The Enforcement Directorate (ED), tasked by the Indian government to probe major financial crimes, announced Friday it had frozen assets worth $8.1 million of cryptocurrency exchange WazirX as part of an investigation into instant personal loan fraud.

WazirX Transferred Laundered Money to Unknown Crypto Wallets

The ED claimed WazirX assisted 16 fintech firms, already under investigation by the agency, in laundering proceeds of crime by transferring the money to unknown foreign wallets, as the crypto exchange encouraged obscurity and had lax anti-money laundering (AML) norms.

The Company Owning WazirX Has a Web of Agreements with Binance

Citing its investigation, the ED further alleged Zanmai Labs Pvt Ltd, the company that owns WazirX, has created a web of agreements with Crowdfire Inc. USA, Binance and Zettai Pte Ltd. Singapore to obscure the ownership of the crypto exchange.

“Earlier, their (WazirX) Managing Director Mr. Nischal Shetty had claimed that WazirX is an Indian Exchange which controls all the crypto-crypto & INR-crypto transactions and only has an IP & preferential agreement with Binance. But now, Zanmai claims that they are involved in only INR-crypto transactions, and all the other transactions are done by Binance on WazirX. They are giving contradictory & ambiguous answers to evade oversight by Indian regulatory agencies,” the agency stated.

The ED said it conducted a search operation under India’s Prevention of Money Laundering (PMLA) Act and found Sameer Mhatre, a co-founder of WazirX, had complete remote access to the database of the company, yet, he did not provide details of the transactions relating to the crypto assets allegedly purchased from the proceeds of crime of Instant Loan APP fraud.

Loose Regulatory Control over Transactions between WazirX and Binance

The agency further said WazirX was unable to provide an explanation for the lost crypto assets due to loose regulatory control over transactions between WazirX and Binance, a lack of blockchain recording of transactions to save money, and the failure to record the KYC information of the opposite wallets.

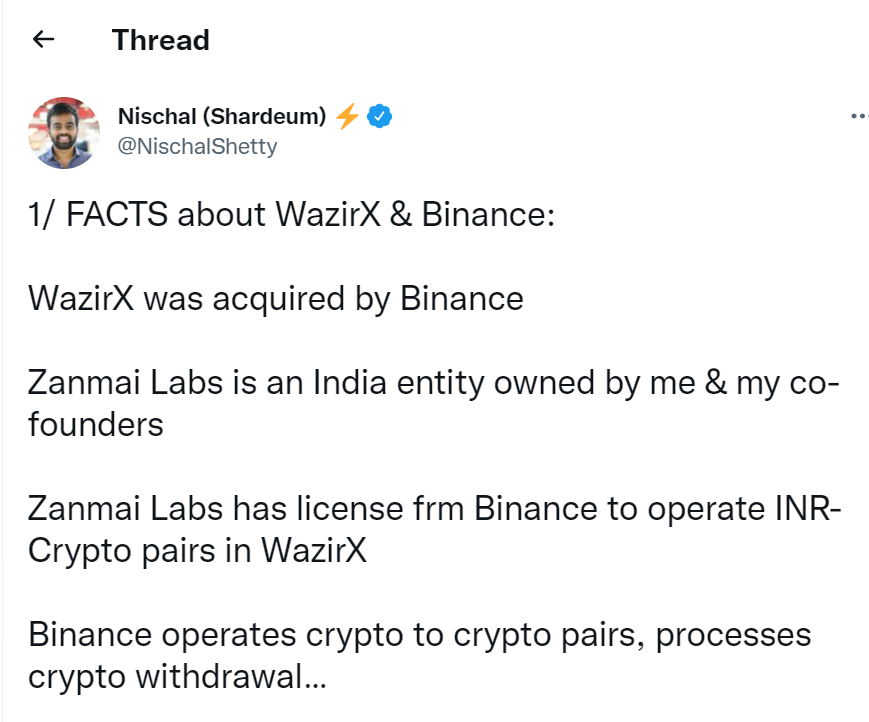

Reacting to the ED’s move, WazirX co-founder and CEO Nischal Shetty wrote in a Twitter thread that Binance acquired his company and Zanmai Labs, an India entity owned by him and other co-founders, had a license from Binance to operate INR-Crypto pairs in WazirX.

“Binance operates crypto to crypto pairs, processes crypto withdrawal. Binance owns WazirX domain name. Binance has root access of AWS servers. Binance has all the Crypto assets. Binance has all the Crypto profits. Don’t confuse Zanmai and WazirX,” Shetty claimed.

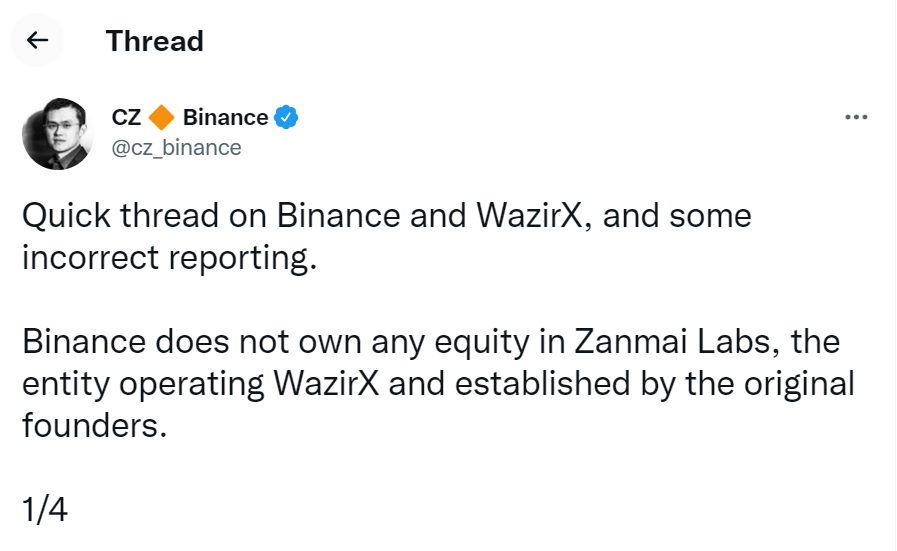

Interestingly, Binance CEO Changpeng ("CZ") Zhao said his crypto exchange does not own any equity in Zanmai Labs, the entity operating WazirX and established by the original founders.

“On 21 Nov 2019, Binance published a blog post that it had 'acquired' WazirX. This transaction was never completed. Binance has never — at any point — owned any shares of Zanmai Labs, the entity operating WazirX,” Zhao stated.

“Binance only provides wallet services for WazirX as a tech solution. There is also integration using off-chain tx, to save on network fees. WazirX is responsible (for) all other aspects of the WazirX exchange, including user sign-up, KYC, trading, and initiating withdrawals,” he added.

Photo: FGC via Shutterstock