Zoom Video (ZM) on Tuesday has been trying to rally off the opening lows, but the shares of the provider of videoconferencing and other tech services at last check are down 14%.

The stock is making multimonth lows after the company reported earnings. At today’s low, Zoom Video stock was down about 15%.

Sales rose 8% year over year but missed analysts’ expectations, while earnings fell 22% and beat expectations. The mixed headline numbers weren’t the problem, so much as the company’s guidance was.

Third-quarter and full-year outlooks for both revenue and earnings came up short of expectations, while management trimmed its full-year earnings outlook.

That’s never a good look, especially for a stock that had been one of the laggards in the group of beaten-down growth stocks.

For what it’s worth, Zoom Video has become the largest holding in the ARK Innovation ETF (ARKK) with a 9.7% stake. That’s just ahead of Roku (ROKU) and Tesla (TSLA), with stakes of roughly 9% and 8%, respectively.

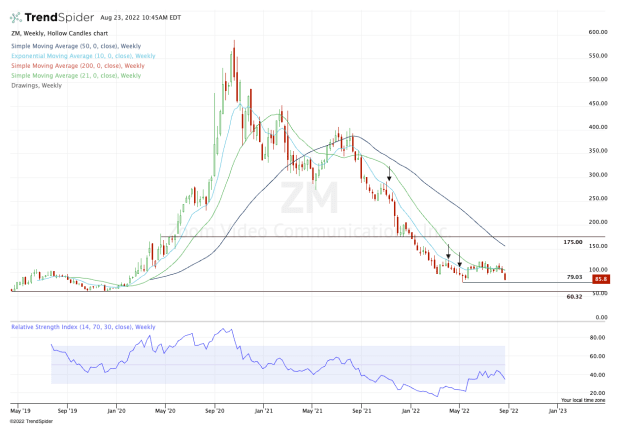

Let’s look at what the ZM charts are telling us now.

Trading Zoom Video Stock

Chart courtesy of TrendSpider.com

Ever since the stock broke down in the first two months of the year, the $120 to $125 zone has been stiff resistance for Zoom Video. This zone was most recently resistance in early July, before the stock pulled back to $96.11 — marking the July low.

Zoom Video nearly retested this level yesterday just ahead of its earnings report after the close.

With today’s gap down, the shares fell below the 78.6% retracement (as measured from the 52-week low to the third-quarter high). Since the stock is trying to rally now, the bulls will want to see if it can reclaim $88.50.

If it can, it opens the door back up toward the $96 level. That could give the stock a chance to reclaim the July low and fill the earnings gap from Tuesday.

On the downside, today’s low will be key. At last check that was $82.88, and a break of this level that isn’t quickly reclaimed could put the 52-week low in play near $79.

If it breaks below this level and can't reclaim it, it could usher in more selling pressure and potentially bring us a test of the $60 level, which was a major support level before the stock erupted higher due to the covid-19 pandemic and work-from-home efforts.