A well-known talking head in the financial sector was the honorary bell ringer Monday, July 18. Here’s a look at why investors are worried about the bell ringing and how the market has performed since the last time he completed the task.

What Happened: The ringing of the bell at the New York Stock Exchange signals the opening or closing of the market trading day.

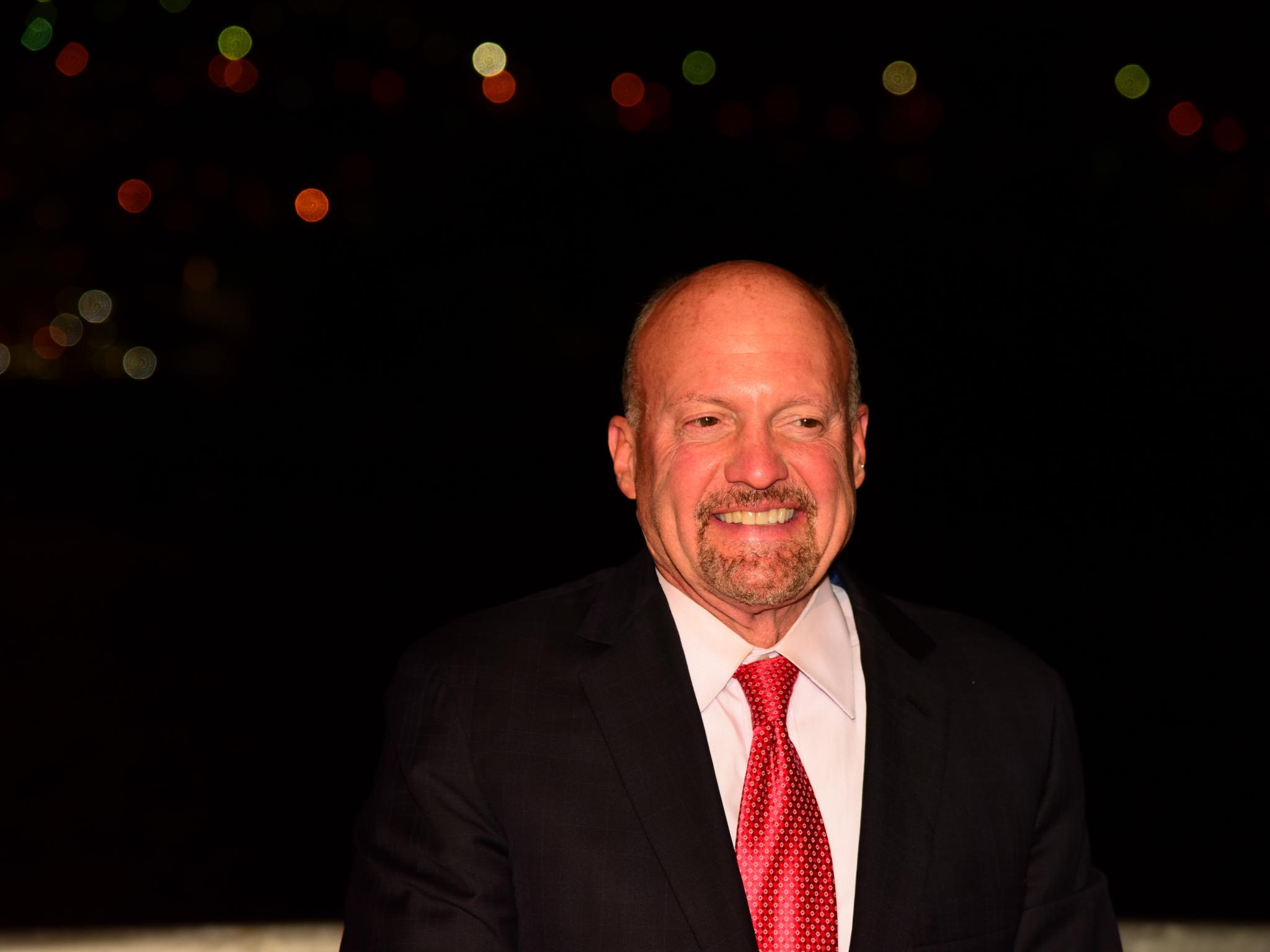

“Mad Money” host Jim Cramer rang the opening bell Monday morning for the New York Stock Exchange, which is owned by Intercontinental Exchange Inc (NYSE:ICE).

The New York Stock Exchange bell ringing coincides with “Mad Money” being broadcast from the NYSE beginning Monday thanks to a new set.

Cramer and other CNBC, a Comcast Corporation (NASDAQ:CMCSA) company, executives were welcomed to the bell ringing Monday morning.

News spread over the weekend on social media that Cramer ringing the bell coincides with a past history of market declines.

Cramer rang the opening bell on March 10, 2015 to celebrate the 10th anniversary of “Mad Money.” The day was the worst day in the market in 2015 at that point. The Dow Jones Industrial Average ended the day down 332.7 points and the S&P 500 fell 1.7% for the day.

Cramer also rang the NYSE opening bell on March 6, 2020 to celebrate the 15th anniversary of “Mad Money.”

While the market traded down when Cramer rang the bell in 2015, the S&P 500 and major indexes have recovered and still turned in profitable investments for investors.

Related Link: Jim Cramer Is Ringing Monday's Opening Bell At The NYSE, Twitter Is Throwing A Fit Already

Investing $1,000 In SPY: A $1,000 investment in the SPDR S&P 500 ETF Trust (NYSE:SPY) on March 10, 2015 could have bought 4.84 shares of the ETF that tracks the S&P 500.

The $1,000 investment would be worth $1,864.03 today based on the $385.13 closing price for the SPDR S&P 500 ETF Trust.

This represents a return of 86.4%, or around 12.3% average annually over the last seven years.

There is no guarantee the market will go up after Cramer rings the opening bell, but it is worth pointing out that the market recovered from the large declines on the fateful day he rang the bell in 2015 that is getting heavy mentions on social media.

Photo via Shutterstock.