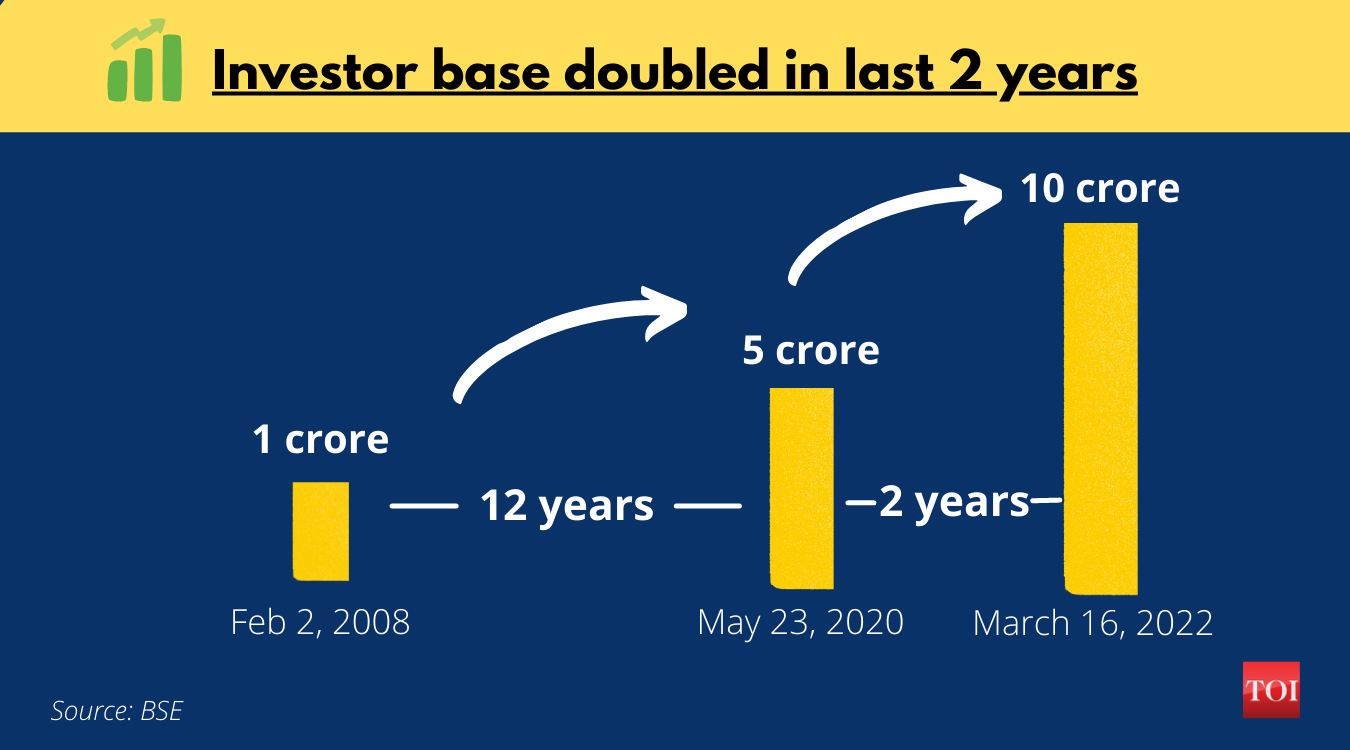

NEW DELHI: The Bombay Stock Exchange (BSE) added yet another feature to its cap by crossing the 10 crore registered investors mark on March 16.

In the last 12 years, BSE investor base grew 10-folds from 1 crore in 2008 to over 10 crore in 2022.

The bourse took just 91 days to go from 9 crore to 10 crore registered investors, recording its second fastest growth.

BSE had hit 9 crore investor base on December 15, taking a record 85 days to make this jump from 8 crore which it had achieved on September 21, 2021.

In a tweet, BSE CEO Ashish Chauhan congratulated all stakeholders on crossing this landmark.

Journey from 1 crore to 10 crore

BSE is one of the largest stock exchanges in the world. Since its inception in 1986, it has been at the forefront of India's securities market.

It took almost 22 years to add 1 crore investors, thereafter the timeline for adding every subsequent crore kept reducing.

Interestingly, from 2008 to 2020, investor base reached 5 crore. Whereas, the next 5 crore were added in less than 2 years' time.

Data shows that domestic investors were completely unfazed by the concerns weighed in by Covid pandemic. Besides, when foreign investors began withdrawing from the Indian markets, the 'desi' investors were the ones who held on to it.

In fact, majority of investors – especially the retail ones – joined the bourses during the lockdown period in search of better returns for their investments.

The market capitalisation of BSE listed companies stands at Rs 259.84 lakh crore as of today.

How BSE's journey began

The BSE is the oldest stock exchange in India. It comprises 30 of the largest and most actively traded stocks on the Bombay Stock Exchange (BSE).

The index was launched with a base price of 100 (base year 1978-79).

The term sensex was coined by Deepak Mohoni, a stock market analyst. It is a blend of the words 'sensitive' and 'index'.

After its launch, sensex was calculated based on market-capitalisation weighted methodology. Since September 2003, it began to be calculated based on a free-float capitalisation method.

Major milestones

The 30-share index experienced enormous growth since India opened up its economy to the world in 1991. It rose from around 5,000 points in early 2000 to over 60,000 in 2021.

It had crossed the 25,000-mark for the first time on May 16, 2014 as the Bhartiya Janta Party (BJP)-led NDA government came to power with a sweeping majority. It took almost 4 more years to jump to the 35,000-mark.

A repeat win of the Narendra Modi-led BJP lifted the sensex past the 40,000 landmark for the first time ever. Interestingly, the sensex has more than doubled today since Modi came to power in 2014.

Bucking the pandemic slump, that had adversely impacted almost all sectors of the economy, the BSE sensex scaled several new highs. Beginning the year 2021 by scaling the 50,000 peak, the bourse went on to have a stellar year. Sensex gained 21.99 per cent or 10,502.49 points during the entire year.

From witnessing gigantic losses to record-shattering gains, investors went on a roller-coaster ride amid the coronavirus pandemic and massive stimulus measures during the year 2020.

The coronavirus pandemic forced the government to announce a nationwide lockdown to curb its spread. As the number of cases rose, massive global selloff pushed the sensex off a cliff in late March 2020.

However, markets staged a massive comeback and jumped nearly 138 per cent from the pandemic-induced slump to breach the 62,000-mark intra-day in October last year.

From falling to a level as low as 25,000 in March 2020, the sensex made a significant jump to scale mount 62,000 in 1.5 years.

In fact, majority of the investors joined the stock markets during the pandemic period. According to the Economic Survey 2021, nearly 221 lakh individual demat accounts were added during April-November 2021.

However, markets have been under pressure since and it is experiencing extreme volatility given the geopolitical scenario and concerns over rising inflation.