the asset category being attractive, there is a development boom in a number of markets. Per the CWK report, the new supply aggregated 193.8 msf in the first half of the year, compared with 151.9 msf reported at midyear 2021, denoting a 27.5% increase. Also, the industrial construction pipeline reached a record 699 msf in the second quarter of 2022. The high supply is likely to have intensified competition during the June-end quarter.

Here's How These Industrial REITs are Placed Ahead of Q2 Earnings:

Prologis is a leading industrial REIT that acquires, develops, operates and manages industrial properties in the United States and worldwide. The company continues to benefit from the scale of its platform. The stock has a decent surprise history in terms of funds from operations (FFO) per share, having beaten estimates in each of the trailing four quarters, the average beat being 1.44%. This industrial REIT behemoth carries a Zacks Rank #2 (Buy), presently.

The second quarter has been a notable one, with Prologis announcing a definitive merger agreement in June to acquire Duke Realty Corporation DRE in an all-stock transaction valued at $26 billion, including the assumption of debt. The transaction is expected to be completed in the fourth quarter of 2022, subject to the approval of shareholders of both the companies and other customary closing conditions.

Prologis is slated to report second-quarter 2022 earnings on Jul 18, before the bell. The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $1.1 billion, suggesting an 8.8% year-over-year jump. The Zacks Consensus Estimate for the quarterly FFO per share of $1.12 calls for a 10.9% increase year over year.

Rexford Industrial Realty is focused on the acquisition, ownership and operation of industrial properties situated in Southern California in-fill markets. Recently, REXR announced that it has shelled out $218.4 million for the acquisition of six industrial properties in prime in-fill Southern California submarkets. With these buyouts, Rexford's investments have reached $993 million so far this year. Also, more than $700 million in additional investments is under contract or accepted offer. Southern California is considered a highly valued industrial property market with high occupancy levels and supply constraints in the United States.

Presently, Rexford carries a Zacks Rank #2 (Buy). REXR has a decent surprise history as each of the trailing four quarters, it surpassed the Zacks Consensus Estimate, with the average beat being 7.48%.

Rexford's quarterly results will be released on Jul 20, after market close. The consensus mark for second-quarter revenues is currently pegged at $153.2 million, suggesting a 46.8% increase from the year-earlier quarter. The estimate for quarterly FFO per share moved north over the past three months to 48 cents, calling for a 23.1% uptick year on year.

First Industrial Realty Trust, a Chicago, IL-based industrial landlord focuses on management, lease, acquisition, (re)development and selling of bulk and regional distribution centers, light industrial and other industrial facility types across major markets in the United States.

Currently, it carries a Zacks Rank of 3 (Hold). Over the preceding four quarters, the company's earnings went past the Zacks Consensus Estimate on each occasion, the average beat being 2.52%.

First Industrial is scheduled to release its earnings results on Jul 20, after market close. The Zacks Consensus Estimate for April-June quarter revenues is currently pegged at $127.1 million, indicating an 8.2% increase year on year. The estimate for quarterly FFO per share of 53 cents also suggests a 10.4% jump year over year.

EastGroup Properties is engaged in the development, acquisition and operation of industrial properties and focuses on properties in major Sunbelt markets throughout the United States, emphasizing assets in the states of Florida, Texas, Arizona, California and North Carolina. With its strategy of ownership of high-quality distribution facilities clustered near major transportation features in supply-constrained submarkets, this industrial REIT is expected to have benefited from the robust fundamentals of the industrial real estate market.

Currently, EGP carries a Zacks Rank #2. It has a decent surprise history, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 3.09%.

EastGroup Properties is scheduled to release its earnings results on Jul 26, after market close. The Zacks Consensus Estimate for April-June quarter revenues is currently pegged at $114.16 million, indicating a 14.6% increase year on year. The estimate for quarterly FFO per share of $1.68 also suggests a 14.3% jump year over year.

Here's the share-price performance of the above-mentioned REITs in the past month.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

To read this article on Zacks.com click here.

Zacks Investment Research

Image sourced from Shutterstock