In the preceding three months, 20 analysts have released ratings for Chipotle Mexican Grill (NYSE:CMG), presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 6 | 7 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 4 | 4 | 6 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

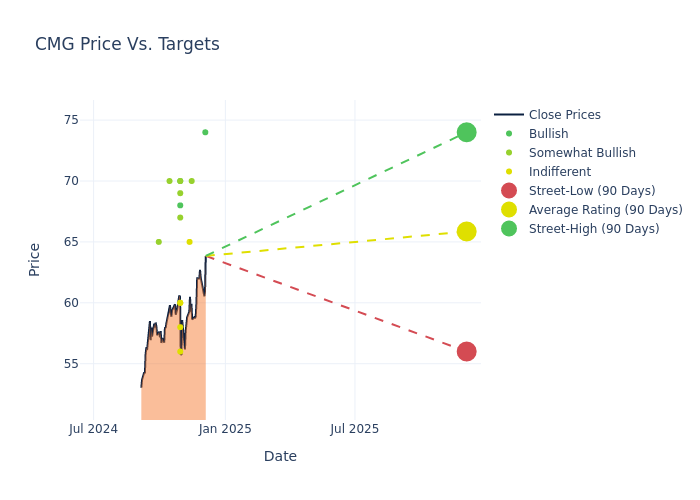

Analysts have recently evaluated Chipotle Mexican Grill and provided 12-month price targets. The average target is $66.25, accompanied by a high estimate of $74.00 and a low estimate of $56.00. Marking an increase of 3.35%, the current average surpasses the previous average price target of $64.10.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Chipotle Mexican Grill by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jake Bartlett | Truist Securities | Raises | Buy | $74.00 | $72.00 |

| Logan Reich | RBC Capital | Maintains | Outperform | $70.00 | $70.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $65.00 | $65.00 |

| Nick Setyan | Wedbush | Maintains | Outperform | $69.00 | $69.00 |

| Andrew Charles | TD Cowen | Raises | Buy | $68.00 | $65.00 |

| Jon Tower | Citigroup | Lowers | Buy | $70.00 | $71.00 |

| Alton Stump | Loop Capital | Raises | Hold | $58.00 | $53.00 |

| Jim Salera | Stephens & Co. | Lowers | Equal-Weight | $65.00 | $66.00 |

| Brian Mullan | Piper Sandler | Raises | Neutral | $60.00 | $59.00 |

| Jake Bartlett | Truist Securities | Raises | Buy | $72.00 | $71.00 |

| Zachary Fadem | Wells Fargo | Raises | Overweight | $67.00 | $66.00 |

| Jeffrey Bernstein | Barclays | Raises | Equal-Weight | $60.00 | $55.00 |

| Andrew Strelzik | BMO Capital | Raises | Market Perform | $56.00 | $55.00 |

| David Tarantino | Baird | Raises | Outperform | $70.00 | $62.00 |

| David Palmer | Evercore ISI Group | Raises | Outperform | $70.00 | $59.00 |

| Jake Bartlett | Truist Securities | Raises | Buy | $71.00 | $69.00 |

| Brian Mullan | Piper Sandler | Raises | Neutral | $59.00 | $56.00 |

| Jon Tower | Citigroup | Raises | Buy | $71.00 | $69.00 |

| Brian Bittner | Oppenheimer | Maintains | Outperform | $65.00 | $65.00 |

| Andrew Charles | TD Cowen | Maintains | Buy | $65.00 | $65.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Chipotle Mexican Grill. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Chipotle Mexican Grill compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Chipotle Mexican Grill's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Chipotle Mexican Grill's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Chipotle Mexican Grill analyst ratings.

Get to Know Chipotle Mexican Grill Better

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is almost exclusively company-owned, with just two license stores opearted through a master franchise relationship with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

A Deep Dive into Chipotle Mexican Grill's Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Chipotle Mexican Grill's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 13.01%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Chipotle Mexican Grill's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 13.87%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Chipotle Mexican Grill's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 10.58%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Chipotle Mexican Grill's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.32%, the company showcases efficient use of assets and strong financial health.

Debt Management: Chipotle Mexican Grill's debt-to-equity ratio is below the industry average at 1.24, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.